A Bitcoin wallet is essential within digital finance, offering secure access to assets while enabling participation in a decentralized economy. These tools let users manage holdings without banks, granting complete control over funds along with access to global finance. As decentralized currency adoption increases, secure, efficient storage becomes vital to navigating this ever-evolving financial landscape.

Why Crypto Wallets Matter

A good storage solution is more than just a place where assets can be kept; it enables interaction with decentralized networks. Whether transferring funds internationally, trading, or securing long-term investments, the right tool keeps assets safe as well as accessible. Key benefits include:

- Fast, secure cross-border transfers

- Proof of ownership, preserving privacy.

- Direct interface with blockchain networks.

By removing intermediaries, storages give users full ownership of funds, meaning no third party can control or interfere.

Types of Wallets, Their Uses

The different types of crypto storages cater to varying needs, depending on how they are used, the level of security required. Choosing the right option hinges on your priorities, whether accessibility, security, or a blend of both.

Hot Wallets. Hot solutions are always connected to the internet, making them ideal for frequent activity.

- Primary use: these wallets are favored by active traders, users who frequently engage in buying, selling, or other regular interactions with Bitcoin.

- Key benefits: quick access, user-friendly interfaces make them convenient. Mobile apps, browser extensions allow seamless transactions anytime.

- Considerations: due to their constant internet connectivity, they are more vulnerable to online threats like hacking or phishing attacks.

Cold wallets. Cold solutions operate offline, offering superior protection.

- Primary use: these wallets are best suited to those holding significant amounts of Bitcoin or those looking to secure their assets for extended periods.

- Key benefits: storing private keys offline ensures protection against online threats. Options like hardware devices or even paper wallets make these a preferred choice for long-term security.

- Considerations: the added security often comes at the expense of convenience, as accessing funds requires physical interaction with the storage.

Hybrid solutions. Hybrid wallets combine features of both hot and cold solutions, aiming to provide a balance between convenience as well as security.

- Primary use: these are excellent for users who need occasional online access while maintaining secure offline reserves for larger holdings.

- Key benefits: by dividing Bitcoin between online and offline components, these storages offer flexibility without compromising significantly on safety.

- Considerations: managing both components requires a bit more effort, as the offline element must be regularly updated to reflect changes.

Making the Right Choice

Selecting a cryptocurrency storage involves assessing your needs, including how often you access funds, the amount being secured, the level of protection required. Each option has its strengths along with limitations:

- Hot solutions: great for everyday use or frequent trades but require robust security measures due to online risks.

- Cold solutions: perfect for safeguarding large reserves, though less practical for quick transactions.

- Hybrid solutions: practical middle ground, offering accessibility, protection in one solution.

Evaluate your priorities, usage patterns carefully to determine the best Bitcoin wallet type for managing your Bitcoin holdings effectively.

The Role of Wallets in Blockchain Interaction

Cryptocurrency storage does more than store assets—it serves as a gateway to decentralized networks. Key functions include:

- Transaction processing: sending and receiving funds with precision.

- Private key management: securing access to funds.

- Blockchain connectivity: interface for interacting with decentralized systems.

Without such tools, controlling assets or securely transacting would be challenging.

Purpose of This Guide

This guide is designed to help you master managing digital assets. Key areas include:

- Setting up secure platforms tailored to your needs.

- Safely adding funds to your storage.

- Finding your unique address, tracking activity.

- Comparing online vs. offline storage options.

- Enhancing privacy as well as security to prevent threats.

Emphasizing Security

Security is a central theme of this guide. Topics covered:

- Backing up recovery phrases, private keys in safe places.

- Avoiding scams by keeping sensitive information private.

- Regularly updating software to address vulnerabilities.

Preparing for a Decentralized Future

Navigating this new financial frontier requires more than tool knowledge. Following the steps in this guide equips you with the skills needed to securely manage assets while taking full advantage of decentralized finance opportunities. Whether you're starting out or refining your approach, this guide ensures you're able to achieve success in the digital finance era.

What is a Cryptocurrency Wallet and Why Do You Need One?

A crypto storage is essential for managing digital assets, acting as the interface between users and the blockchain. It enables sending, receiving, securing funds by facilitating interactions with decentralized networks. Unlike traditional accounts that rely on centralized systems, this tool provides complete ownership, giving users control over their funds without intermediaries.

Definition, Functionality

At its core, crypto storage functions as a gateway for managing digital assets. It doesn't store assets directly; instead, it holds keys granting access to funds on the blockchain. These keys authenticate ownership, enabling actions, ensuring only the rightful owner can move funds.

Key functions include:

- Sending funds: initiating payments for goods, services, or transfers.

- Receiving assets: generating unique addresses for incoming assets.

- Secure storage: protecting keys that grant access to assets.

This tool allows seamless interaction with blockchain networks, ensuring secure transactions as well as ownership verification.

