See also

19.04.2024 05:03 AM

19.04.2024 05:03 AMEUR/USD

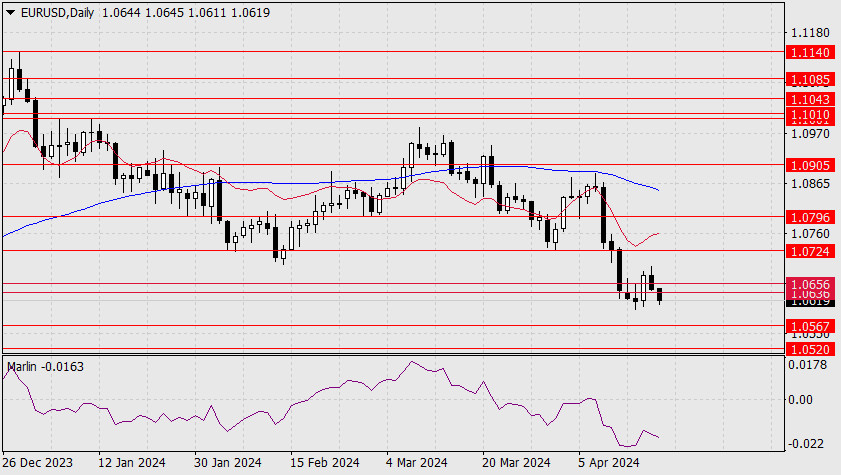

As anticipated in yesterday's review, the euro and other counter-dollar currencies have used up all their strength to rise on Wednesday while risk appetite was broadly declining. So yesterday, the euro fell by 29 pips. Stock markets and oil also continued to decline.

Economic indicators from the US came out strong; initial claims for state unemployment benefits were at 212,000, against a forecast of 215,000, and the Philadelphia Fed Manufacturing Index rose from 3.2 to 15.5 points in April. Market expectations for a rate cut slightly increased for the November meeting, from 41.5% to 42.7%.

In today's Pacific session, the quote broke below the 1.0636/56 range. The pair can now aim for 1.0567.There are no economic reports scheduled for today, so the price may continue to decline following yesterday's momentum.

On the 4-hour chart, we can see that the euro recently ascended below the balance indicator line, indicating a corrective movement. The signal line of the Marlin oscillator is still within the uptrend territory. To completely form a bearish signal, the price must consolidate below the lower boundary of the range, at which point Marlin will enter the downward territory.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.