See also

24.06.2022 11:19 PM

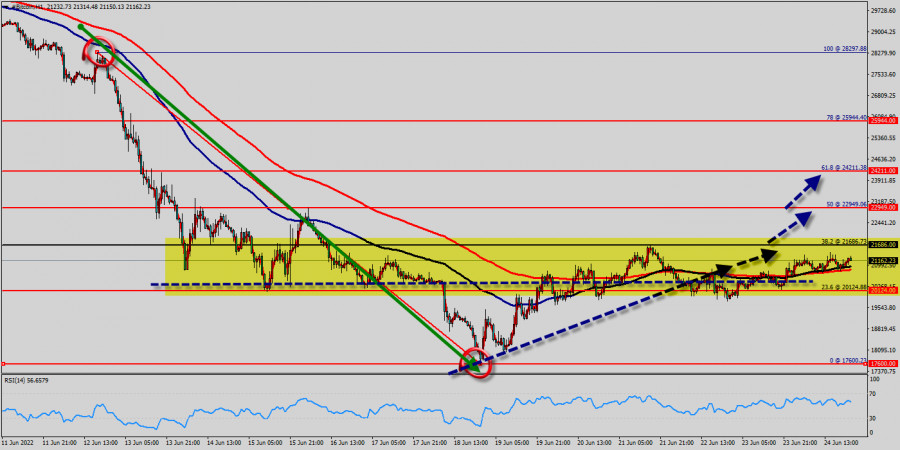

24.06.2022 11:19 PMWe expect to see a strong reaction off this level to push price up towards $21,686 before $22,949 resistance (horizontal swing high resistance).

RSI is seeing major support above 60% and a bullish divergence vs price also signals that a reversal is impending. According to the previous events the price is expected to remain between $20k and $23k levels (around $3000).

Profit target reached perfectly once again, prepare for a bounce from the area of $21,200. Buy-deals are recommended above $21,200 with the first target seen at $21,686.

The movement is likely to resume to the point $22,949 and further to the point $23k. Moreover, in larger time frames the trend is still bullish as long as the level of $20k is not breached.

A daily closure above $23k allows the pair to make a quick bullish movement towards the next resistance level around $24k.

Trading recommendations :

The trend is still bullish as long as the price of $20k is not broken. Thereupon, it would be wise to buy above the price of at $20k or $21k with the primary target at $22k. Then, the BTC/USD pair will continue towards the second target at $23k (a new target is around $24k in coming days).

As we know (23/06/2022) :

1 BTC ---> $21,295 approximately 1

ETH ---> $1,222 approximately

So, 1 ETH ---> 0.0573 BTC. One Ethereum is only worth 0.0573 Bitcoin.

Conclusion :

BTC/USD increased within an uptrend channel from the prices of $420k and $21k since a week. The bulls must break through $21,686 in order to resume the uptrend.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.