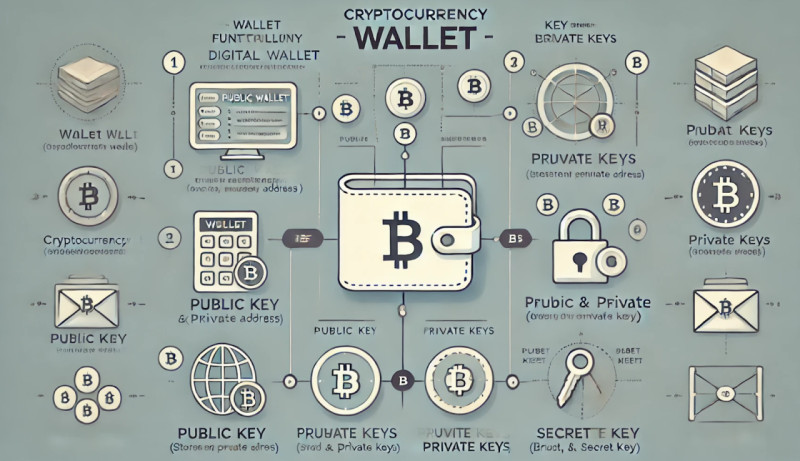

Public and Private Keys: The Foundation of Security

A crypto storage relies on two critical elements: public and private keys.

- Public key: shared address used to receive assets. It represents your account but cannot access funds.

- Private key: confidential code granting access for transactions, ownership verification.

Importance of Private Keys:

- Access control: without the private key, assets are inaccessible.

- Security: sharing or losing this key compromises ownership, so it must be protected.

- Recovery: recovery phrase tied to the private key helps regain access if lost.

Keeping private keys secure is vital. Best practices include offline storage, encrypted backups, avoiding exposure on untrusted platforms.

Different Wallet Solutions

Knowing storage options helps users select the best one based on their needs as well as security preferences.

Hot Storage Solutions:

- Connected online, offering real-time access.

- Best for frequent transactions, trading, or everyday use.

- Examples: Mobile apps, web platforms, browser extensions.

Cold Bitcoin Wallet Solutions:

- Offline, highly secure, designed for long-term holding, large investments.

- Examples: hardware devices, paper wallets, air-gapped systems.

Hybrid Solutions:

- Combination of hot and cold features, offering partial online access while keeping larger amounts offline.

Each option has trade-offs: hot solutions prioritize convenience but face greater online risks, while cold storage minimizes these risks but is less accessible.

Security Considerations

Choosing a secure platform is crucial. Key factors include:

- Encryption: ensures strong data protection.

- Two-factor authentication (2FA): adds an extra verification layer to prevent unauthorized access.

- Reputation: choose solutions with a solid track record, positive user feedback.

A crypto storage isn't just a tool—it's foundational for safe interactions within decentralized networks. By knowing its function, protecting private keys, choosing the right storage, users can confidently manage digital assets in today’s financial landscape.

Choosing the Right Storage Method

Selecting the correct storage method is key for balancing accessibility with security. Cryptocurrency storages generally fall into hot or cold categories, each suited to different needs like active trading or long-term investment. Comprehending the pros and cons of each option helps users make informed decisions that align with their usage, security requirements.

Hot Wallet vs. Cold Wallet Bitcoin: Choosing the Right Solution

Deciding between hot and cold crypto storages involves evaluating how frequently you interact with digital assets as well as the level of security you require. Each type serves unique purposes, catering to both active users and those with a focus on safety.

Hot Wallets: Designed for Speed and Convenience

Hot storages connect to the internet, offering immediate access, ease of use. They are excellent for active engagement with Bitcoin, especially when frequent transactions are necessary.

Key features, benefits:

- Intuitive interfaces: these wallets are designed with usability in mind, making them suitable for beginners, experienced users alike. Apps, browser extensions provide straightforward navigation without additional devices.

- Frequent usage: ideal for small, regular activities such as trading or shopping. Traders benefit from rapid execution, while everyday users appreciate the ability to make quick payments.

- Real-time access: Bitcoin is accessible anytime through devices connected to the internet, allowing users to act quickly in time-sensitive situations.

Examples of hot storages:

- MetaMask: well-suited for Ethereum, decentralized apps (dApps), this wallet supports NFTs, enhances privacy with local key management.

- Trust Wallet: versatile mobile wallet supporting multiple tokens like Ethereum or Binance Coin. It includes staking options, enabling users to earn rewards while managing assets conveniently.

Security considerations. While hot storages excel in accessibility, they are more vulnerable to online threats.

- Risks: exposure to hacking, phishing, malware can compromise private keys.

- Solutions: use strong passwords, enable two-factor authentication (2FA), keep software updated, avoid public Wi-Fi for accessing wallets.

Best Suited For:

- Active traders along with those needing frequent access.

- Users prioritizing convenience in daily transactions.

Cold Wallets: Built for Security and Long-Term Holding

Cold Bitcoin wallet functions offline, providing unparalleled protection against online risks. These storages are preferred by those who prioritize safety over accessibility.

Key features, benefits:

- Offline protection: operating without internet connectivity shields private keys from hacking, phishing attempts.

- Long-term reliability: perfect for safeguarding large holdings or Bitcoin kept for long durations.

- Versatility: many cold wallets support a range of digital assets, making them ideal for diverse portfolios.

Examples of Cold Wallets:

- Ledger Nano X: this hardware device combines robust security with Bluetooth functionality, enabling smartphone access while keeping keys offline. Secure chip technology ensures physical tamper resistance.

