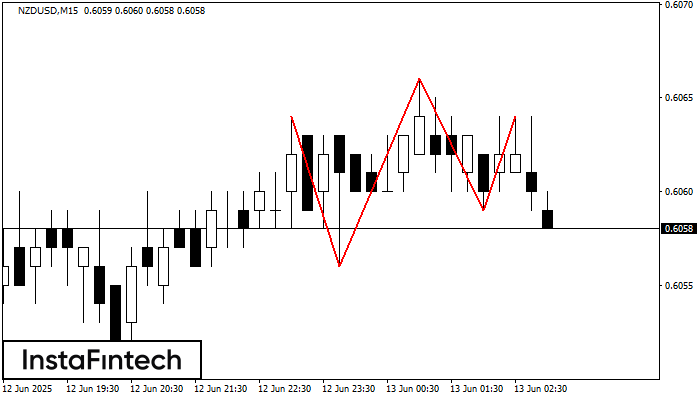

Triple Top

was formed on 13.06 at 02:00:45 (UTC+0)

signal strength 2 of 5

On the chart of the NZDUSD M15 trading instrument, the Triple Top pattern that signals a trend change has formed. It is possible that after formation of the third peak, the price will try to break through the resistance level 0.6056, where we advise to open a trading position for sale. Take profit is the projection of the pattern’s width, which is 8 points.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength