See also

24.06.2022 09:00 AM

24.06.2022 09:00 AMCrypto Industry News:

China's leading social media platform, WeChat, has updated its policy to ban accounts that provide access to cryptocurrency or NFT-related services.

Under the new guidelines, accounts related to the issuance, trading and financing of cryptocurrencies and NFTs will either be restricted or banned and will fall under the category of "illegal activity".

The policy also covers secondary NFT transactions with the company noting that "accounts that provide services or content related to the secondary transaction of digital collections should also be treated in accordance with this article."

The move was made public by a Hong Kong cryptocurrency news reporter Wu Blockchain earlier this week when he highlighted the importance of the move considering WeChat has more than 1.1 billion users in China every day.

Regarding the foreseen penalties, the new policy states that "upon detection of such violations, the public WeChat platform, depending on the severity of the violations, will order violators of official accounts to correct within a specified period of time and limit certain functions until the permanent account is blocked"

The Chinese government gradually introduced a ban on the local cryptocurrency sector between May and last September. However, considering the time of WeChat's last update, it can be concluded that the platform has since turned a blind eye to some cryptocurrency activities.

Technical Market Outlook:

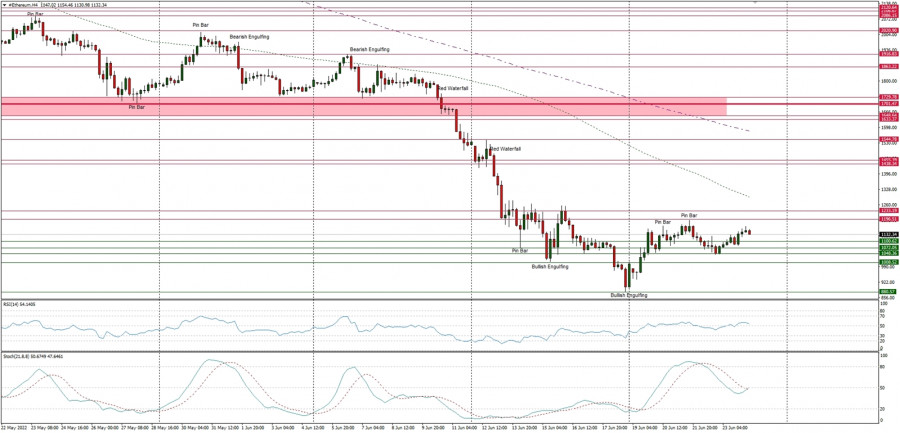

The ETH/USD pair has been seen moving sideways for quite some time now, so the period of lower volatility had started. The market keeps trading in a narrow zone between the levels of $1,048 - $1,196. The next target for bulls is seen at the level of $1,233, which is the technical resistance. The intraday technical supports are seen on the levels of $1,048, $1,008 and $1,100. The larger time frame chart trend remains down and as long as the key short-term technical resistance is not clearly violated, the outlook remains bearish.

Weekly Pivot Points:

WR3 - $2,249

WR2 - $1,737

WR1 - $1,420

Weekly Pivot - $1,161

WS1 - $818

WS2 - $551

WS3 - $206

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $1,420 and bears continue to make new lower lows with no problem whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,000. Please notice, the down trend is being continued for the 11th consecutive week now.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.