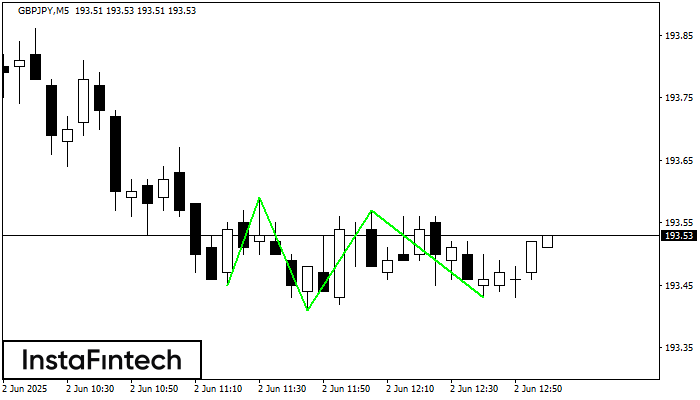

Triple Bottom

was formed on 02.06 at 12:00:00 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of GBPJPY M5. Features of the pattern: The lower line of the pattern has coordinates 193.59 with the upper limit 193.59/193.57, the projection of the width is 14 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 193.45, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength