See also

31.03.2022 08:50 PM

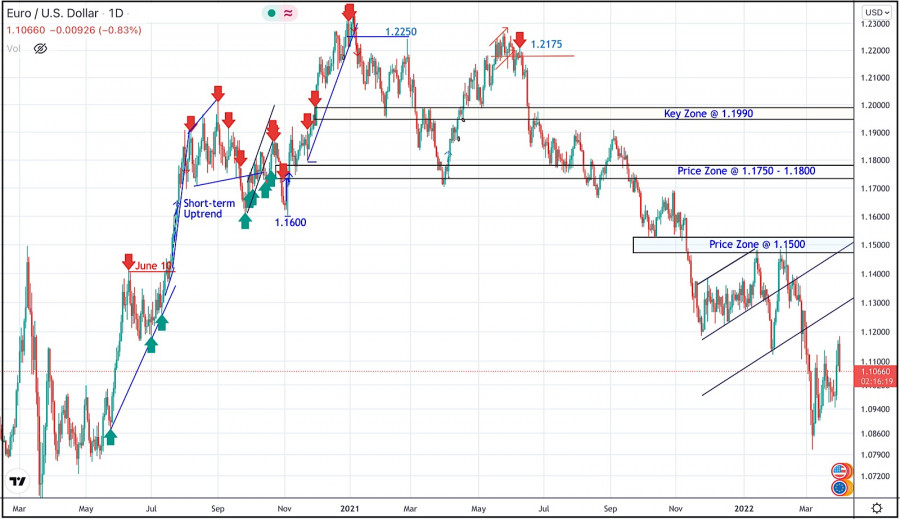

31.03.2022 08:50 PMDuring the past few weeks, the EURUSD pair has been trapped within a consolidation range between the price levels of 1.1700 and 1.1900.

In late September, Re-closure below the price level of 1.1700 has initiated another downside movement towards 1.1540.

Price levels around 1.1700 managed to hold prices for a short period of time before another price decline towards 1.1200.

Since then, the EURUSD has been moving-up within the depicted movement channel until bearish breakout occurred by the end of last week's consolidations.

Few weeks ago, the price zone of 1.1350 failed to offer sufficient bearish rejection that's why it was bypassed until 1.1500 which applied significant bearish pressure on the pair.

A possible SELL Entry was offered upon the previous ascending movement towards 1.1500 which provided significant bearish pressure.

Shortly after, the EURUSD looked oversold while approaching the price levels of 1.0850. That's where the current upside movement was initiated.

Any movement towards 1.1200 should be considered for another SELL trade as long as sufficient SELLING pressure is demonstrated.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.