See also

17.01.2022 12:31 PM

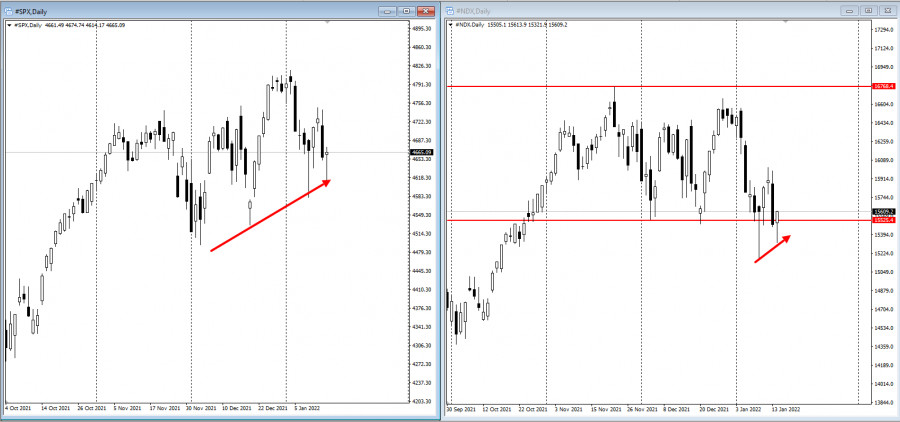

17.01.2022 12:31 PMVolatility gripped the financial markets on Friday as investors reevaluated their strategies amid potential early rate hikes this year. The S&P 500 traded near session lows, while Treasury yields rose along with dollar.

Disappointing results from JPMorgan and Citigroup also put pressure on banks, but gains in Wells Fargo preserved a bullish outlook. That is why Friday still closed on the positive side ahead of Martin Luther King Day, which is celebrated today in the US.

Jamie Dimon, chief of JPMorgan, said the Federal Reserve could raise rates up to seven times this year. He added that the tightening may not be as "sweet and soft" as some might expect, but he did not specify how quickly this could happen.

Meanwhile, New York Fed President John Williams said the central bank will work to bring inflation down to 2%. San Francisco Fed chief Mary Daly agreed on this and noted that officials "will have to adjust policy." For Philadelphia Fed leader Patrick Harker, "three, maybe four, 25 basis point increases this year are appropriate."

Callie Cox, analyst at eToro, commented that "it is clear the ground is shifting under investors' feet. After all, the Fed's expectation went from no hikes in 2022 to four in a matter of a few months. This could be a big change in how investors view the risk and reward of different markets. And change can be uncomfortable."

Goldman Sachs said equities offer the best opportunity to outperform inflation, and cyclical stocks like financials, energy and commodities are particularly well-suited to benefiting from higher prices as these firms usually do well when the economy is in good shape or recovering from a crisis.

But according to the latest poll of Bloomberg, the economy will stumble because of the omicron virus, albeit not as long-lasting as in the first quarter. Back then, consumer sentiment in the US fell more than expected, and retail sales dipped in December by the most in 10 months. Industrial production in the US also dropped unexpectedly.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.