See also

24.01.2022 02:28 PM

24.01.2022 02:28 PMThe main news from the crypto space:

Elon Musk criticized the integration of NFTs by the social network Twitter, which introduced an option last Thursday that allows adding NFTs as profile avatars. Access was opened to users of iOS devices that are among the subscribers of the premium Twitter Blue service. According to Musk, the company is wasting engineering resources that should have been directed to the fight against fraudsters and spam. It is worth noting that scammers often use Musk's name in cryptocurrency spam schemes. Until now, messages from fake accounts appear under almost all the answers of the Tesla founder.

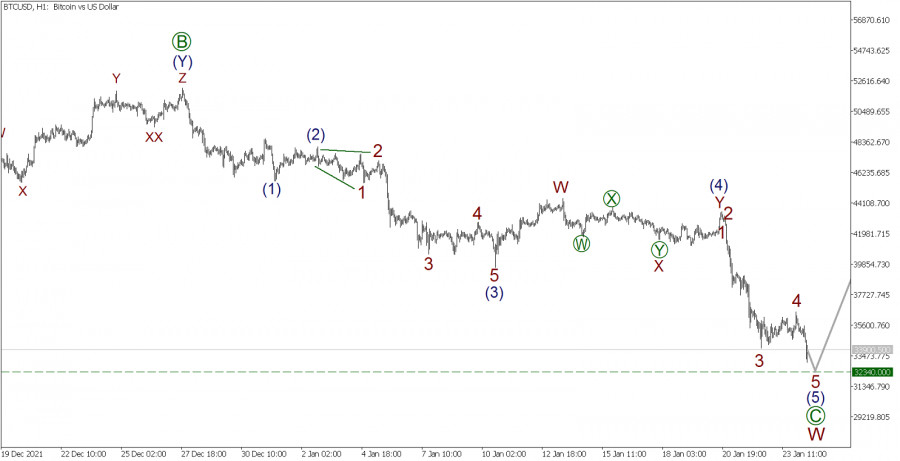

We continue to consider Bitcoin from the viewpoint of the Elliott theory on the hourly timeframe.

BTC/USD, H1 timeframe:

The formation of the initial part of a new corrective trend can be observed for the BTC/USD pair. Most likely, the bearish correction will take the form of a double zigzag W-X-Y, but so far we are at the end of the first active wave W.

The descending wave W looks like a simple zigzag [A]-[B]-[C]. The bearish wave [A] in the form of a five-wave impulse, which is not visible on the hourly timeframe, as well as correction [B] with a complex internal double zigzag structure (W)-(X)-(Y), has fully completed its pattern. At the moment, we are seeing a decline in impulse [C], which may be over soon. The end of wave [C] is expected at 32340.00. Currently, opening sell deals can be considered.

Trading recommendations:

It is suggested to sell from the level of 33900.50 and take profit at 32340.00.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.