See also

22.06.2022 01:04 PM

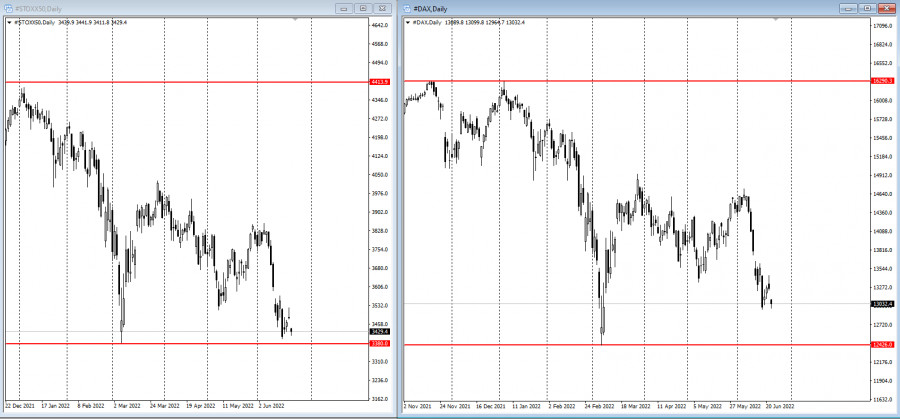

22.06.2022 01:04 PMStocks in Europe fell along with US futures and commodities amid ever-louder warnings that Federal Reserve rate hikes may lead to an economic downturn.

The Stoxx Europe 600 Index retreated while contracts on the Nasdaq 100 dropped with those on the S&P 500, pointing to a reversal from yesterday's bounce in the main US stock gauge. Haven assets including the dollar, Treasuries and the yen advanced.

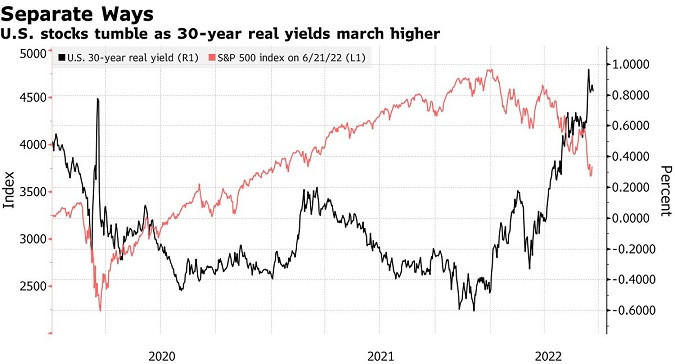

Optimism that policymakers can achieve a soft landing as they pursue a course of aggressive monetary tightening to curb inflation has evaporated.

Fed Chairman Jerome Powell is expected to reiterate his resolve when he addresses lawmakers today. Concerns about the economy have spread to commodities, putting oil in line for a monthly loss.

There is skepticis about the prospects for risky assets in a year of sharp declines in markets. Top strategists at Societe Generale SA and Goldman Sachs Group Inc. warn of more stocks declines amid a deteriorating economic outlook.

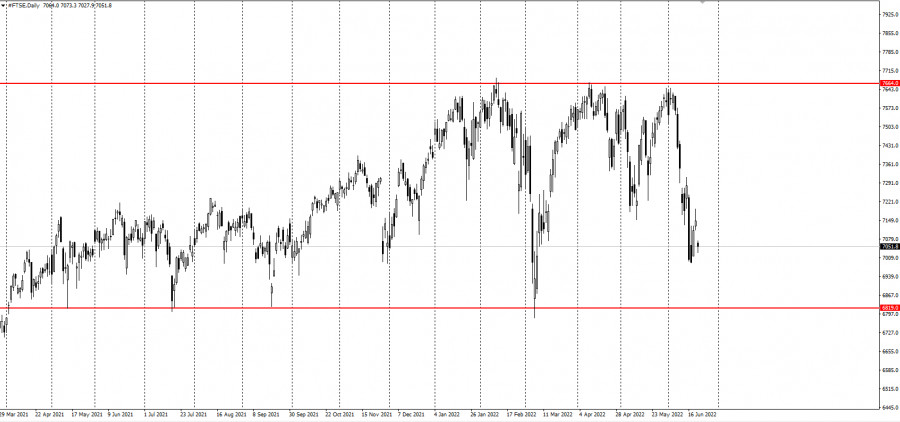

The FTSE 100 outperformed as the pound weakened after UK inflation rose to a fresh four-decade high in May after broad increases in the cost of everything from fuel and electricity to food and beverages.

Reflecting the gathering jitters about economic growth, investor Ray Dalio warned that reducing inflation would only come at a great cost.

President Joe Biden plans will call for suspending the federal gasoline tax to curb rising fuel prices and ease pressure on consumers.

What to watch this week:

• Fed chair Jerome Powell semi-annual Senate testimony, Wednesday• Powell US House testimony, Thursday• US initial jobless claims, Thursday• PMIs for eurozone, France, Germany, UK, Australia, Thursday• ECB economic bulletin, Thursday• US University of Michigan consumer sentiment, Friday• RBA's Lowe speaks on panel, Friday

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.