यह भी देखें

17.02.2026 06:44 PM

17.02.2026 06:44 PMThe USD/JPY pair is under pressure after encountering resistance around 153.75. Market participants remain highly cautious amid the risk of potential joint intervention by Japan and the United States to stabilize the yen. Moreover, the divergence in monetary policy approaches between the two countries, particularly regarding interest rates, continues to limit the pair's upside potential.

Disappointing fourth-quarter GDP results from Japan, released on Monday, are likely to weaken arguments in favor of further monetary tightening by the Bank of Japan, which may prevent bulls from making aggressive yen purchases. At the same time, market risk appetite could further dampen the yen's strength as a safe-haven currency, thereby providing some support to USD/JPY.

However, a significant dollar rally in USD/JPY appears unlikely, as expectations of Federal Reserve monetary easing and debates surrounding the central bank's independence are discouraging large-scale dollar buying.

For better trading opportunities, it makes sense to wait for the FOMC meeting minutes to gain clarity on the Fed's next steps regarding interest rates and the pace of potential cuts.

This week's economic calendar also includes U.S. durable goods orders and housing data, as well as global preliminary PMI readings and speeches by influential FOMC members, all of which may shape USD/JPY dynamics in the second half of the week. Overall, the broader fundamental backdrop suggests that the path of least resistance for spot prices is to the downside.

From a technical perspective, bulls will regain control only if the pair breaks above the 20-day SMA near 155.00. For now, daily chart oscillators remain in negative territory. If the pair fails to hold support at 152.70, it may accelerate its decline toward the psychological level of 152.00.

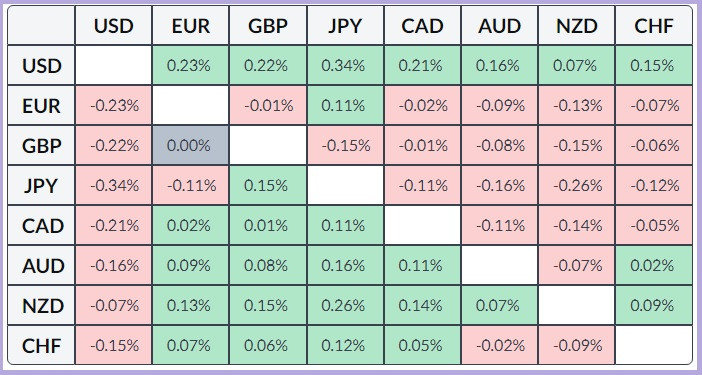

The table below shows the U.S. dollar's percentage performance against major currencies today. The dollar has shown the strongest performance against the Japanese yen.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |