यह भी देखें

29.01.2026 12:52 PM

29.01.2026 12:52 PMOn Wednesday, meetings of the Bank of Canada and the FOMC took place. The outcomes of both meetings almost fully matched forecasts, and the market reaction to them was rather weak.

The Bank of Canada left the overnight interest rate unchanged at 2.25%. Forward guidance contained minimal changes, as did the forecasts themselves. Essentially, the Bank repeated what it had stated at the previous meeting—to keep the rate unchanged until new information emerges. Tariffs and overall uncertainty are expected to continue putting pressure on the Canadian economy, resulting in slower growth; GDP growth for 2026 is forecast at +1.1%.

The Bank expects inflation to continue slowing in the coming months. Overall, the BoC has no difficulty maintaining a wait-and-see stance going forward. The key point is that slowing economic growth is also contributing to lower inflation, which means the regulator can simply wait for new data without taking any action.

Such a position, of course, provides little support for the loonie, and there are virtually no domestic reasons for further declines in USD/CAD.

As for the FOMC meeting, it naturally attracted much more attention. The Committee delivered several signals, each of which was weak on its own, and the overall perception of the Committee's stance remained unchanged. In particular, in the updated statement, economic activity was described as "solid" (previously "moderate"), and the unemployment rate was said to be "showing some signs of stabilization" (instead of "rose slightly in September"). The sentence stating that "the risks to employment have increased in recent months" was removed entirely.

Powell refrained from commenting on the situation involving Lisa Cook, the investigations concerning himself, and the possibility of continuing his work as a Fed Governor after May—exactly as expected. Overall, the impact of the FOMC meeting results on the markets turned out to be minimal.

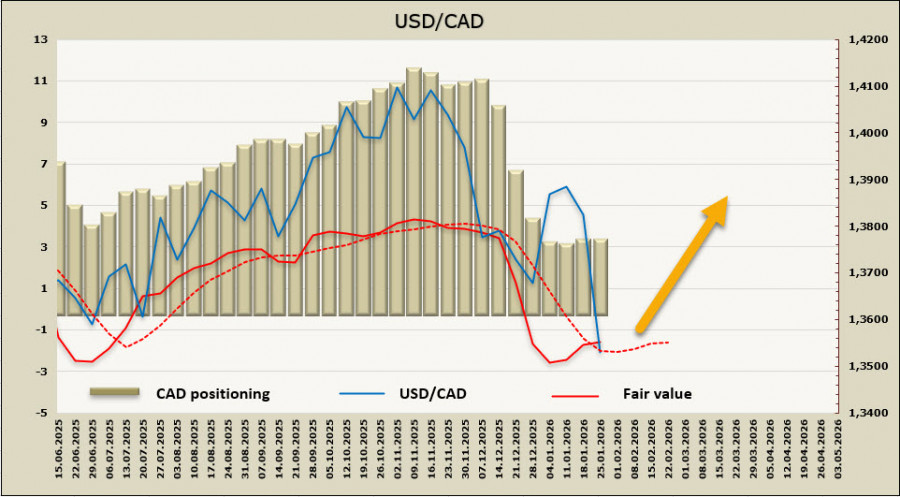

The fair value price failed to return to levels below the long-term average.

Apparently, there are virtually no reasons for further declines in USD/CAD. The Canadian economy is unable to generate a strong driver for strengthening the national currency, and the recent decline in USD/CAD has been almost entirely due to the overall drop in the U.S. dollar index.

If USD/CAD manages to consolidate below 1.3538, there may be an opportunity to attempt a move toward support at 1.3419, though the chances are slim. A more likely scenario is the formation of a base near current levels, followed either by trading in a sideways range—with the recent support at 1.3635 acting as the upper boundary—or an attempt to resume growth if incoming data provides such an opportunity for the U.S. dollar.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |