See also

24.06.2022 02:19 PM

24.06.2022 02:19 PMLower commodity prices contributed to a softening of market indicators and inflation expectations. Oil suffered its first weekly loss since early April amid a broader sell-off in commodity markets:

The technology sector boosted shares on Friday as investors assessed economic threats and lowered expectations of inflation and higher interest rates.

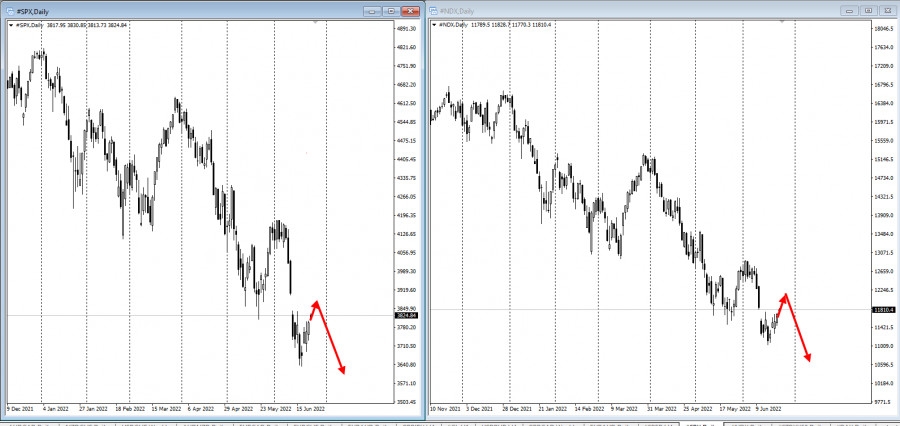

Contracts on the S&P 500 added 0.9% following the main US stock indicator closing around session highs on Thursday, adding more than 3% in three days. High-tech futures on the Nasdaq 100 added 1%. Overall, the trend remains bearish.

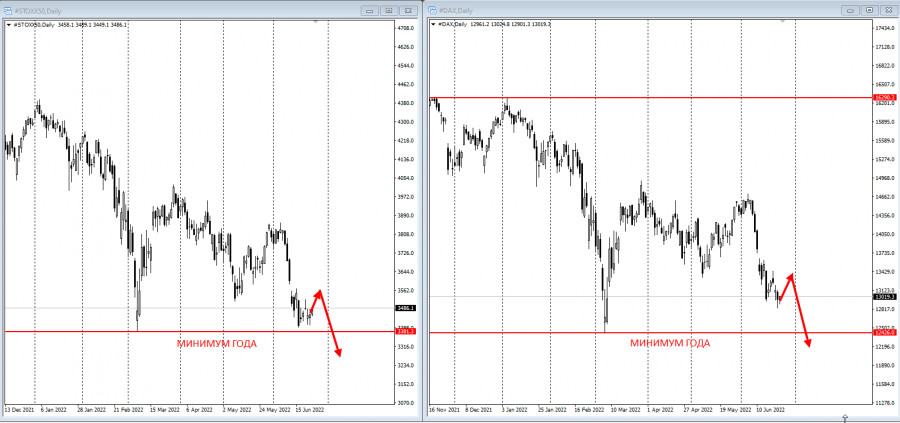

The Stoxx50 gained 1.5%. Meanwhile, a small rebound is expected this week as part of a general short-term trend:

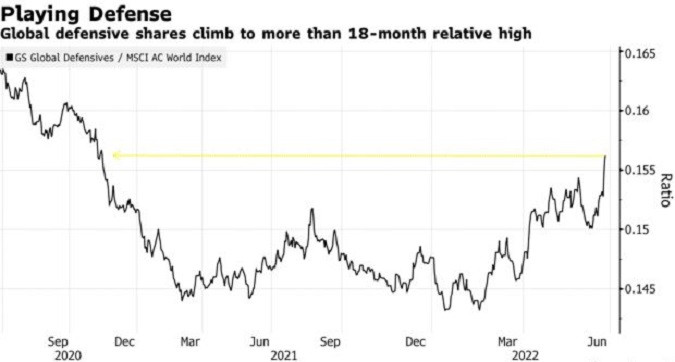

Investors are grappling with the question of what comes next if an economic downturn takes hold. One scenario envisages a reduction in price pressures and an opportunity for central banks to reduce the pace of interest rate increases. Federal Reserve Chair Jerome Powell hardened his resolve to cool inflation in testimony to lawmakers this week, after acknowledging that a recession may be the price to pay.

"In spite of the hawkish remarks from Fed officials, the growing worries that their hikes would trigger a recession actually meant that investors priced in a shallower pace of rate hikes over the coming 12-18 months," Deutsche Bank AG strategists led by Jim Reid wrote in a note. "That had a knock-on impact on Treasuries," they added

Due to the prospect of a rate rally, the policy-sensitive US two-year yield was on course for one of its biggest weekly drops since March 2020. Traders are starting to price out any Fed action on rates beyond the December meeting, scaling back the additional tightening they expect and flirting with the possibility of cuts by in 2023.

Meanwhile, investors continued to yank cash from equity funds, which recorded their biggest outflows in nine weeks amid rising recession risk. About $16.8 billion exited global stock funds in the week through June 22, with US equities seeing their first outflow in seven weeks at $17.4 billion, Bank of America Corp. said, citing EPFR Global data.

What to watch this week:

US University of Michigan consumer sentiment, Friday

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.