See also

05.01.2022 10:23 AM

05.01.2022 10:23 AMThe US National Nonfarm Employment report is expected to be released today at 13:15 Universal time, which will be followed by a report on crude oil inventories at 15:00 UTC+00. A detailed report on the rates committee meeting held two weeks ago is also expected at 19:00 Universal time. Most likely, such a volume of news can accelerate the movement of the course towards the intended target.

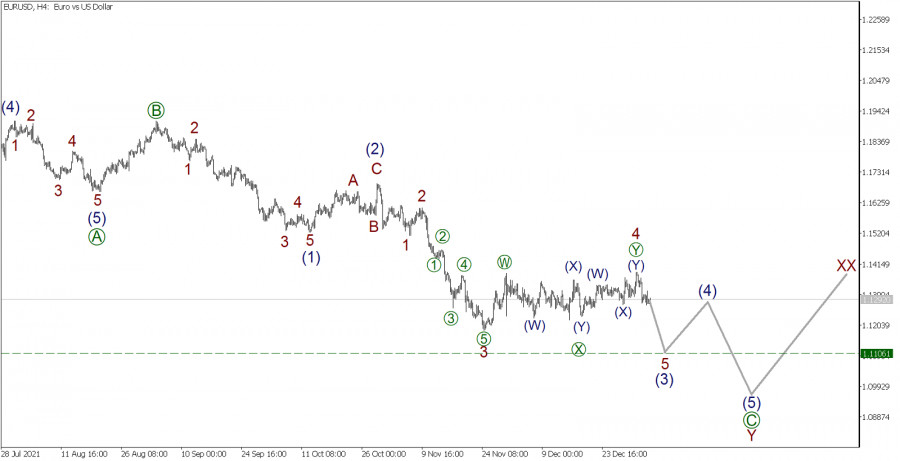

EUR/USD, H4 timeframe:

Just like in previous trading weeks, the formation of a downward wave Y can be observed, which is part of a large zigzag trend that takes the form of a triple zigzag.

Wave Y is similar to a simple zigzag [A]-[B]-[C], where the first two sub-waves were fully done with their pattern – impulse [A] and correction [B]. Now, the last downward wave [C] is still under development, taking the form of a simple impulse, which will consist of sub-waves (1)-(2)-(3)-(4)-(5).

Earlier, only the first two parts, sub-waves (1) and (2), have been fully completed within the framework of the potential impulse. A downward impulse wave (3) is still in the process of development. It seems that the development of a complex correction 4, consisting of sub-waves [W]-[X]-[Y], has recently ended, then the price began to make a downturn. It is very possible that the decline began in the last fifth wave.

Now, we expect the price to fall to the level of 1.1106, after which it may reverse and a correction (4) will start to form, as shown in the chart. Currently, opening sell deals can be considered.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.