Lihat juga

16.01.2026 01:12 AM

16.01.2026 01:12 AMWhen everything is going wrong, people buy the dollar. The start of 2026 was marked by mass unrest. Protests took place in Iran and Minnesota, the US kidnapped the president of Venezuela, and Greenland could provoke a conflict between NATO and the United States. Germany is sending troops there, while US administration officials are confident they can negotiate with Denmark amicably.

Geopolitics has become the key driver of the greenback's strengthening; its successful start has forced Wednesday's "bulls" to revise their forecasts. Thus, Bank of America believes EUR/USD will rise to 1.17 by the end of 2026, but expects a serious correction to the uptrend in the first half of the year. The idea of lower Fed rates and fiscal stimulus from China is unlikely to materialize in Q1 or Q2. At the same time, labor-market stabilization and the strength of the US economy are exerting serious pressure on the major currency pair.

According to Bank of America, Germany's fiscal stimulus and increased EU defense spending will show effect only in the second half of the year or in Q1–Q2 2027. In addition, the European Central Bank disappointment with inflation will force it to resume a cycle of monetary easing. That would be an unpleasant surprise for EUR/USD.

Germany's economy is indeed lackluster. In 2025, it expanded by a modest 0.2% after two consecutive years of contraction. This is not comparable to US GDP, which most likely grew around 2.5% last year. According to the Bloomberg consensus forecast, 2026 is expected to see growth of about 2%. Its stronger dynamics compared with Germany's argue for buying EUR/USD.

There are signs of stabilization in the US labor market. After unemployment fell to 4.4% in December, a pleasant surprise came in the form of jobless claims. For the week ending January 10 they fell to 198k — an indicator that was below all Bloomberg analysts' forecasts. It is quite possible that with a shrinking labor force due to the administration's anti-immigration policies, the US economy does not need employment gains of more than 50k.

If the labor market has bottomed and rebounds, and strong domestic demand accelerates inflation, the Fed will have no grounds to cut the federal funds rate before the end of 2026. And that is a completely different story — favorable for the US dollar.

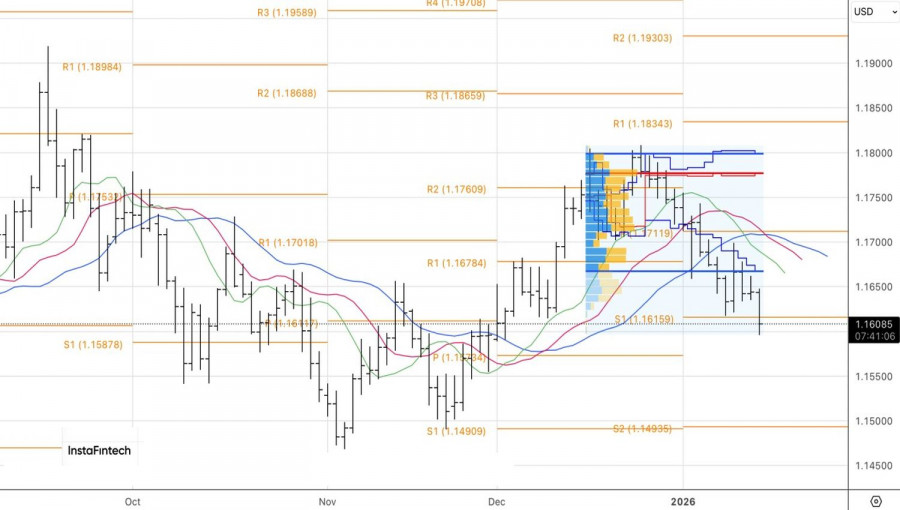

Technically, on the daily chart, EUR/USD saw the inside bar play out, which allowed shorts to be formed from 1.1630. If the bears manage to secure a close below 1.1615, the risks of a continued plunge toward 1.1500 and even 1.1400 will increase. It makes sense to continue following a strategy of selling the euro against the US dollar. A correction to the long-term uptrend in the major currency pair risks being prolonged.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.