- Trezor Model T: featuring encryption along with a user-friendly touchscreen, it supports over 1,000 assets. Open-source software builds trust by allowing public audits.

Drawbacks:

- Accessibility: requires physical connection to a device, making frequent usage less practical.

- Physical Risks: While secure against online threats, they can be damaged, lost, or stolen. Safeguarding backup phrases is critical to prevent permanent loss.

Best Suited For:

- Investors with substantial holdings prioritizing security.

- Those focusing on long-term goals, such as retirement or asset preservation.

Key Differences Between Hot & Cold Wallets

| Feature | Hot Wallets | Cold Wallets |

| Security | Higher risk (online exposure) | Superior protection (offline storage) |

| Convenience | Instant access (frequent use) | Requires physical setup for access |

| Use Cases | Active trading, small balances | Long-term storage, large investments |

| Examples | MetaMask, Trust Wallet | Ledger Nano X, Trezor Model T |

Choosing the Right Option

- Hot solutions: optimal for users who need regular access, fast interactions, such as trading or shopping.

- Cold solutions: best for securing significant holdings, ensuring protection against online threats.

Knowing how often you use Bitcoin as well as the importance of security will help you decide. Both hot and cold storages play essential roles in managing digital assets effectively, so the choice depends on balancing convenience with protection.

A Balanced Approach

Many users find a balanced approach, using both hot and cold storages, provides the best of both worlds. A hot storage manages daily transactions as well as small trades, while a cold storage secures larger reserves. This strategy offers flexibility while maintaining the highest level of security, helping you navigate the digital economy with confidence.

How to Create a Bitcoin Wallet

Establishing a cryptocurrency storage is straightforward but crucial in securing digital assets. Whether the goal involves trading, saving, or exploring decentralized systems, following these steps ensures a reliable setup tailored to specific needs.

Step-by-Step Guide

1. Select the Right Type of Wallet

The type of storage depends on the intended usage, security priorities.

- Hot wallets: these internet-connected tools are designed for quick access, suitable for frequent trading or transactions. While convenient, they require robust security measures to mitigate online threats.

- Cold wallets: offline storages prioritize security and are best suited for holding large amounts over extended periods. They are impervious to online threats, serve as ideal solutions for long-term holders.

- Multi-currency wallets: supporting multiple assets, these storages simplify managing diverse portfolios by eliminating the need for multiple tools.

2. Download a Trusted App or Acquire a Hardware Device

Choose reputable providers to ensure safety. Verifying the source before downloading or purchasing a Bitcoin wallet is essential to engaging with digital assets. Whether purchasing through exchanges, receiving funds from others, or using Bitcoin ATMs, choosing the most suitable method ensures efficiency, security while minimizing costs.

Examples of trusted storages:

- Electrum: Known for its speed along with privacy features, popular among advanced users.

- Exodus: Easy to use, supports multiple currencies, ideal for beginners.

- Ledger Nano X: A highly secure hardware device, supports many assets, has Bluetooth functionality.

- Trezor Model T: Known for strong encryption, a user-friendly touchscreen interface.

3. Install the Software or Set Up the Device

Software solutions: download from official app stores or trusted websites. Follow the installation process carefully, ensure you're on a secure connection.

Hardware devices: unbox the device, follow the manufacturer’s instructions for setup. Most hardware storages come with clear, easy-to-follow steps for initializing, connecting the device.

4. Generate Keys

During setup, you will be given two keys:

- Public key: this is a receiving address, similar to a bank account number. You can share it openly to receive funds.

- Private key: this is a digital signature. It grants access to your funds, so it must remain private as well as secure. Losing it means losing access to assets.

Store Keys or Recovery Phrase Securely

After generating keys, you will also receive a recovery phrase (usually 12–24 words). This phrase is crucial for restoring storage if a device is lost or damaged. Write it down, store it in a safe, offline location. Do not keep it online or in the cloud as it could be hacked.

Back Up Your Wallet

Make sure to create multiple backups of a recovery phrase and/or private key. Keep these backups in secure locations like a fireproof safe, a locked drawer, or an encrypted USB drive. Backups help prevent the loss of access in case of physical damage to the device.

Test with a Small Transaction

Once everything is set up, send a small test transaction. This will help ensure that crypto storage works as expected, give you a chance to familiarize yourself with its features. You can always send more once you're comfortable with the process.

Popular Storage Platforms

- Software solutions:

- Electrum: fast, feature-rich storage known for its privacy features. Best for experienced users comfortable with advanced settings.

- Exodus: beginner-friendly storage with a simple interface, supporting multiple digital assets.

- Hardware devices:

- Ledger Nano X: offers Bluetooth connectivity, allowing you to manage funds from mobile devices. It’s a top choice for long-term storage as well as high-security needs.

- Trezor Model T: offers great encryption, supports a wide range of digital assets. It’s easy to use, ideal for both beginners as well as advanced users.

Tips for Success

- Verify sources: always double-check the wallet’s official website or trusted retailer before downloading or purchasing any storage. This helps avoid scams or counterfeit products.

- Enable security features: for added protection, enable two-factor authentication (2FA) or set up a strong PIN code. Some storages also support biometric authentication, such as fingerprint scans, for even more security.

