See also

07.11.2023 09:24 AM

07.11.2023 09:24 AMStock rally halted and dollar weakened in anticipation of the speeches by Federal Reserve members. Clearly, market players remain doubtful of the Fed's next step on interest rates, as after a year of positive sentiment, the central bank still did not stop aggressively raising interest rates. It seems that as long as the US economy remains alive, the Fed will raise rates in an effort to bring inflation down to 2%.

The uncertainty offset the gains seen last Friday, when negative data on new job numbers and average wages triggered a rise across all markets. US Treasury bonds also rose at that time, while dollar came under serious pressure due to expectations of the end of the Fed's rate hike cycle. The US stock market failed to make significant gains this Monday, while European trading platforms ended in the red. Today, the Asian-Pacific region traded in negative territory, and although dollar showed a rise, commodity assets traded in the red.

Market players now anticipate the speeches of Fed members, especially their reaction to the weak data on new job numbers in the US economy. Earlier, the heads of Fed banks and Chairman Jerome Powell himself repeatedly pointed out the strong labor market despite the high interest rates, but now it showed some weakness.

Perhaps, the Fed will find it difficult to express further optimism about the state of the labor market, and they may highlight the problems that currently exist. If they, for even a moment, doubt their statements that the labor market remains strong, stock rally will resume, accompanied by a further decline in Treasury yields and dollar.

Forecasts for today:

EUR/USD

The pair may trade lower in anticipation of the Fed's speeches. It may move towards the support level of 1.0685, but then resume its rise towards 1.0775.

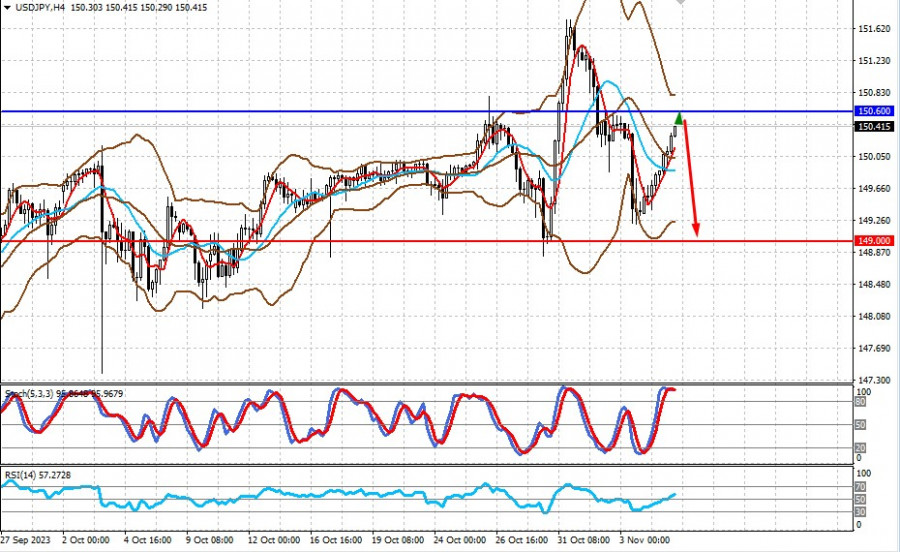

USD/JPY

The pair rose ahead of the speeches of Fed members. It may climb further to the level of 150.60, followed by a reversal if Powell and the Fed members discuss weaknesses in the US labor market. In this case, the pair will drop back to the level of 149.00.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.