See also

24.06.2022 04:50 PM

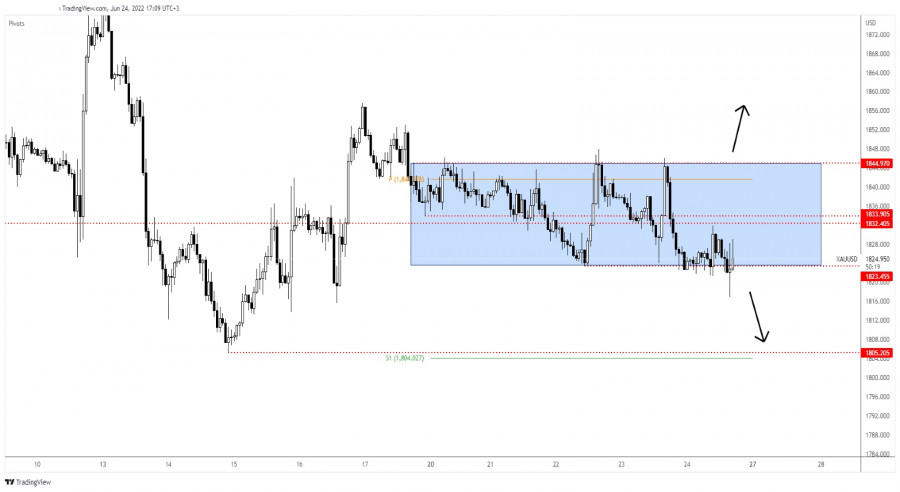

24.06.2022 04:50 PMThe price of gold rallied in the last minutes after the US data dump. Still, this could be only a temporary rebound. XAU/USD was trading at the 1,827 level at the time of writing and it continues to stay above the 1,823 key level.

Technically, the yellow metal is still trapped within a range pattern, the breakdown needs confirmation. Fundamentally, XAU/USD received a helping hand earlier as the Revised UoM Consumer Confidence dropped unexpectedly from 50.2 to 50.0 points. The USD plunged after the US data, so Gold took advantage of this situation.

As you can see on the H1 chart, the price failed to take out the resistance represented by the 1,844 signaling strong sellers around that level. Also, it has registered only a false breakout above the weekly pivot point of 1,841 announcing strong bearish pressure.

Now, it has dropped but it has failed to stabilize under the 1,823 static support. The US data pushed the rate above this key level again, otherwise, it would have been traded in the sellers' territory. The 1,832 - 1,833 represent an immediate upside obstacle.

Coming back and stabilizing below the 1,823 could confirm the breakdown below this key support and could open the door for a larger drop. Only a valid breakout above the 1,833 could activate further growth towards the 1,844 again.

A larger downside movement could be confirmed by a valid breakdown below 1,816 today's low. This scenario could bring us new short opportunities.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.