- Update software regularly: regular updates help protect Bitcoin wallet from vulnerabilities, ensure it runs smoothly. Always download updates from official sources.

- Organize backups: keep a recovery phrase or private key backups in a safe place. Avoid keeping them in easily accessible areas, especially online.

Final Thoughts

Creating a storage for digital assets is essential for anyone looking to manage digital assets securely. By following the steps above, you ensure that funds remain safe, easily accessible. Whether you choose a hot or cold wallet, it’s important to prioritize security, regularly back up information. With the right setup, you’ll be well-equipped to navigate the world of digital finance confidently.

How to Top Up Bitcoin Wallet

Adding funds to a crypto storage is essential for interacting with digital assets. Whether you’re purchasing through exchanges, receiving transfers from others, or using Bitcoin ATMs, knowing these options helps ensure smooth, secure transactions. Choosing the right method can save both time and money.

Purchasing Through Exchanges

Exchanges are among the most reliable ways to acquire Bitcoin, fund a wallet. They offer various payment methods and are widely accessible.

- Reputable platforms: platforms like Coinbase, Binance, Kraken allow users to deposit funds using bank transfers, credit cards, or even PayPal. It is important to choose platforms with robust security features like two-factor authentication, cold storage to protect holdings.

- Transferring purchased Bitcoin: after purchasing, move Bitcoin to a private storage to enhance security. Keeping funds on exchanges carries risks such as hacking or platform failures. Configure automatic withdrawals to transfer assets immediately after purchase.

Receiving Bitcoin from Another User

Peer-to-peer transactions are direct, often faster than using centralized platforms.

- How it works: another user sends Bitcoin directly to a receiving address generated by your wallet. This can result from a trade, service payment, or personal transfer.

- Using peer-to-peer platforms: platforms like LocalBitcoins or Paxful connect buyers and sellers while offering escrow services to increase security. Choose services with anti-fraud measures along with positive user reviews for added peace of mind.

Bitcoin ATMs

Bitcoin ATMs enable users to convert cash into Bitcoin quickly, efficiently.

- Finding a Bitcoin ATM: use tools like CoinATMRadar to locate nearby machines. Check each ATM's fees and limits before visiting.

- Using the ATM:

- Choose the "Buy Bitcoin" option.

- Input or scan the receiving address generated by your storage.

- Insert cash, the ATM will send Bitcoin to the specified address.

- Benefits: ideal for individuals who prefer using cash or require fast transactions without involving traditional banking systems or exchanges.

Steps to Deposit Bitcoin

Generate a receiving address: open the "Receive" section in the wallet, create a unique address. Generating a new address for each deposit improves privacy, tracking.

Provide or input the address: share the address with the sender or input it into the appropriate field on a sending platform. Many storages also allow QR codes for easier address sharing.

Confirm the transfer: verify details such as the address, amount, transaction fee before approving. Track the status of the transfer using tools like Blockchain Explorer. Expect 3-6 confirmations for the transfer to Bitcoin wallet finalization, depending on network activity.

Tips for Smooth Transfers

- Monitor fees: Bitcoin network fees fluctuate based on demand. Tools like Mempool.space help estimate fees. Opt for higher fees for urgent transactions, lower fees for less time-sensitive ones.

- Double-check addresses: always confirm the receiving address, as errors can result in irreversible losses. QR codes help reduce typos or copy-paste mistakes.

- Send a test amount: for large transfers, send a small amount first to ensure accuracy. Once confirmed, proceed with the full transfer.

- Beware of scams: avoid sharing addresses through insecure channels or with unknown individuals. Be cautious of unsolicited requests or offers.

- Keep records: save transaction IDs, confirmations. These records are useful for resolving issues or tracking payments.

Conclusion

Topping up a crypto storage is a straightforward process when using trusted methods, following best practices. Whether funding through exchanges, peer-to-peer platforms, or Bitcoin ATMs, ensuring security as well as accuracy at every step builds confidence in managing assets. By employing these strategies, you can efficiently navigate the digital financial landscape, maintain control over your Bitcoin.

How to Transfer Money to Bitcoin Wallet

Transferring funds to a crypto storage is simple but requires precision to ensure security. Whether sending funds, transferring between accounts, or making payments, knowing the process minimizes risks, improves efficiency.

Steps to Transfer Funds

Obtain the recipient’s address. The recipient’s address is a unique alphanumeric string generated by their platform or hardware device. QR codes simplify this by allowing you to scan the address, ensuring accuracy. Always confirm the address directly with the recipient.

Initiate the transfer. Open your app or platform, go to the "Send" or "Transfer" section. Paste or scan the recipient’s address. Double-check it carefully—errors can lead to irreversible loss. If necessary, select the cryptocurrency to transfer, especially on platforms supporting multiple tokens.

Specify the amount. Enter the amount to send. Some platforms show the fiat equivalent, which can help clarify the value. Pay attention to decimal places to avoid sending too much or too little.

Confirm details. Review the recipient’s address, amount, transaction fees. Fees vary based on network congestion, so adjust them for speed—higher fees process faster. Once sure all details are correct, proceed. Blockchain transactions are irreversible.

