03.06.2022 01:00 PM

03.06.2022 01:00 PMHello, dear colleagues!

It is Friday, the last trading day of the week. Today, the US Labor Department will publish a jobs report for May. Clearly, these are the most expected fundamentals to come out this week. Although some think tanks question the importance of labor market data under current circumstances, Nonfarm Payrolls have always been one of the most closely-watched fundamental indicators able to cause changes in the technical picture of any currency pair. Speaking of market expectations, the unemployment rate in the US is projected to fall to 3.5% m/m from 3.6% a month earlier. At the same time, the American economy could add 325,000 new jobs. As for hourly earnings, figures are anticipated to rise by 0.4%. In general, such expectations can hardly be called unreasonably high, especially since Fed Chairman Jerome Powell has foreseen such an outcome. During his press conference after the May meeting and a 50 basis-point rate hike, the Fed's chief suggested there could be a fall in unemployment and a steady growth in new jobs. By this point in time, potential positive results, including the two future 50 basis-point rate increases have already been priced in by the market. However, if data comes in worse than expected, the dollar may feel some bearish pressure.

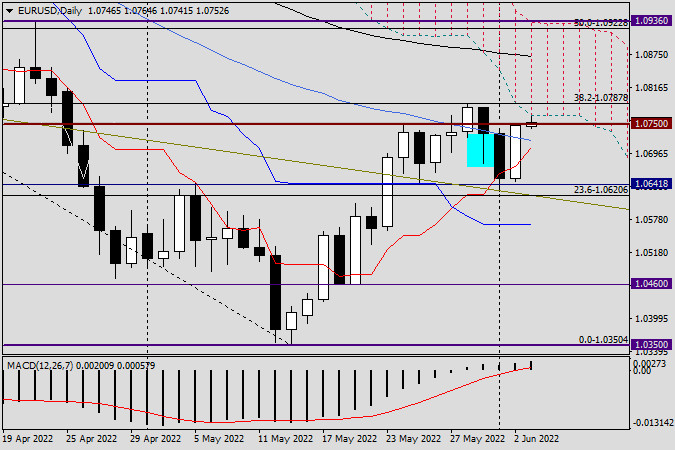

Daily

The price broke through support at 1.0641. Earlier, the quote pulled back from this level thrice when bears tried to push EUR/USD below 1.0641. However, this level managed to withstand bearish pressure every time and provide strong support for the pair. Yesterday, after a rebound from 1.0645, the quote went up and closed at 1.0747. Another important technical level worth paying attention to stands at 1.0700. Bulls and bears seem to have been fighting for the barrier because the price closes either below or above the mark, unable to consolidate. In this light, taking into account the pair's strong growth yesterday and the fact that the price closed above 1.0700, a bullish scenario would seem more likely if not for Nonfarm Payrolls. After the labor market report, it will become clear where the price closes. If it closes in the Ichimoku Cloud and above the 1.0787 high of May 30, the pair is likely to ascend further. If it breaks through 1.0641 and closes below this important level, the quote will go down. Since today is the last trading day of the week it would be unwise to give a new outlook, especially ahead of perhaps the most important macroeconomic report. However, in general, the bullish scenario seems more likely.

Have a nice weekend!