Lihat juga

06.06.2025 10:11 AM

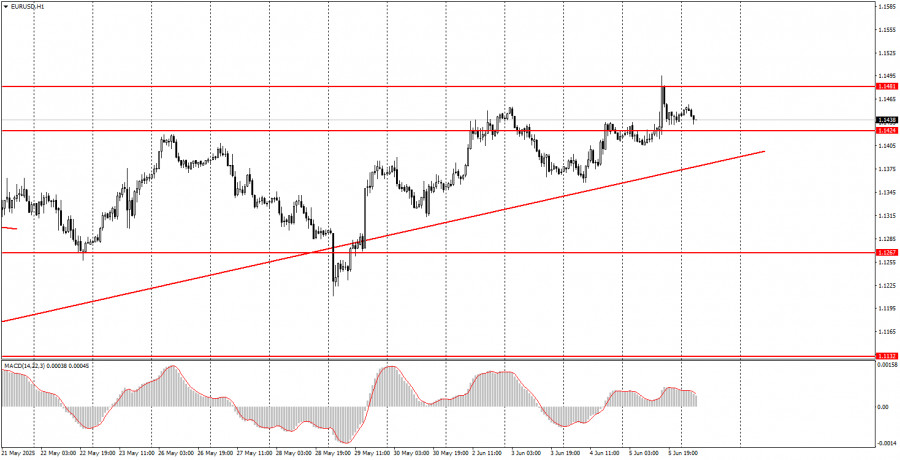

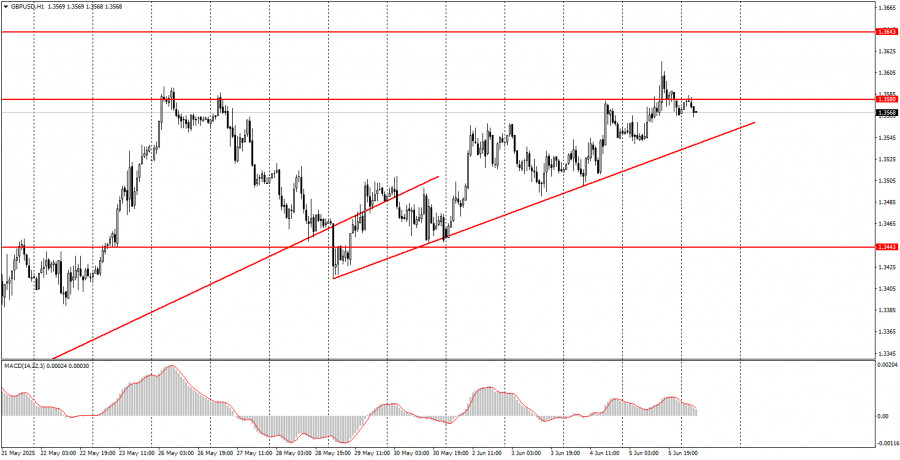

06.06.2025 10:11 AMA fairly large number of macroeconomic publications are scheduled for Friday, but most of them will not interest traders. For example, the report on industrial production in Germany or the retail sales report in the Eurozone. Even the GDP report in the Eurozone (third estimate for the first quarter) is unlikely to have any impact on market sentiment. However, U.S. publications may trigger a storm of emotions in the market. The NonFarm Payrolls and unemployment rate reports remain among the most important. If the U.S. labor market shows signs of slowing and unemployment continues to rise, traders will associate these events with Donald Trump's tariff policy and will expect the Fed to resume its monetary policy easing cycle. And right now, it doesn't take much for the dollar to fall.

Analysis of Fundamental Events:

There's absolutely nothing noteworthy among fundamental events. The ECB meeting has already taken place, and the Bank of England and Fed meetings will be held later, but they carry no intrigue either. Both central banks are 90% likely to leave key interest rates unchanged.

We believe the market still cares only about the ongoing trade war. The dollar's decline may continue if trade agreements with most countries are not signed before the end of the grace period — and that ends in just a month. The dollar may continue to fall even without new tariffs from Trump, as market sentiment toward the U.S. president and his policies remains extremely negative. The International Trade Court decided to block Trump's tariffs, but the U.S. Appeals Court overturned this decision the same day. Later, it was announced that tariffs on imported steel and aluminum would be increased.

General Conclusions:On the last trading day of the week, both currency pairs will trade based on technical factors in the first half of the day and U.S. macroeconomic data in the second. Thus, we can expect sluggish, low-volatility movements in the morning and a storm after lunch.

Main Rules of the Trading System:

What's on the Charts:

Beginner forex traders should remember that not every trade will be profitable. Developing a clear strategy and good money management are the keys to success in long-term trading.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Kemarin, harga emas naik, bersiap untuk minggu terbaik dalam sebulan terakhir saat para trader menghadapi ketidakpastian seputar dimulainya kembali pemerintahan AS setelah jeda enam minggu dan risiko jeda dalam siklus

Hanya ada sedikit laporan makroekonomi yang dijadwalkan pada hari Jumat, dan pasar jarang bereaksi terhadap berita lokal dan laporan makroekonomi dalam beberapa minggu terakhir. Oleh karena itu, laporan PDB Zona

Pada hari Kamis, pasangan mata uang GBP/USD diperdagangkan naik. Kebanyakan para trader mungkin bertanya-tanya mengapa. Namun, bagi mereka yang secara rutin membaca ulasan kami, pertanyaan ini seharusnya tidak muncul. Mari

Pada hari Kamis, pasangan mata uang EUR/USD melanjutkan pergerakan naiknya, yang sejalan dengan latar belakang fundamental secara keseluruhan, tetapi tidak sesuai dengan berita hari itu. Mari kita perjelas sekali lagi

Dengan pertanyaan mengenai tindakan masa depan Federal Reserve yang tampaknya telah terjawab, fokus kini beralih pada apa yang diharapkan dari dolar AS di tengah perubahan ekspektasi terhadap kebijakan moneter. Minggu

Secara internal, Federal Reserve terus mendiskusikan apakah akan lebih mengutamakan pasar tenaga kerja atau inflasi. Semua gubernur tampaknya terbagi menjadi dua kelompok: pendukung ide dan tuntutan Trump, serta para pembuat

Permintaan terhadap dolar AS telah meningkat selama lebih dari seminggu, dimulai sekitar waktu ketika "aroma" dari berakhirnya penutupan pemerintah muncul di Amerika. Mungkin penutupan ini bukanlah masalah sebenarnya, dan pasar

Sentimen investor mulai pulih, sementara dolar AS mengalami penurunan setelah berakhirnya penutupan pemerintah yang berkepanjangan. Pada awal sesi trading Amerika pada hari Kamis, futures pada indeks dolar AS (USDX) trading

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.