Authorize the transaction. Confirm the transfer by following your platform’s security steps. Software apps may require a PIN or password; hardware devices often need physical confirmation. Two-factor authentication (2FA) adds an extra layer of security.

Track the transaction. Monitor the transaction’s status on a blockchain explorer using the transaction ID. Share this ID with the recipient for verification. Track confirmations, as each block added to the blockchain verifies the transfer. Usually, 3-6 confirmations are needed for full validation.

Tips for Seamless Bitcoin Transfers

Ensuring precision along with security during Bitcoin transfers is crucial to avoid errors, maintain confidence in your transactions. Following these best practices minimizes risks, ensures smooth operations.

Double-Check Addresses

Before initiating a transfer, confirm the recipient's address by reviewing the first and last few characters. Using the copy-paste function or scanning a QR code of a Bitcoin wallet is highly recommended to avoid manual entry mistakes. Typing errors can lead to irreversible losses, so always cross-verify the input.

Leverage QR Codes

QR codes are an excellent way to ensure accuracy. Most wallets as well as hardware devices provide this feature, allowing quick, error-free address input by scanning. This method eliminates the risk of typographical errors while saving time during the transfer process.

Monitor Network Congestion

Blockchain networks can experience delays when congestion is high, affecting both processing times along with fees. Tools like Mempool.space provide real-time data on network activity, helping users gauge the optimal fee required for timely confirmation. Adjust the fee based on the urgency of the transfer—higher fees generally result in quicker validation.

Start with a Small Amount

When sending cryptocurrency to a new cryptocurrency storage or transferring large sums, initiate the process with a smaller test amount. Once the initial transfer is confirmed, proceed with the remaining balance. This step ensures the address is correct, minimizes potential losses if an error occurs.

Track Confirmations

Each Bitcoin transfer requires validation on the blockchain through confirmations. Use a blockchain explorer to monitor the progress. Typically, three confirmations are sufficient for smaller transactions, while larger amounts may require up to six for added security. Tracking ensures peace of mind, helps identify delays or issues early.

Conclusion

Efficient Bitcoin transfers depend on meticulous attention to detail, proactive measures. By verifying addresses, leveraging QR codes, monitoring network conditions, using blockchain explorers, you can confidently manage your crypto storage operations. These steps not only enhance security but also improve the overall user experience, ensuring reliable, hassle-free transfers.

How to Find Your Bitcoin Wallet

Accessing your storage is essential to manage digital assets effectively. Whether you’re using mobile apps, hardware devices, or exchange platforms, knowing how to retrieve wallet details ensures smooth transactions, accurate tracking, secure fund management. This guide provides clear steps to find your cryptocurrency storage across various platforms, recover access if needed.

Finding Wallet Details

Using Mobile or Desktop Applications

Most applications provide intuitive navigation to display storage addresses:

- Open the app, access the "Receive" or "Deposit" section.

- Here, you’ll find a unique Bitcoin address, typically an alphanumeric string. This serves as the destination for incoming Bitcoin.

- Many apps also display a QR code for ease of use, allowing others to scan, send Bitcoin without manually entering the address.

- If the app supports multiple accounts, ensure you select the correct Bitcoin address to avoid confusion or errors.

- For more detailed settings, navigate to the app’s "Settings" or "Overview" sections, where additional address options may be available.

Using Hardware Devices

Hardware devices like Ledger or Trezor provide secure offline storage for Bitcoin. To locate your storage address:

- Connect the hardware device to its companion app or a computer.

- Navigate to the “Receive” section within the software.

- The Bitcoin wallet address will be displayed on both the device’s screen and in the app. This allows you to confirm its accuracy before sharing.

- Many devices offer the option to generate multiple addresses to enhance privacy. These can typically be found under advanced settings in the companion app.

- If encountering issues, consult the user manual or search for guidance on the manufacturer’s official website.

Through Exchange Platforms

If using an exchange as a wallet, follow these steps to find your Bitcoin address:

- Log in securely to your account, ensure two-factor authentication (2FA) is enabled to safeguard access.

- Go to the "Deposit" section, select Bitcoin as the asset.

- The exchange will display a unique receiving address that you can copy manually or share via QR code.

- For added security, some exchanges allow users to generate new addresses for every transaction, reducing traceability.

- If working with multiple subaccounts, confirm you’ve selected the correct one to prevent processing delays.

Tips for Ensuring Accuracy

- Double-check addresses: Always verify the first and last few characters of the address when copying or sharing to avoid errors.

- Refresh addresses: if privacy is a concern, generate a fresh address before every transaction, when supported by the platform.

- Enable notifications: many apps as well as exchanges offer alerts for account activity, helping you stay informed about incoming transfers or changes.

Recovering Wallet Access

In case of lost access, recovery options vary by platform:

- Mobile, desktop apps: use the recovery phrase provided during setup. Entering this phrase into a compatible app restores access.

- Hardware devices: follow manufacturer-specific steps to restore the storage using the backup recovery phrase.

- Exchanges: contact customer support with verification details, such as transaction IDs or identity documents, to regain access.

Locating your crypto storage is a straightforward process when using trusted platforms. Following these steps ensures you can easily find wallet details, manage assets securely, avoid errors during transactions. Regularly verifying address information, enabling platform-specific security features adds an extra layer of protection to your holdings.

