See also

24.03.2025 08:55 AM

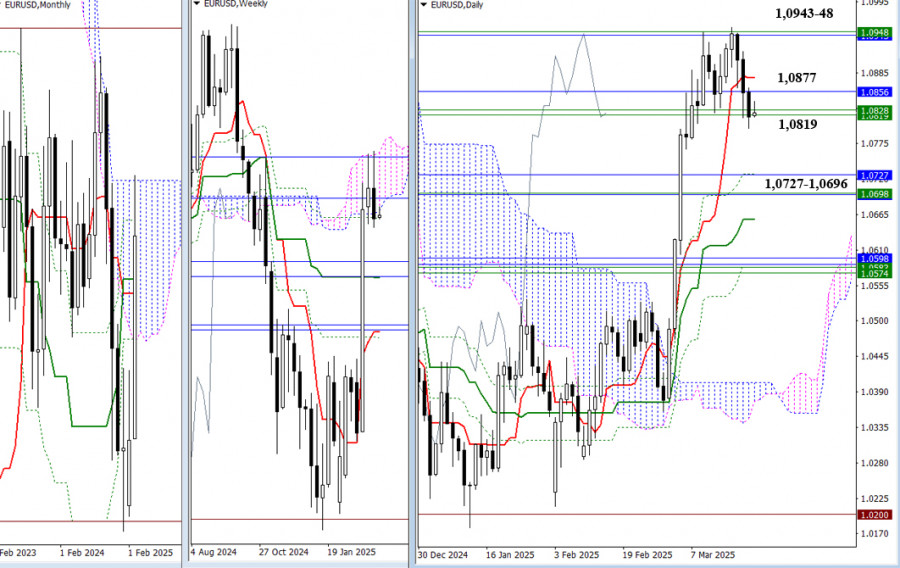

24.03.2025 08:55 AMRecently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946–1.0825) and monthly levels (1.0943–1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend this rejection. If successful, their focus will shift to the cluster of supports around 1.0727–1.0696 (monthly Tenkan + Kijun, weekly Kijun, and daily levels). If sellers fail to maintain control, consolidation may develop around the current support area (1.0877–1.0819). In this case, buyers could regain the initiative at any moment, aiming once again for the upper boundaries of the monthly (1.0943) and weekly (1.0948) Ichimoku clouds.

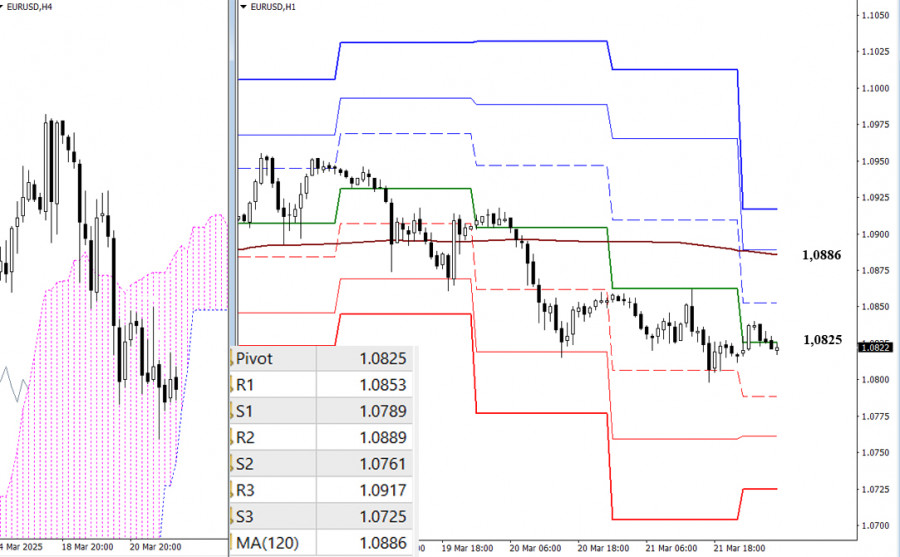

On the lower timeframes, sellers currently maintain the upper hand. A continuation of the decline today is possible through a break below the classic Pivot support levels (1.0789 – 1.0761 – 1.0725). If buyers extend the ongoing correction, the key focus will be testing and breaking the weekly long-term trend level (1.0886). A trend reversal at that level would shift the balance of power, giving intraday buyers access to the following targets at the classic Pivot resistance levels (1.0889 – 1.0917).

