See also

02.07.2024 09:21 AM

02.07.2024 09:21 AMEUR/USD

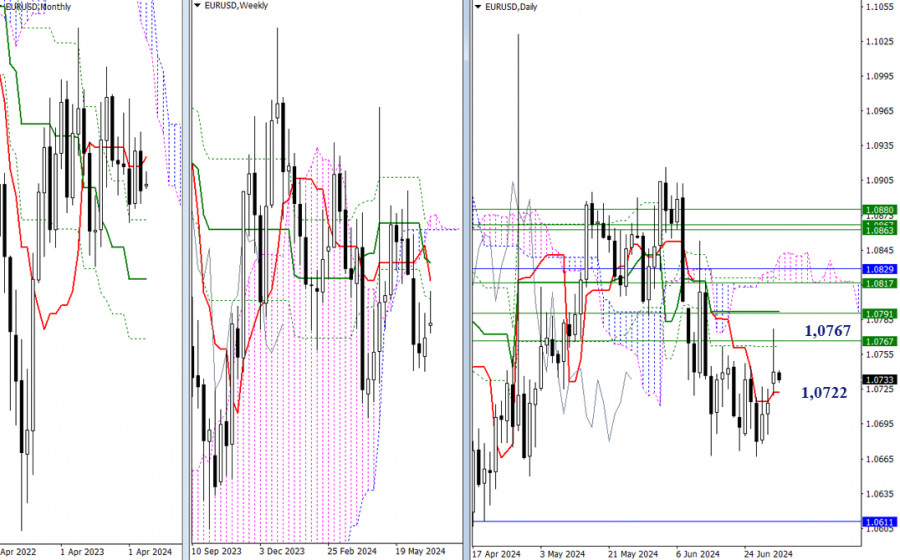

Higher timeframes

Yesterday, the pair tested the resistance around 1.0767 (weekly and monthly Fibonacci Kijuns), but as a result, there was a long upper shadow. The bulls' weakness may lie in the fact that the bears could completely neutralize the bullish activity at the beginning of the week, manage to close the bullish gap formed at the opening level, and reclaim the support of the intraday short-term trend (1.0722). After this, the focus will shift to two bearish targets: the nearest low (1.0667) and the monthly support (1.0611). The bulls can prevent this scenario from unfolding by returning EUR/USD to the resistance area (1.0767) and have the price consolidate above this mark.

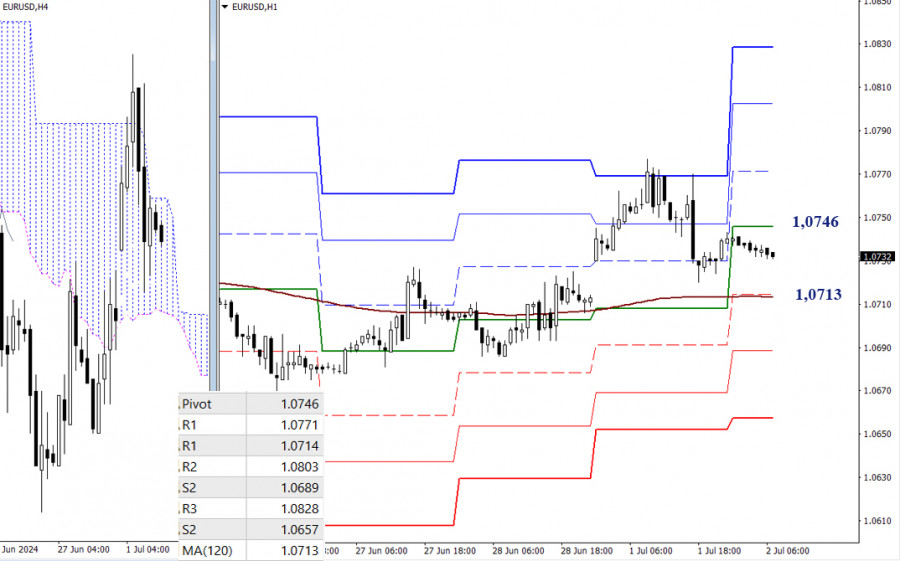

H4 – H1

Yesterday, the pair stopped rising by the final resistance of the classic Pivot levels. Under these conditions, the bulls still have the advantage, but the pair is in a deep correction, with the nearest support being the weekly long-term trend (1.0713). Breaking and reversing this trend could change the current balance of power. In order to continue the downward movement within the day, additional support levels are found at 1.0689 and 1.0657 (classic Pivot levels). If the bulls want to prepare in advance, they will need to restore their positions and work on the pair's upward movement during the day. To do so, the price must overcome the resistances of the classic Pivot levels (1.0746 - 1.0771 - 1.0803 - 1.0828).

