See also

25.04.2024 04:55 AM

25.04.2024 04:55 AMGBP/USD

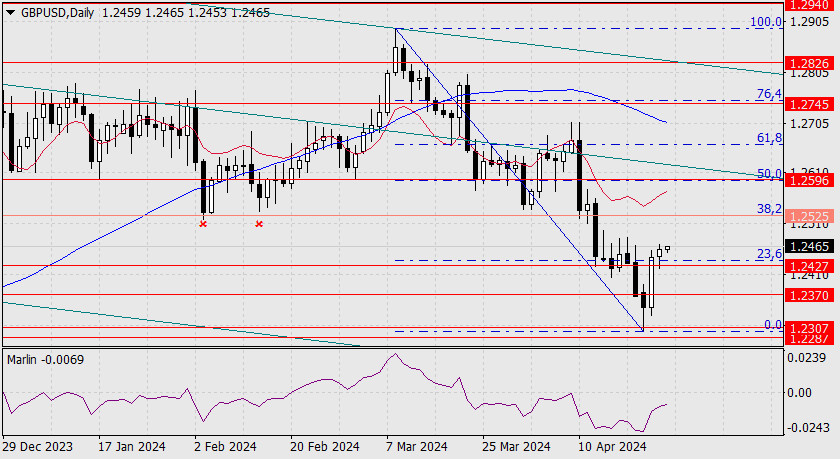

Yesterday, the British pound stayed above the target level of 1.2427 and above the Fibonacci corrective level of 23.6%. The Marlin oscillator is rising, and if the April 15-18 highs do not offer serious resistance, the price may rise to the intermediate level of 1.2525 – up to the corrective level of 38.2%. However, there is one troubling factor in this plan – trading volumes are decreasing every day, which means that the correction can end at any moment, regardless of record levels. All it takes is a signal.

Today, the US GDP report could provide the signal. The forecast is 2.5%. The market often has a delayed reaction to the US GDP report, around 1-5 days, either to assess other data or to wait for tensions to ease among mid-level players. On Friday, a report on personal income/expenditure will be released and the Bank of Japan meeting will also take place. On this day, the Japanese central bank may issue a final warning to speculators who are overly engaged in playing against the yen.

On the 4-hour chart, we see a hint of such a development – divergence between price and the Marlin oscillator. If the price continues to rise, which is very likely as it has consolidated above both indicator lines, then the divergence will turn into regular growth. And the British currency's rise is quite risky.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.