See also

27.10.2023 02:40 PM

27.10.2023 02:40 PMToday marks the end of the last full trading week of October. The dollar continues to dominate in the market, while major global stock indices, including US ones, keep losing value. In the equity market, the dollar as a safe-haven asset is also in demand amid global geopolitical tensions.

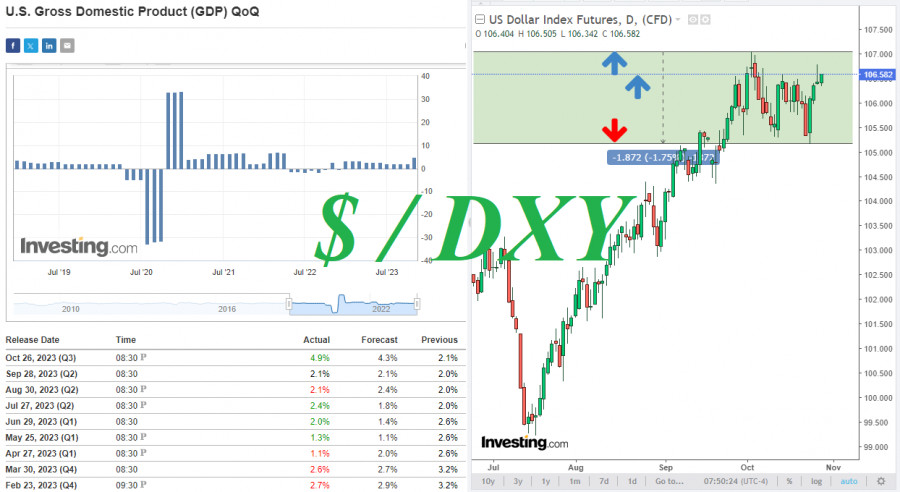

After Tuesday's release of the PMI indices, Thursday's macroeconomic figures once again confirmed the strength of the US economy. Data showed that gross domestic product in the United States grew by 4.9% in the third quarter, marking the highest pace since the end of 2021. The reading followed the previous quarterly rise of 2.1% and surpassed a forecast of 4.2%. The GDP price index, measuring the changes in prices for all of the goods and services produced in an economy, rose to 3.5% in the third quarter, up from a 1.7% increase in the second quarter and above a consensus estimate of 2.5%. This indirectly indicated that inflation accelerated.

Statistics suggest that despite high interest rates, the US economy is coping well, and inflation remains elevated. This has sparked talks that the Federal Reserve might consider cutting interest rates instead of raising them further.

Economists believe that the resilience of the American economy and its relatively high growth rate paves the way for increased investor interest in US assets and government bonds. This in turn is likely to lead to lower yields and a weaker dollar.

Today, market participants will be closely watching the release of the US personal consumption expenditures (PCE) price indices. The core figure is expected to climb to 0.3% month on month, up from the 0.1% rate recorded in August. On an annual basis, the PCE price index is forecast to rise by 3.7% in September, slightly down from a gain of 3.9% recorded in August. If data exceeds forecasts, the US dollar will most likely advance. Besides, traders are awaiting the University of Michigan's final consumer confidence index. The figure is anticipated to remain at 63.0. Thus, its release will hardly trigger a significant investor response.

From a technical point of view, the US dollar index (#USDX) is trading upwards. In the medium term, the index is above the key level of 104.10 (EMA200 on the daily chart). In the long term, it is above the crucial support levels of 101.40 (EMA144 on the weekly chart), 100.30 (EMA200 on the weekly chart), and 100.00.

Thus, long positions remain a priority. Local resistance levels at 107.00, 107.32, 107.80, and 108.00 can be seen as immediate growth targets.

Support Levels: 106.32, 106.15, 106.00, 105.80, 105.40, 105.00, 104.10, 103.00, 102.00, 101.40, 101.00, 100.30, 100.00 Resistance Levels: 106.75, 107.00, 107.32, 107.80, 108.00, 109.00, 109.25.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.