***

GBP/USD

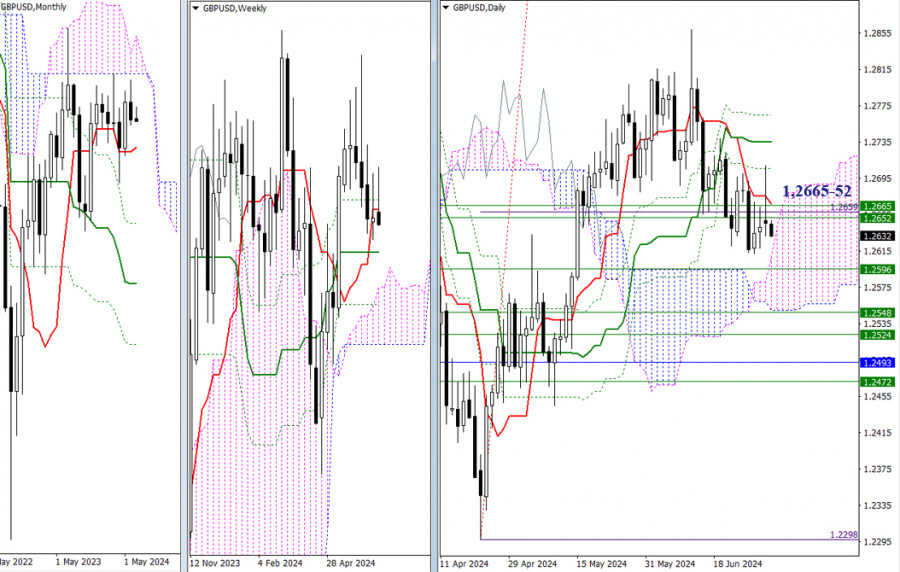

Higher timeframes

The pound, having cast a long upper shadow and reached the daily resistance (1.2706), returned below the weekly levels (1.2652-65) by the end of the day. In order to support the bearish bias, the pair needs to exit the current corrective zone and meet the nearest supports around 1.2608 – 1.2596 (the upper boundary of the daily cloud + the weekly medium-term trend). Meanwhile, the bulls need to take control of the weekly levels (1.2652-65), consolidate above them, and move away from their area of influence.

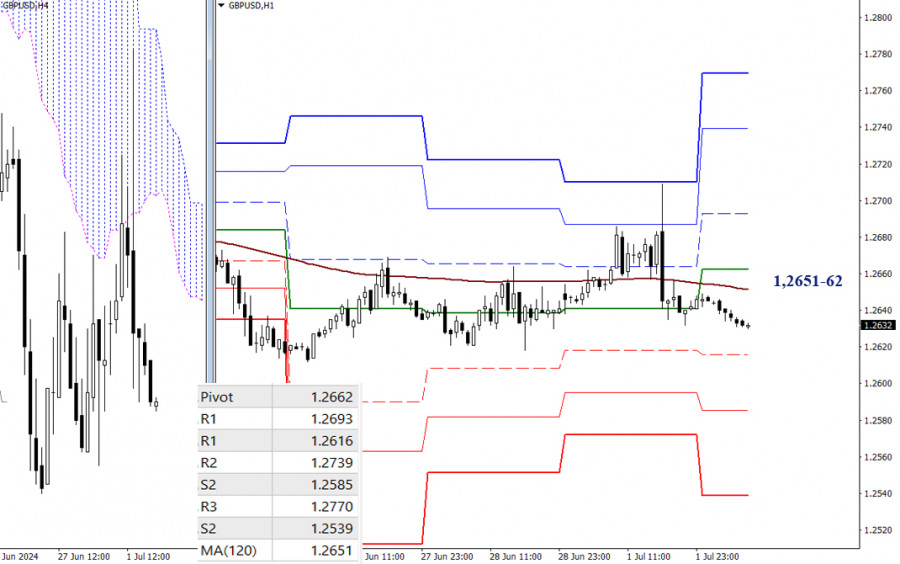

H4 – H1

The key levels on the lower timeframes are 1.2651 (weekly long-term trend) and 1.2662 (central Pivot level of the day), positioned near the most critical levels of the higher timeframes (1.2652-65). Therefore, all conclusions and expectations mentioned above have been confirmed on the lower timeframes. The bears must keep the GBP/USD below these levels. Increased bearish sentiment will progress throughout the day through the supports of the classic Pivot levels (1.2616 – 1.2585 – 1.2539). The bulls will gain an advantage if the pound breaks the key levels (1.2651-62) and firmly consolidates above them. To support the upward movement, the targets will be the resistances of the classic Pivot levels (1.2693 – 1.2739 – 1.2770).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.