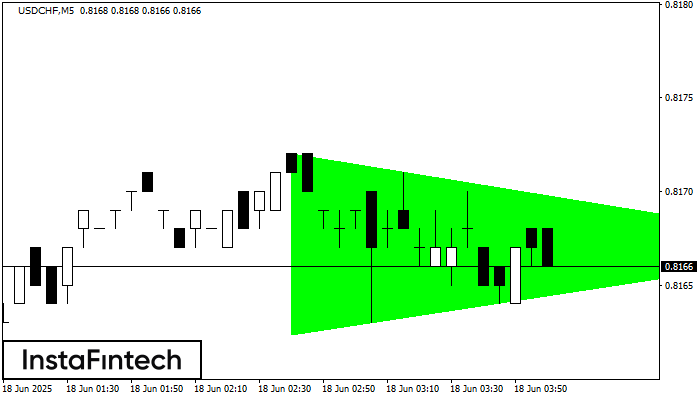

Бычий симметричный треугольник

сформирован 18.06 в 03:00:54 (UTC+0)

сила сигнала 1 из 5

По USDCHF на M5 фигура «Бычий симметричный треугольник». Характеристика: Фигура продолжения тренда; Координаты границ – верхняя 0.8172, нижняя 0.8162. Проекция ширины фигуры 10 пунктов. Прогноз: В случае пробоя верхней границы 0.8172 цена, вероятнее всего, продолжит движение к 0.8182.

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Фигура

Инструмент

Таймфрейм

Тренд

Сила сигнала