See also

05.03.2025 08:11 AM

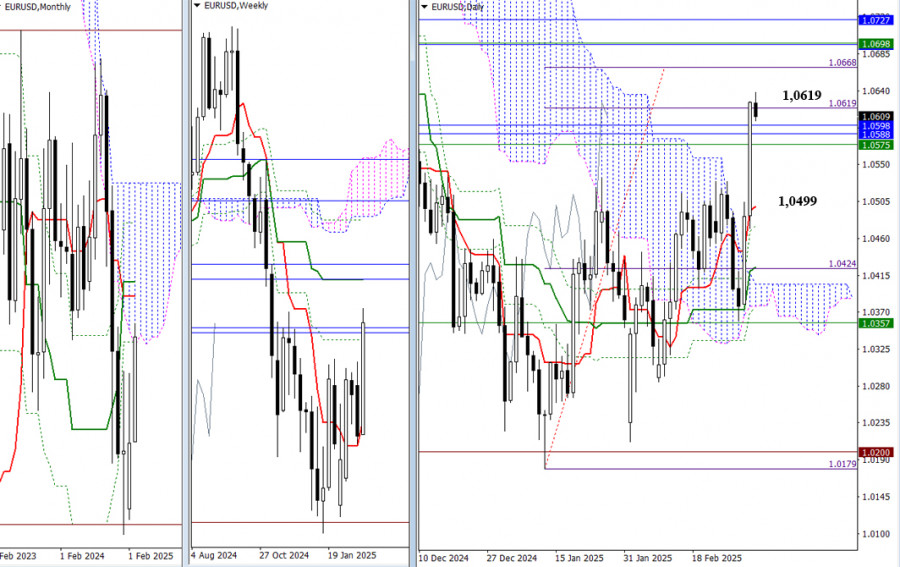

05.03.2025 08:11 AMThe start of the new week gives bullish traders a reason to remain optimistic and effective. They have not only exited the daily Ichimoku cloud, creating a breakout target, but have also quickly reached the initial target level of 1.0619. In this context, the next bullish targets can be identified at 1.0668, 1.0698, and 1.0727. Achieving these levels would fully realize the daily breakout target while simultaneously testing the key resistances of the monthly Ichimoku cross and the medium-term weekly trend.

Yesterday, on the way to reaching the target level of 1.0619, the pair surpassed several strong resistance levels at 1.0575, 1.0588, and 1.0598, thereby entering the monthly cloud. Today, these breached levels may serve as support on lower timeframes, helping the bulls maintain their gains.

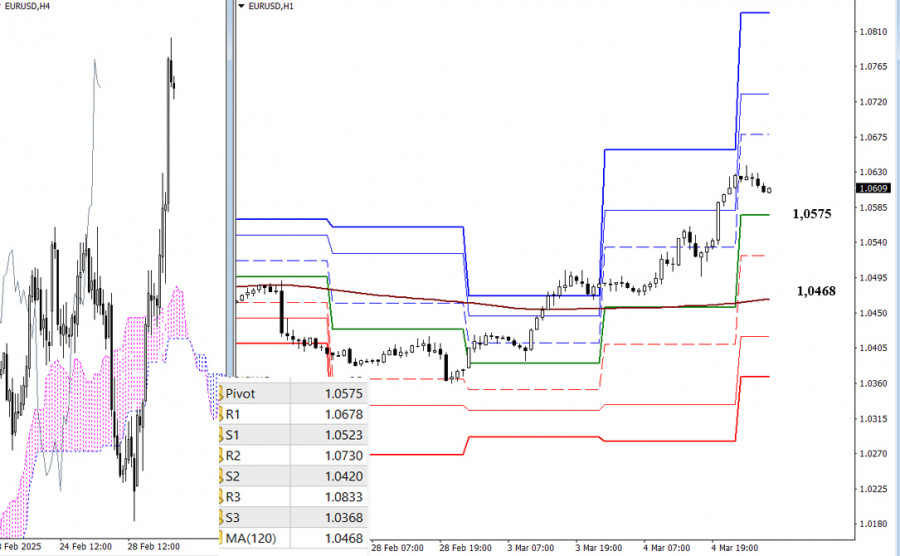

On the lower timeframes, the bulls currently hold the main advantage, as we observe an uptrend formation. Intraday bullish targets today are set at 1.0678, 1.0730, and 1.0833 (the resistances of the classic Pivot levels). A downward correction could jeopardize the testing of key levels at 1.0575 (the central daily Pivot level) and 1.0468 (the weekly long-term trend), with an intermediate support at S1 positioned at 1.0523. A breakout and subsequent trend reversal could significantly shift the balance of power. Further strengthening of bearish sentiment would likely unfold through the classic Pivot level supports at 1.0420 and 1.0368.