Verifying the Address

Check Address Accuracy

Always verify that the address you're sharing is correct. Even small errors can result in the irreversible loss of funds. After pasting an address, compare the first and last few characters to ensure it hasn’t changed.

Use Blockchain Explorers

To verify your address’s activity, use a blockchain explorer. Paste your address to check balances, transaction history. Blockchain explorers offer real-time transaction tracking, helping you monitor incoming and outgoing funds.

Lost Wallet Recovery

Use Recovery Seed Phrases

Recovery seed phrases, provided during storage setup, are key to regaining access if login details are lost. Enter this phrase into a compatible app or hardware device to restore access. Store seed phrases in multiple secure locations, like fireproof safes or encrypted digital files, to avoid loss or theft.

Recovery Tools

Many platforms offer built-in recovery options. Mobile apps may allow account recovery via email after identity verification. Hardware devices typically provide step-by-step guides for restoring storage with backup phrases. Always use official recovery tools for Bitcoin wallet to avoid phishing risks.

Contact Wallet Providers

If recovery tools don’t work, contact storage provider or exchange support. Be prepared to verify ownership by sharing transaction IDs, account details, or backup codes. Some platforms may require identity verification (e.g., government-issued ID) to confirm account ownership.

Tips to Prevent Future Access Problems

Backup keys, addresses. Create multiple backups of recovery phrases, private keys, storage addresses to safeguard against loss. Use both physical and digital methods:

- Write down key details on paper, store them in secure places, such as a fireproof or waterproof safe.

- Digitally encrypt sensitive information, save it in protected storage devices, such as USB drives or offline systems.

- Physical backups in secure containers prevent damage from fire or water, ensuring long-term preservation of crypto storage credentials.

Organize, label addresses. To simplify management, label addresses based on their purpose:

- Use descriptive names, such as "Personal Savings," "Business Transactions," or the name of the exchange, to differentiate between multiple addresses.

- This organization reduces confusion when reviewing accounts, tracking activity.

Strengthen security. Strong security measures prevent unauthorized access:

- Create unique passwords with a mix of letters, numbers, and special characters, avoiding easily guessed phrases.

- Activate two-factor authentication (2FA) to add an extra security layer. This ensures that access requires a verification code along with the password.

- Keep passwords updated periodically to minimize the risk of breaches.

- Never share private keys or recovery phrases, even with customer support teams claiming to assist.

Conclusion

Securing as well as organizing a crypto storage is fundamental to protecting digital assets. Regularly backing up credentials, labeling addresses clearly, implementing robust security practices ensure assets remain accessible, safe. Proper planning reduces risks, provides confidence in navigating the digital economy effectively.

Check Bitcoin Wallet: Monitoring Balance and Transactions

Managing a cryptocurrency storage requires vigilance to secure funds, verify transactions. Regularly checking balances, transaction history helps spot discrepancies, track transfers, stay informed about account activity. Blockchain explorers as well as storage apps make tracking holdings simple, efficient.

Methods to Monitor Cryptocurrency Wallet Activity

Access Through Storage Applications

Open your wallet app or related platform to review balances, recent activity, linked addresses. Hardware devices require a connection to their companion app or software for synchronization, visibility.

- Always keep software or firmware updated to maintain compatibility, benefit from the latest features.

Leverage Blockchain Explorers

Blockchain explorers, such as Blockchain.com, Blockchair, or BTCScan, allow comprehensive tracking of public addresses. These tools enable you to independently verify activity without relying solely on your wallet's interface.

- What they provide:

- Detailed records of funds received and sent.

- Confirmation counts for each transfer.

- Real-time updates on current balances linked to specific addresses.

Using these explorers ensures an additional layer of transparency as well as validation for your activity.

Enable Notifications

Certain storage providers include push or email alerts to keep users informed about account movements. Activating these updates ensures you are promptly notified of deposits, withdrawals, or any unusual actions.

- Sync notification-enabled apps with your mobile device to receive instant updates, improving oversight of account activity of Bitcoin wallet.

Ensuring Transparency Through Blockchain

Blockchain’s transparency allows anyone to view transactions linked to a specific address. While this ensures accuracy, it also protects privacy by keeping users anonymous unless their identity is explicitly connected to an address.

Benefits of Public Transparency

- Verify legitimacy of incoming transactions

- Track payments to confirm they reach the correct destination

- Provide proof of payment for personal or business exchanges

Protecting Your Privacy

- Avoid reusing addresses to make it harder to trace activity.

- Use privacy tools like mixers or privacy-focused networks if anonymity of crypto storage is important.

Common Issues, Troubleshooting

Incorrect balance updates:

- Cause: network delays can show outdated balances.

- Solution: refresh the app or reconnect your device. If the issue persists, check balance with a blockchain explorer.

Delayed confirmations

- Cause: network congestion or low transaction fees can slow processing.

- Solution: check confirmation status via an explorer. Use platforms with fee adjustments for faster processing.

Unrecognized Transactions

- Cause: unauthorized access or errors may be the cause.

- Solution: review private keys, recovery phrases for security. If compromised, transfer funds to a new storage immediately.

