See also

09.02.2024 04:39 PM

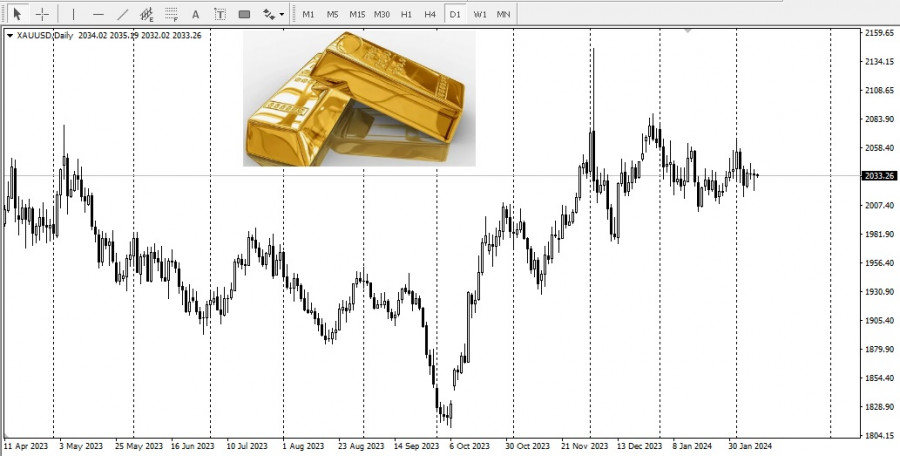

09.02.2024 04:39 PMAccording to the latest data from analysts of the World Gold Council (WGC), the outflow from gold ETFs continued in January 2024, following the trend observed in 2023, led by North America. European funds also continued to suffer significant losses, while Asia experienced another monthly inflow.

Global physically backed gold ETFs started 2024 with a fund outflow of USD 2.8 billion. This streak of misfortune has persisted for eight consecutive months. The report also notes that this outflow is equivalent to a reduction of global reserves by 51 tonnes by the end of January, reaching a total of 3,175 tonnes.

North American funds incurred losses of USD 2.3 billion in January, thereby concluding a short two-month period of fund inflow into the region. Analysts also consider the fact that the first Federal Reserve rate cut in March is unlikely. As a result, both the dollar and the yield of 10-year Treasury bonds have rebounded, putting pressure on the price of gold and leading to the sale of gold ETFs. Additionally, as U.S. stock prices reached new highs, the interest of local investors in gold further diminished.

As a result of the January decline, the collective assets of North American funds dropped to the lowest level observed since April 2020. The most significant outflow was observed from the largest funds.

On the other side of the ocean, Europe extended its series of consecutive net outflows of gold to eight months. Although the region liquidated gold reserves worth USD 730 million in January, it was still significantly less than the net outflow of USD 2 billion the previous month.

Meanwhile, Asian funds increased their net inflow by USD 215 million, extending the streak of consecutive net inflows to 11 months. China continues to dominate investment inflows into the region, as the sixth consecutive monthly decline in local stocks and a weaker currency heightened investor demand for safe-haven assets.

In another region, there were minor changes in the demand for gold ETFs. Adding USD 8 million in the month, with a significant portion of the demand coming from South Africa.

Gold-backed ETFs and similar products constitute a significant portion of the gold market. ETF flows often highlight short-term and long-term opinions and the desire to hold onto gold. The data in the report tracks gold held in physical form in open ETFs and other products, such as closed-end funds and mutual funds. Most funds included in the dataset are fully backed by physical gold.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.