See also

10.05.2022 12:23 PM

10.05.2022 12:23 PMAnalysis of transactions in the GBP / USD pair

GBP/USD is slowly recovering from the sharp fall that occurred because of the latest policy decision of the Bank of England. Most likely, the quote will continue rising today as there are no scheduled statistics for the UK. However, sellers will certainly use any good correction that can give them more attractive prices than now, which will clearly limit the upward potential of the pair.

In the afternoon, the US will release a report on economic optimism, but that will not really shake the markets. Instead, the upcoming speeches of Fed members John Williams, Raphael Bostic and Loretta Mester will be decisive, especially if their statements are hawkish. Such rhetoric will ramp up demand for dollar, which, in turn, will lead to another decline in GBP/USD.

For long positions:

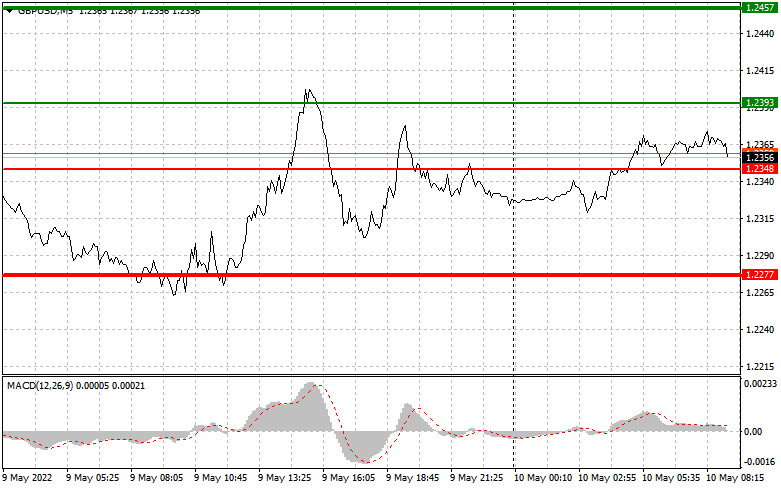

Buy pound when the quote reaches 1.2393 (green line on the chart) and take profit at the price of 1.2457 (thicker green line on the chart). There is a chance for a rally today, but only after the breakdown of the upper boundary of the side channel. Nevertheless, when buying, make sure that the MACD line is above zero, or is starting to rise from it. It is also possible to buy at 1.2348, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2393 and 1.2457.

For short positions:

Sell pound when the quote reaches 1.2348 (red line on the chart) and take profit at the price of 1.2277. Pressure may return at any moment, especially if Fed officials talk about inflation and interest rates again. However, before selling, traders should make sure that the MACD line is below zero, or is starting to move down from it. Pound can also be sold at 1.2393, but the MACD line should be in the overbought area, as only by that will the market reverse to 1.2348 and 1.2277.

What's on the chart:

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.