Best Practices to Monitor Crypto Wallet Activity

Track Transaction IDs

Keep a record of transaction IDs, especially those involving significant transfers. These IDs are essential references for verifying activity, troubleshooting, resolving any disputes related to your funds.

Use Two-Factor Authentication

Strengthen security by enabling two-factor authentication (2FA). This extra layer requires an additional verification step, such as a code from an authenticator app or SMS, reducing the risk of unauthorized access.

Conduct Regular Reviews

Set aside time to examine storage activity periodically. Look for unexpected entries, irregular balances, or unrecognized outgoing transactions. Early detection helps mitigate potential risks, ensures account accuracy.

Conclusion

Effective monitoring of crypto storage is vital for maintaining control over your assets. Combining tools like transaction tracking, security enhancements such as 2FA, routine activity reviews keeps your holdings secure, ensures that all transactions remain transparent, verifiable.

Anonymous Bitcoin Wallet: Protecting Privacy

In a world where privacy concerns are growing, anonymous crypto storage helps maintain discretion. While Bitcoin transactions offer transparency, they are also traceable on the blockchain, which can reveal users' identities. For enhanced privacy, certain features as well as practices can significantly reduce traceability. This guide outlines methods, storage options, best practices to protect privacy while using Bitcoin.

Privacy Features: Coin Mixing, Tor, VPNs

Coin Mixing

Coin mixing (or CoinJoin) hides the origin along with destination of transactions by pooling funds from multiple users into one. This makes it much harder to trace any transaction back to an individual. Some solutions, like Wasabi or Samourai, have integrated CoinJoin for seamless anonymity, allowing users to mix funds directly within the app.

Tor Network

Tor (The Onion Router) routes internet traffic through decentralized servers, masking IP addresses. Using Tor with a cryptocurrency wallet hides your online activity, making it more difficult for anyone to track you. Many privacy-focused storages, including Wasabi, Electrum, support Tor integration, enhancing privacy for Bitcoin wallet by routing all data through the Tor network.

VPN Usage

A Virtual Private Network (VPN) encrypts internet traffic, hides your IP address. While VPNs don’t offer the same level of anonymity as Tor, they add an extra layer of security. Using a VPN alongside Tor can provide a double shield against surveillance, geo-tracking. Select a trustworthy VPN provider that does not log your activities to maintain your privacy.

Privacy-Focused Wallets

Selecting the right wallet is crucial for maintaining anonymity. Several options are designed for users prioritizing privacy as well as security:

- Wasabi Wallet:

An open-source solution with built-in CoinJoin mixing, Wasabi helps anonymize transactions without third-party services. It integrates Tor for routing traffic through secure servers, ensuring complete privacy while using Bitcoin.

- Samourai Wallet:

Known for its advanced privacy features, Samourai offers CoinJoin integration along with a unique "Stonewall" feature that obfuscates transaction origins. "Ricochet" adds extra hops to transactions, making tracking even more difficult.

- Electrum Wallet:

Electrum is a popular, open-source storage with Tor support. When properly configured, it provides an effective solution for privacy by routing all wallet traffic through Tor.

- Armory Wallet:

Armory is an advanced solution designed for secure offline storage but also offers features for enhanced privacy. With multi-signature support, full control over private keys, Armory is ideal for those serious about securing funds, maintaining anonymity.

Protecting Your Identity: Best Practices

Using a privacy-centric storage is just one step in maintaining anonymity. To further protect your identity, adopt these practices:

Use a new address for each transaction

Bitcoin transactions are public on the blockchain, so reusing addresses can link multiple activities together. Many wallets generate new addresses after each transaction, making it harder for anyone to associate your transactions with you.

Avoid linking personal information

Do not connect personal details like your name, phone number, or email to your storage. When purchasing Bitcoin or using exchanges, consider using pseudonyms. For decentralized exchanges (DEXs), no identity verification is typically required.

Limit KYC Use

Know-Your-Customer (KYC) platforms require personal information, which can compromise privacy. Use platforms that allow peer-to-peer (P2P) trades, bypassing the need for identity verification. Options like LocalBitcoins or Bisq support P2P trades without compromising privacy.

Avoid Public Wi-Fi

Public Wi-Fi is often unsecured, making it vulnerable to hackers. If you must use public networks, ensure your traffic is encrypted with a VPN or Tor. Always avoid accessing your crypto storage over unprotected networks to prevent exposure.

Review Privacy Regularly

Privacy tools, threats evolve, so it's essential to regularly review your privacy practices. Stay informed about the latest privacy features along with technologies to ensure continued protection.

Conclusion

An anonymous storage helps users protect their privacy while using Bitcoin. By employing features like coin mixing, Tor integration, VPNs, you can significantly enhance your confidentiality. Select a solution that prioritizes security, follow best practices like using fresh addresses, avoiding linking personal information. With the right tools along with strategies, you can maintain privacy while enjoying the benefits of Bitcoin wallet.

Best Bitcoin Wallet: Choosing the Right Option

Choosing a storage for cryptocurrency is crucial for safeguarding digital assets. With many options available, comprehending key factors helps identify the best fit. Whether focusing on security, usability, or compatibility, selecting wisely ensures your funds stay secure as well as accessible.

