See also

13.11.2023 06:29 AM

13.11.2023 06:29 AMEUR/USD

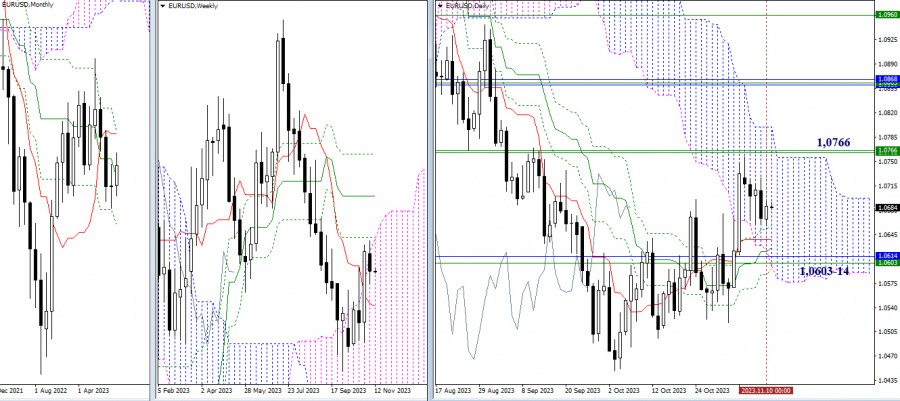

Higher Timeframes

The confirmation and development of the bullish sentiment did not succeed. The entire past week was occupied by a decrease and consolidation. As a result, the pair remained within the boundaries, breaking which could help change the current situation and provide new prospects for continued movement. At the moment, the market from above is limited by the accumulation of resistances around 1.0766 (weekly levels + upper boundary of the daily cloud), and below, its supports, except for the daily Ichimoku cross (1.0657 – 1.0638 – 1.0627 – 1.0588), include the weekly short-term trend (1.0603) and the monthly medium-term trend (1.0614).

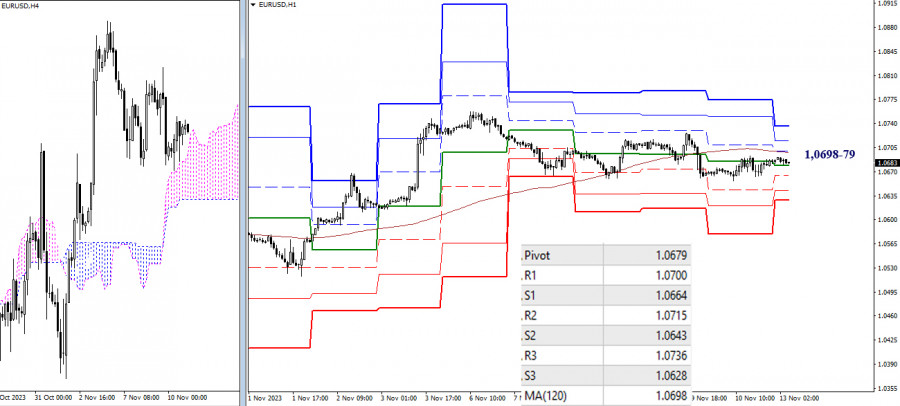

H4 – H1

On lower timeframes, the market continues to be constrained by key levels, currently consolidating efforts around 1.0698-79 (central pivot point + weekly long-term trend). The prolonged lack of directional movement indicates uncertainty and a wait-and-see position, although the main advantage remains on the bears' side. Intraday bearish targets today can be marked at 1.0664 – 1.0643 – 1.0628 (supports of classic pivot points). Consolidation above 1.0698-79 and a reversal of the movement can change the current balance of power on the lower timeframes. And for further strengthening of bullish sentiment, players will need to overcome the resistances R2 (1.0715) and R3 (1.0736) of classic pivot points.

***

GBP/USD

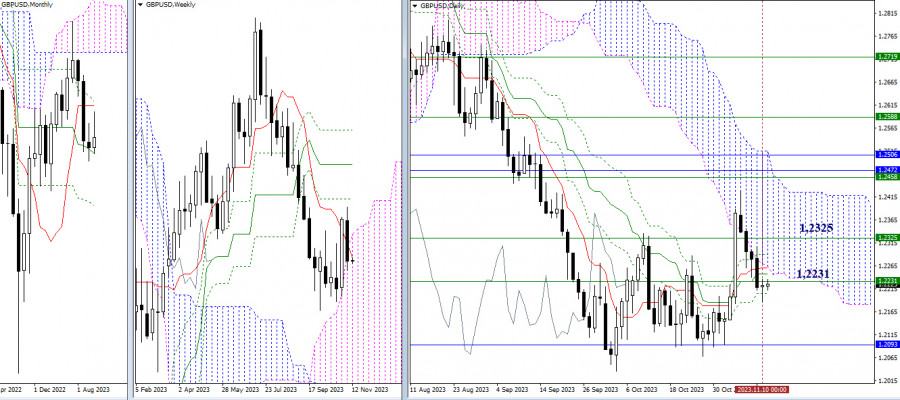

Higher timeframes

Last week, bears could not completely neutralize all the previous achievements of the opponent. Nevertheless, they managed to decline below many current supports, so all the nearest levels (1.2231 – 1.2248 – 1.2260 – 1.2264 – 1.2290 – 1.2325) passed last week are now transformed into resistances, playing the role of top-priority tasks for bulls to restore their positions. For bears, it is still important to eliminate the daily Ichimoku cross (1.2205), overcome the support of the monthly medium-term trend (1.2093), and restore the downward trend (1.2036).

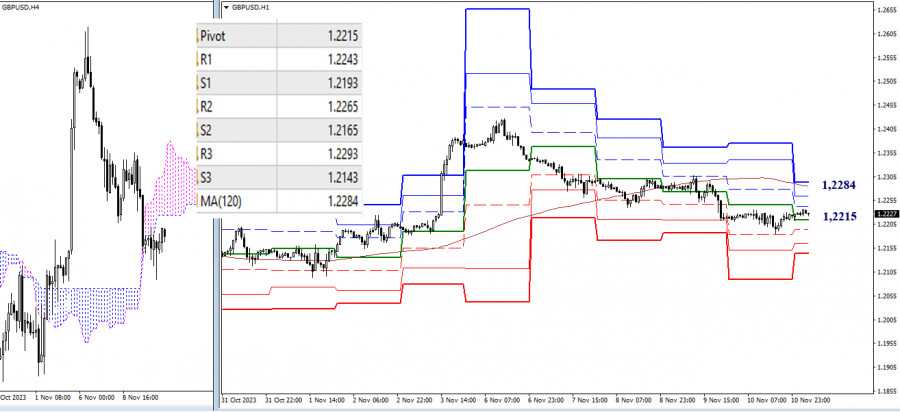

H4 – H1

At the moment, bears have the main advantage. To change the situation, bulls need to rise and consolidate above the weekly long-term trend (1.2284), turning the movement in their favor. Intraday bearish targets during the continuation of the decline today will encounter the market at 1.2215 – 1.2193 – 1.2165 – 1.2143 (classic pivot points).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.