See also

19.01.2022 09:25 AM

19.01.2022 09:25 AMOn Tuesday, stocks dropped across the board. US Treasuries rose amid expectations of monetary policy tightening by the Fed. The regulator may hike the interest rate earlier than expected.

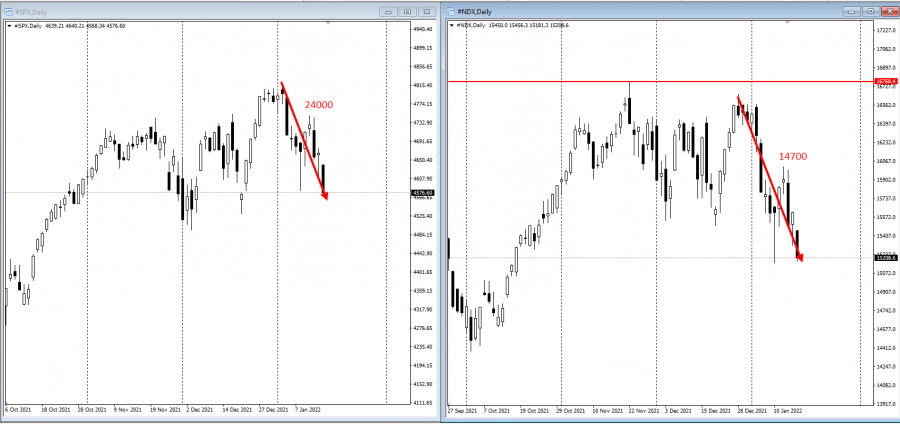

All 11 industries included in the S&P 500 index incurred losses. The Dow Jones Industrial Average fell to its lowest level this year. The heavy-tech Nasdaq 100 index decreased by more than 2%. Apple Inc. and Meta Platforms Inc. showed the biggest drop. Goldman Sachs Group Inc. reported worse-than-expected fourth-quarter revenue. It adversely affected the sentiment in the banking sector. The net profit of Microsoft Corp also tumbled as the company acquired Activision Blizzard Inc. for $69 billion.

"Higher interest rates are going to be here to stay and that has to factor into everyone's decisions -not just those that are borrowing capital but mostly in terms of valuations. So those super high-flying narrative-driven tech stocks are going to continue to take a beating," Julie Biel, the Portfolio Manager & Senior Research Analyst at Kayne Anderson Rudnick, said.

The New York Empire State Manufacturing Index fell sharply in January as the numbers of orders and shipments plunged. Apparently, the Omicron variant caused a decline in production activity.

Stocks across the globe showed mixed results at the beginning of the year as investors shifted from more expensive and vulnerable to the Fed's decisions IT shares to cheaper, so-called value stocks. The Global Fund Manager Survey conducted by Bank of America in January demonstrated that net allocation to the tech sector fell to 1%, the lowest since 2008, though they expect inflation to decline this year. They are placing record bets on a boom in both commodities and stocks overall.

Investors are uncertain whether the Fed will tighten monetary policy to curb inflation or it will postpone it amid a slowdown in economic growth.

Joe Kinahan, the Chief Strategist at TD Ameritrade, believes that it is crucial to raise the two-year key rate to the level of February 2020.

This week, traders should pay attention to the following economic reports:

US – Housing starts on Wednesday and initial jobless claims on Thursday;

- Indonesia, Malaysia, Norway, Turkey, and Ukraine will announce their decision on the key rate on Thursday;

- EIA crude oil inventory report, Thursday.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.