Key Selection Criteria

Security features

- Two-factor authentication (2FA): adds an extra verification step, such as a code from Google Authenticator.

- Encryption: protects private keys, even if accessed by unauthorized parties.

- Backup options: secure recovery phrases, key storage prevent loss in case of device failure.

- Open source: open-source storages allow security audits, building trust through transparency.

User experience

- Simplicity: iIntuitive interfaces are essential, especially for beginners.

- Accessibility: storages available on mobile apps, desktops, or as browser extensions offer flexibility.

- Customization: advanced users may need storages with fee customization or extra tools.

Compatibility:

- Operating systems: ensure storage supports your device’s OS (iOS, Android, Windows, Mac).

- Multicurrency support: some storages support various digital assets, ideal for diverse portfolios.

- Hardware compatibility: integration with hardware devices like Ledger or Trezor ensures offline storage.

Reputation:

- Trustworthiness: choose storages from developers with a solid security, reliability track record.

- Reviews, ratings: user reviews, expert feedback reveal performance along with issues.

- Customer support: reliable support is crucial for troubleshooting or resolving problems.

Top Wallets in 2024

Ledger Nano X (Hardware)

- Recognized for exceptional security, the Ledger Nano X ensures private keys remain offline, providing strong protection against online threats.

- Equipped with Bluetooth functionality, it seamlessly integrates with mobile devices while maintaining high safety standards.

- Designed for long-term holders who emphasize maximum asset security.

Trezor Model T (Hardware)

- Device that features a touchscreen interface that simplifies navigation while upholding advanced encryption protocols.

- Supports a broad range of assets, making it a suitable option for users managing varied portfolios.

- Compatible with software storages, offering enhanced flexibility as well as accessibility.

Exodus (Software)

- Delivers an intuitive user interface, appealing to both novice and seasoned users.

- Combines aesthetic design with robust functionality, including a built-in exchange for effortless asset management.

- Available across desktop and mobile platforms, enabling convenient management wherever needed.

Electrum (Software)

- A lightweight, fast solution, favored by experienced individuals seeking efficiency.

- Offers customizable fees, seamless integration with hardware devices for enhanced security.

- Open-source design ensures transparency, allows for community-driven security reviews.

Trust Wallet (Mobile)

- A versatile mobile solution supporting a wide variety of digital assets.

- Includes advanced features like staking, DeFi integration, expanding its utility beyond simple storage.

- Prioritizes simplicity, ensuring accessibility across experience levels, from beginners to advanced users.

Final Thoughts

Choosing the right storage depends on your needs. Long-term investors may prioritize offline security, while active traders may value convenience as well as accessibility. By evaluating security, compatibility, user experience, you can confidently select a solution that meets your goals. Whether focused on privacy, control, or functionality, the right choice will ensure your digital assets remain secure in crypto storage.

Conclusion

Cryptocurrency storage is more than a tool for managing digital assets—it's your gateway to financial autonomy in a decentralized world. Mastering Bitcoin wallet is essential for participating in the evolving digital economy, from setup, funding to securing private keys along with tracking activity. Here's a recap of key points to use storages effectively.

Key Takeaways

Creation & Setup

Choosing the right storage starts with knowing your goals. Hot storages offer convenience for frequent transactions, while cold storages provide high security for long-term holdings. Setting up a storage involves generating private keys, securing recovery phrases, customizing features based on your preferences.

Adding Funds

Fund your storage by purchasing assets on exchanges, transferring from other accounts, or using ATMs. Always generate, securely share receiving addresses to ensure smooth transactions. Monitor fees to avoid unnecessary costs.

Transactions & Monitoring

Sending or receiving funds requires precision. Double-check addresses, track confirmations, use blockchain explorers to stay updated. Regularly review activity to catch errors or potential security threats early.

Privacy & Security

Consider privacy-focused storages, VPNs, address obfuscation tools to enhance anonymity. Secure private keys, enable two-factor authentication, store encrypted backups to protect assets from theft or loss.

Choosing the Best Wallet

The right crypto storage depends on your needs—security, usability, or compatibility. Look for trusted providers with solid reputations, strong features, proven reliability.

Actionable Steps for Securing Your Future

Whether you're new to digital currencies or experienced, proactive steps ensure your financial security. Start by selecting a storage that fits your habits. Learn its features, secure your private keys, explore privacy-enhancing methods, such as Tor or VPNs, to protect anonymity. Stay informed about security best practices to stay ahead of evolving threats.

Take advantage of decentralized finance (DeFi). Experiment with small transactions, support global causes, or use platforms for trading or earning. These activities build confidence in managing your digital assets.

Final Thoughts: Embracing Financial Autonomy

Cryptocurrency wallets aren't just a tool to store assets — they embody financial independence as well as innovation. By using them, you participate in a more inclusive, efficient financial system, free from traditional constraints. They provide control over wealth in ways that weren't possible just a few years ago.

Mastering Bitcoin wallet isn't just about securing assets — it's about exploring the possibilities of a decentralized economy. As adoption increases, those who know how to protect, and manage holdings will be better positioned to thrive in this new financial frontier. Embrace these tools, explore their potential, and discover how they can redefine how you engage with value, opportunity, and freedom.