***

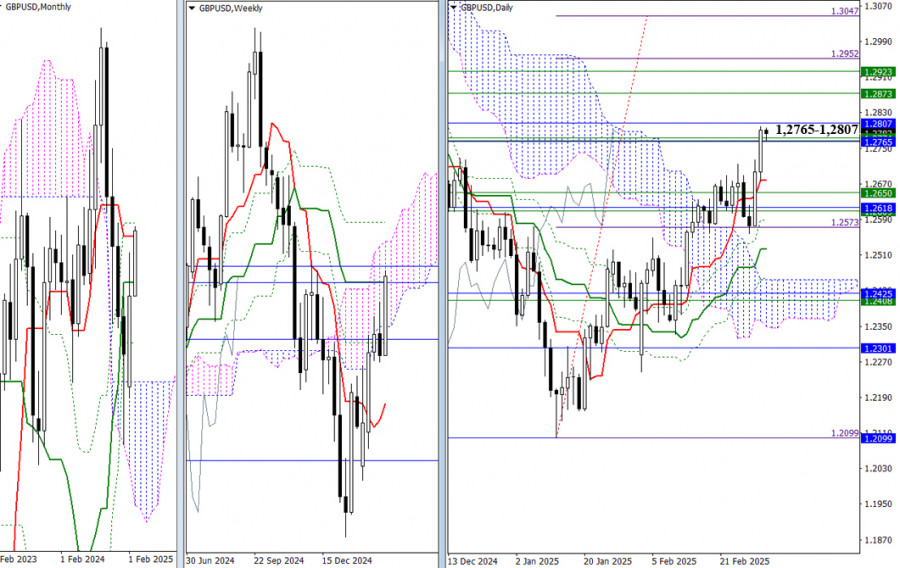

In the first two days of the new week, the bulls have achieved what they were unable to accomplish in the previous two weeks. The pair is currently testing the resistance levels of the monthly Ichimoku cross at 1.2765–1.2807 and the medium-term weekly trend at 1.2766. If these levels are broken, the next targets will include a breakout from the weekly cloud at 1.2873, the elimination of the weekly Ichimoku cross at 1.2923, and reaching the daily breakout target of 1.2952–1.3047. However, if the bulls fail and the upward movement is halted, the pair could return to previously crossed levels around 1.2650–1.2618, with the first support encountered at the daily short-term trend of 1.2678.

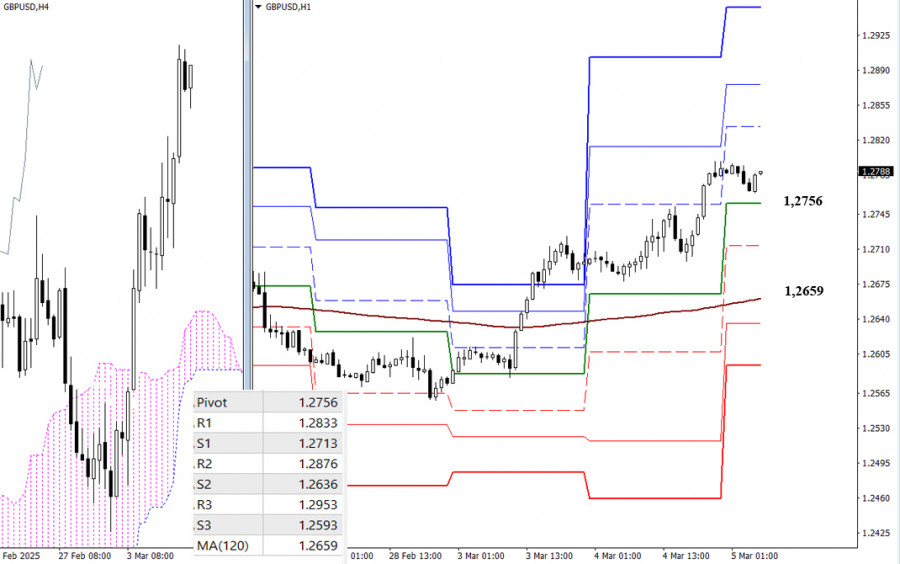

Currently, the bulls hold a significant advantage on the lower timeframes. To continue the uptrend, intraday targets are set at the classic Pivot level resistances of 1.2833, 1.2876, and 1.2953. If the bears manage to take control, their key support levels will be at 1.2756 (the central daily Pivot level) and 1.2659 (the weekly long-term trend). A breakout and trend reversal could shift the balance of power in favor of the bears, leading to a further strengthening of bearish sentiment. Additional intraday targets for bearish traders include the classic Pivot level supports at 1.2713, 1.2636, and 1.2593.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.