***

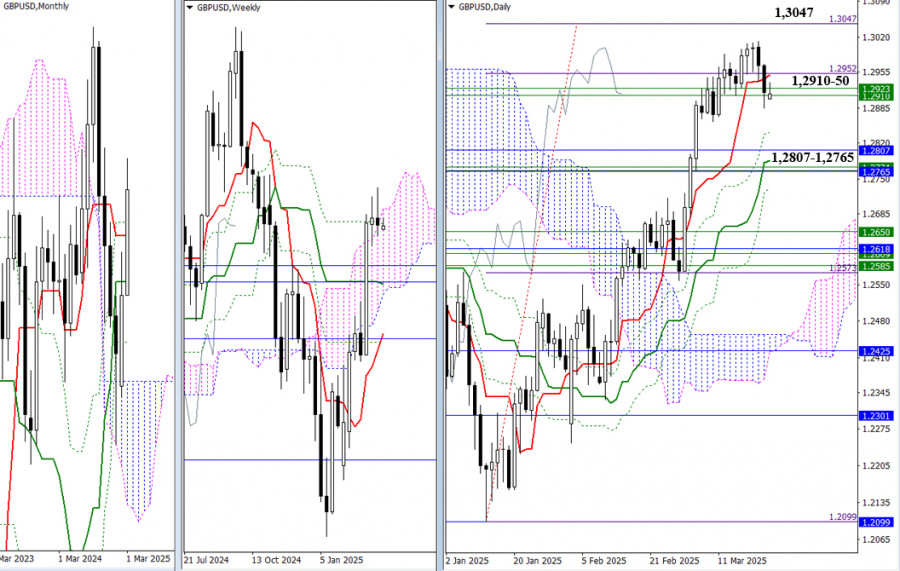

For the past two weeks, the market has remained indecisive, hovering around the area of the daily short-term trend (1.2950) and weekly levels (1.2910–1.2923). For the bulls, the target of breaking through the daily Ichimoku cloud (1.3047) remains unfulfilled. If bears are the first to exit this zone of uncertainty, the next downside target will be the cluster of supports near the monthly levels (1.2807–1.2765).

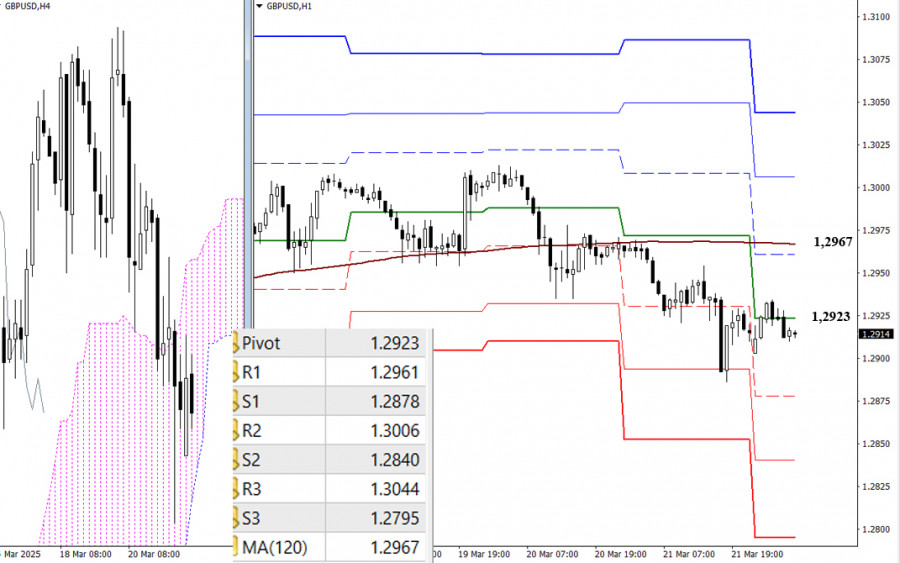

At the moment, sellers have the main advantage on the lower timeframes. Intraday support targets for further downside can be noted at 1.2878 – 1.2840 – 1.2795. The current balance of power can only be altered by a break and reversal of the weekly long-term trend level (1.2967). If buyers consolidate above this level and gain the upper hand, today's targets will be the classic Pivot resistance levels (1.3006 – 1.3044).

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.