یہ بھی دیکھیں

13.02.2026 12:31 AM

13.02.2026 12:31 AMOn Thursday, the USD/CHF exchange rate remained within the previous day's range, under pressure from sellers as the Swiss franc strengthened amid demand for safe-haven assets and rising yields on local bonds.

The yield on 10-year Swiss government bonds rose to 0.32%—the highest since December—boosting the appeal of the Swiss franc as a safe-haven asset for global investors. This rise in yields stimulates capital inflows, strengthening the Swiss currency and, consequently, restraining the growth of the USD/CHF pair. The Swiss National Bank (SNB) is expected to maintain its interest rate at 0% for the coming months, as inflation is close to the target level, and the threshold for reintroducing negative rates remains high.

To better capture trading opportunities, attention should be paid to Switzerland's January Consumer Price Index (CPI) data release on Friday, with annual inflation forecast to remain at 0.1%. Commerzbank experts note that, due to the recent increase in oil prices, the risks to overall inflation are skewed to the upside, as this could quickly feed through to transportation costs. Their assessment indicates that an unexpected spike in inflation could improve the Swiss National Bank's position by reducing pressure for additional monetary easing.

The bank noted that since oil prices increased by about $10 in January, this rise typically impacts transportation prices in Switzerland quickly, which is a component currently contributing significantly to the negative impact on the core interest rate.

From the US dollar's perspective, the dollar index remains strong after robust labor market figures. The Non-Farm Payroll (NFP) report showed the creation of 130,000 jobs in January—above the expected 70,000—with unemployment at 4.3%, down from 4.4%. This has weakened expectations of an imminent Federal Reserve rate cut.

The CME FedWatch tool shows that 94% of traders now expect the Fed to pause at its next meeting (up from 80% pre-NFP), with a sharp decline in the chances of easing in March-April, although June is still seen as the likely time for the debut of rate cuts.

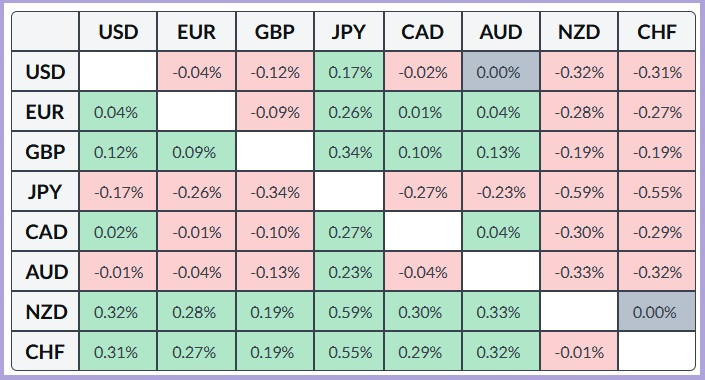

The table below shows the percentage change of the Swiss franc against major currencies for the day. The Swiss franc reached its strongest level against the Japanese yen.

From a technical perspective, oscillators on the daily chart are negative, and prices are trading below all moving averages, indicating a negative outlook. Additionally, all moving averages are pointing downward, which suggests weakness among buyers.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.