See also

24.02.2022 05:00 PM

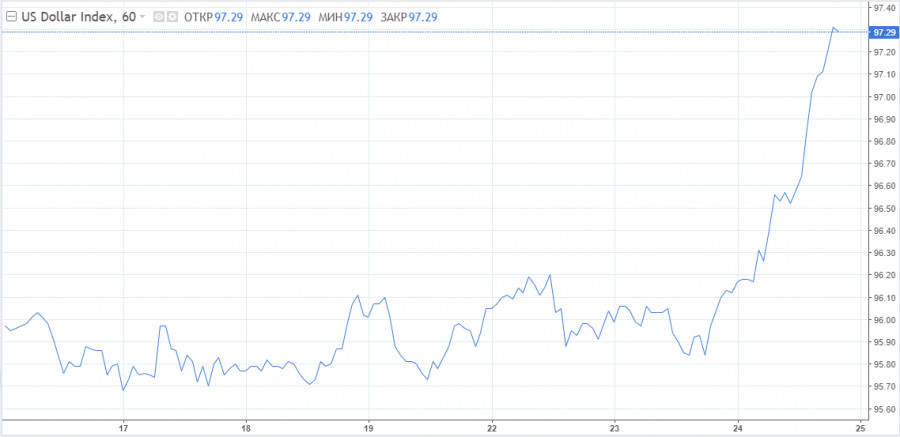

24.02.2022 05:00 PMAs war in Ukraine dominates the headlines and keeps tensions high, USDX has begun to show its defensive asset qualities. The scale of Russian advance in Ukraine remains unclear. However, market players are likely to buy defensive assets in response to the news.

USD found some additional support in interest rate hike expectations. Investors expect the interest rate to be increased to 164 basis points by the end of the year. The likelihood of a 50 basis point increase has fallen to 20%.

Amid the ongoing war, USDX bulls managed to break through the key barrier at 97.00. The pair is likely to surpass 97.40 as well. If the index breaks above it, 97.80, the high of late June 2020, would become its next obstacle.

A downward movement into the lower part of the 95.00-96.00 range would allow opening long positions targeting 97.00 or higher. The Fed is more likely to tighten its policy compared to the ECB.

EUR/USD has taken heavy losses on Thursday. The pair managed to consolidate briefly above 1.1200, However, bearish pressure resumed afterwards. If the geopolitical situation remains tense, EUR/USD could fall to 1.1100 or even lower. The euro is nosediving, while analysts are struggling to update their outlooks.

European leaders are conducting an emergency meeting, with the EU reaction to Russian invasion being in the focus. Risk aversion currently predominates in the marker. If Russia deescalates and agrees to a diplomatic solution, risk appetite could slowly return, pushing the euro up from its current lows.

However, it is too early to make predictions about the war between Russia and Ukraine and its impact on future ECB policy.

Rising tensions between Russia and Ukraine are undermining the European economy amid rising inflation. Earlier, the ECB announced its plans to finish its bond-buying program, followed by the first interest rate increase in more than a decade. These measures were aimed at tackling record-high inflation.

The unprecedented high energy prices will be very detrimental for the euro, Danske Bank analysts say. The pair is almost certain to fall to 1.1100. Furthermore, EUR/USD could reach 1.0800 over the next 12 months.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.