यह भी देखें

16.01.2026 01:12 AM

16.01.2026 01:12 AMAt the time of writing on Thursday, the USD/CAD pair is trading around the round 1.3900 level. The pair's movement is driven by renewed US dollar strength amid resilient US macroeconomic data, while the Canadian dollar remains under pressure from falling oil prices.

Fresh labour-market data support the US dollar: initial jobless claims for the past week fell to 198k from 207k, significantly beating expectations. At the same time, continuing claims fell to 1.884 million, confirming the US economy's continued resilience and reducing concerns about a slowdown in business activity.

The labour-market data reinforce the argument that the Federal Reserve will maintain a cautious, wait-and-see approach to monetary easing, despite persistent expectations for rate cuts closer to the end of the year. Against this backdrop, the US Dollar Index (DXY), which reflects the greenback's performance against a basket of major currencies, is rising.

Other data, including regional manufacturing surveys, point only to a limited slowdown, which further supports the US dollar.

For the Canadian dollar, the external environment remains less favourable. Falling oil prices — Canada's key export commodity — weigh on the national currency. Easing geopolitical tensions and expectations of more abundant energy market supply limit the potential for an oil recovery and, accordingly, the ability of the Canadian dollar to benefit despite a relatively stable domestic macro environment.

Expectations for further Bank of Canada action also remain muted: investors assume that, given modest growth and contained inflation, the Bank of Canada will keep a neutral stance in the coming months.

Therefore, the US dollar's strengthening on positive economic data and the Canadian dollar's weakening due to falling oil prices keep USD/CAD around the round 1.3900 level, with short-term bullish sentiment while these fundamental factors persist.

From a technical viewpoint, resistance for the pair remains unchanged — the 100?day SMA, the round level 1.3900, and 1.3920. Main support levels are 1.3885 and the 200?day SMA. Oscillators on the daily chart are positive, so the bulls are not ready to give up.

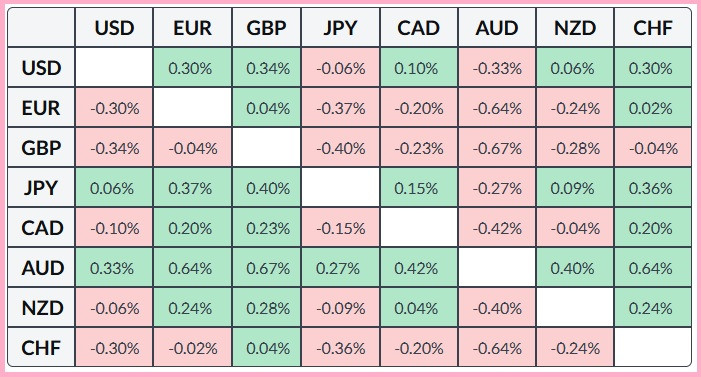

The accompanying table shows the percentage change in the Canadian dollar against a basket of major currencies today; the largest CAD strengthening was observed against the British pound.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |