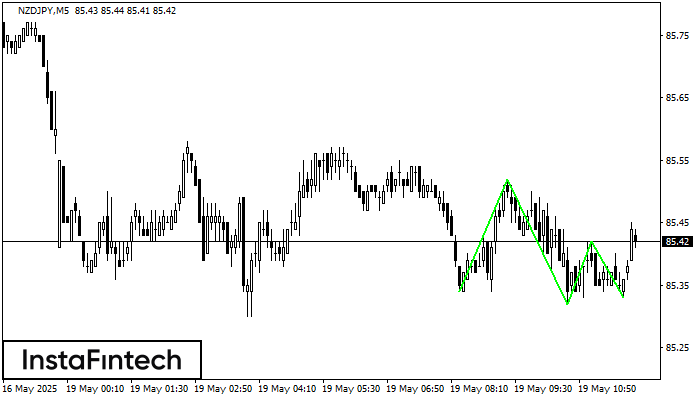

Triple Bottom

was formed on 19.05 at 11:00:17 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of the NZDJPY M5 trading instrument. The pattern signals a change in the trend from downwards to upwards in the case of breakdown of 85.52/85.42.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength