See also

12.03.2024 08:57 AM

12.03.2024 08:57 AMAlthough the situation in the labor market remained unchanged despite the slight pullback, the trend that emerged yesterday may gain significant development and continuation, as forecast indicates that US inflation will accelerate from 3.1% to 3.2%. If this happens, the Federal Reserve will not reduce interest rates until the summer. However, many believe that the decrease will happen as early as spring, so a revision of such expectations will inevitably lead to a strengthening of dollar. Additionally, labor market data in the UK will likely increase pressure on pound, since forecast says the unemployment rate will rise from 3.8% to 3.9%.

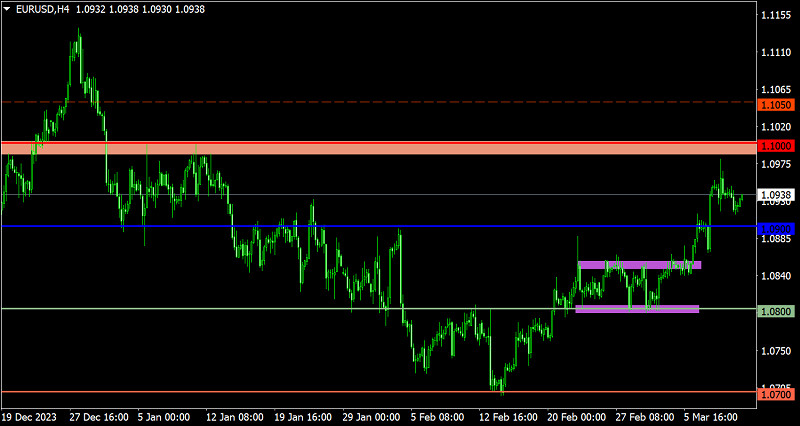

EUR/USD lost over 50 pips. Staying below the level of 1.0900 will certainly increase the volume of short positions. Otherwise, the upward trend may resume.

GBP/USD reached the level of 1.2800. Staying below this level, at least in the four-hour period, will provoke a pullback. Otherwise, long positions will surge, resulting in a price increase.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.