18.10.2023 12:12 PM

18.10.2023 12:12 PMAccording to the annual LBMA survey following the conference, participants stated that gold will outperform the precious metals market. However, certain observations and comments during the conference supported silver, evaluating its affordability compared to its fundamental indicators.

As per analysts, despite the Federal Reserve maintaining interest rates at a restrictive level for most of 2024, geopolitical uncertainty in the coming 12 months will continue to support precious metal prices.

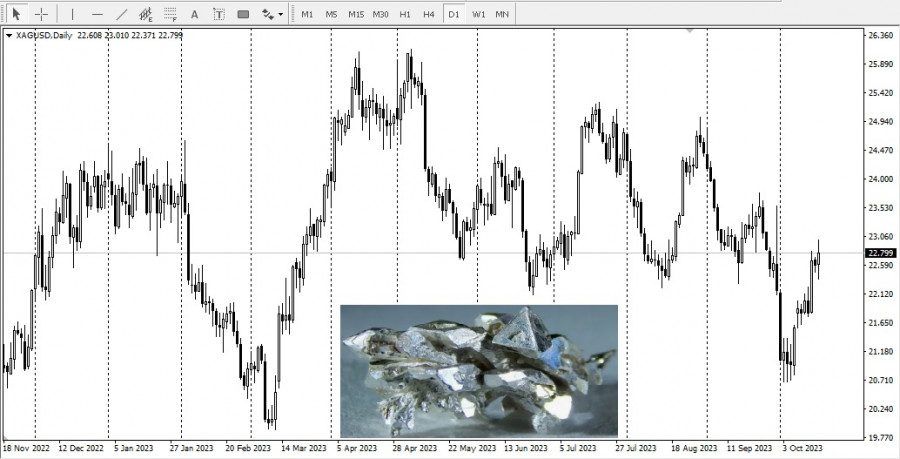

Based on the sentiments expressed at the 2023 Global Precious Metals Conference of the London Bullion Market Association, participants believe that by the next year's conference in Miami, Florida, silver prices will be trading around $26.80 an ounce.

Despite the challenges faced by both gold and silver in 2023, as the Federal Reserve aggressively raised interest rates, silver managed to maintain substantial growth compared to where prices were during the previous year's conference. Silver prices were around $18.60 an ounce at that time.

Currently, the bullish forecast is driven by the fact that silver is trading around $23 an ounce.

Analysts also noted that industrial demand for silver in the solar sector has provided strong support for the precious metal as investors focus on transitioning to green energy.

According to Phillips Baker, CEO of Hecla Mining, the use of silver in Photovoltaic (PV) solar panels will "drive silver prices higher." The need for Photovoltaic solar panels will stimulate demand in the coming decade.

As for gold, according to the LBMA survey, participants believe that prices will rise to $1990.30 an ounce by the same time next year.

This forecast is based on the ongoing chaos in the Middle East, showing how safe-haven asset demand can influence prices. Gold has risen more than 5% compared to seven-month lows from last month. The gold market, like silver, has established a strong base well above last year's prices.

Alongside the demand for safe-haven assets, gold is also well supported by central bank demand, which reached a record level in the first half of 2023.