See also

16.01.2025 01:40 PM

16.01.2025 01:40 PMThe USD/CAD pair is showing positive momentum today, rebounding from the 1.4300 level—a level near the weekly low—and continuing its intraday upward movement during the first half of the European session.

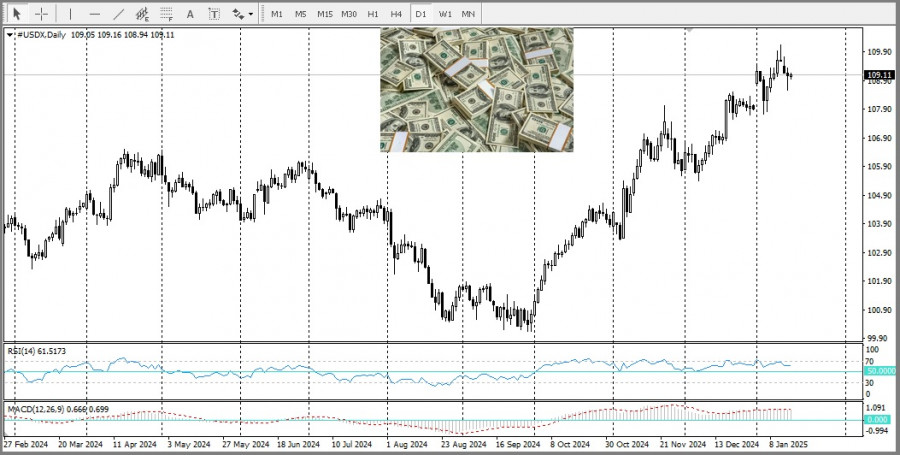

This upward trajectory is supported by a combination of factors. A drop in crude oil prices, attributed to profit-taking following a sharp rise to the highest levels since July 2024, has weakened the commodity-linked Canadian dollar. Simultaneously, renewed demand for the US dollar during its recent dip, driven by growing expectations that the Federal Reserve may pause its rate-cutting cycle, has bolstered the pair's strength.

However, recent US economic data, including the Producer Price Index (PPI) and Consumer Price Index (CPI), has indicated signs of easing inflationary pressures. This could prompt the Fed to remain open to further rate cuts later this year, which led to a sharp overnight decline in US Treasury yields. Such developments may curb the dollar's upward momentum and limit further gains for the USD/CAD pair.

Additionally, the easing of fears surrounding potentially disruptive trade tariffs by US President-elect Donald Trump has improved market sentiment. While this optimism supports riskier assets, it could deter bullish traders from aggressively buying the US dollar, further capping the pair's rise.

Traders seeking opportunities should keep an eye on upcoming US economic reports, including monthly retail sales, weekly jobless claims, and the Philadelphia Fed Manufacturing Index, as these could influence the near-term trajectory of USD/CAD.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.