See also

25.04.2025 12:59 AM

25.04.2025 12:59 AMU.S. President Donald Trump once again commented on Federal Reserve Chairman Jerome Powell, openly expressing dissatisfaction with the pace of rate cuts. Another public expression of disapproval of the Fed's policy, accompanied by an accusation against Powell (whom Trump called a "major loser"), triggered a new wave of dollar selling and renewed growth in gold as the primary safe-haven asset.

Market anxiety is beginning to resurface as a result. Although the reaction is less restrained than on Monday, it signals that something is amiss with Trump. The dollar is being forced to respond to this nervousness with another decline.

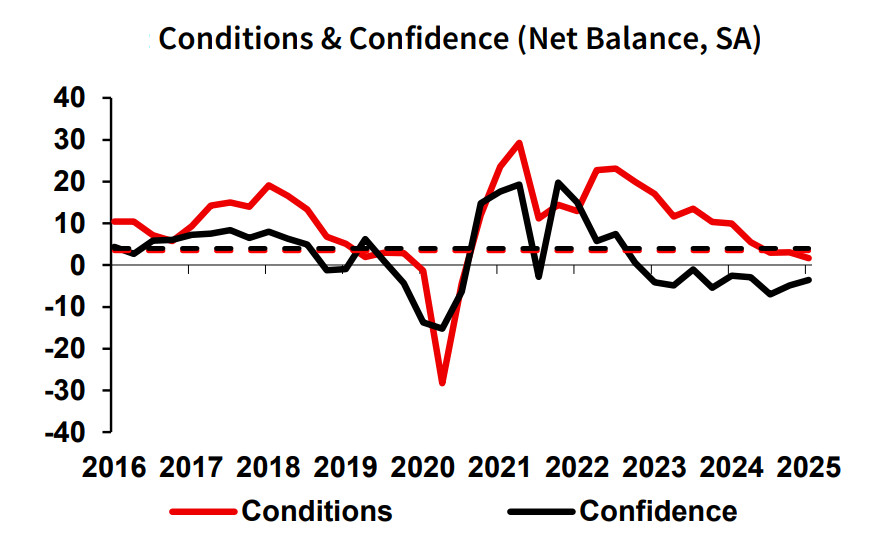

The NAB quarterly business survey showed a slight improvement in conditions in Q1 but remains below average. Business confidence also improved slightly but remains in negative territory and significantly below the long-term average.

Several components, such as capital expenditure, declined, indicating that businesses remain cautious.

The Australian dollar faces additional pressure due to the ongoing trade war between the U.S. and China. Despite rumors that the U.S. is ready to exclude some Chinese goods from the new tariffs and Treasury Secretary Bessent suggesting that tensions might ease, China has informed markets that no tariff negotiations are taking place and that if the U.S. truly wants to resolve the issue, it should cancel all unilateral measures. Australia, in turn, is concerned about U.S. pressure to cut back on trade with China, as this would hit Australian exports—something the country would be unable to compensate for elsewhere fully.

Weak recovery momentum, threats to exports, and sluggish consumption growth will continue to pressure the Reserve Bank of Australia, which does little to support bullish sentiment for the AUD. Even outright dollar weakness may only help AUD/USD rise in the short term.

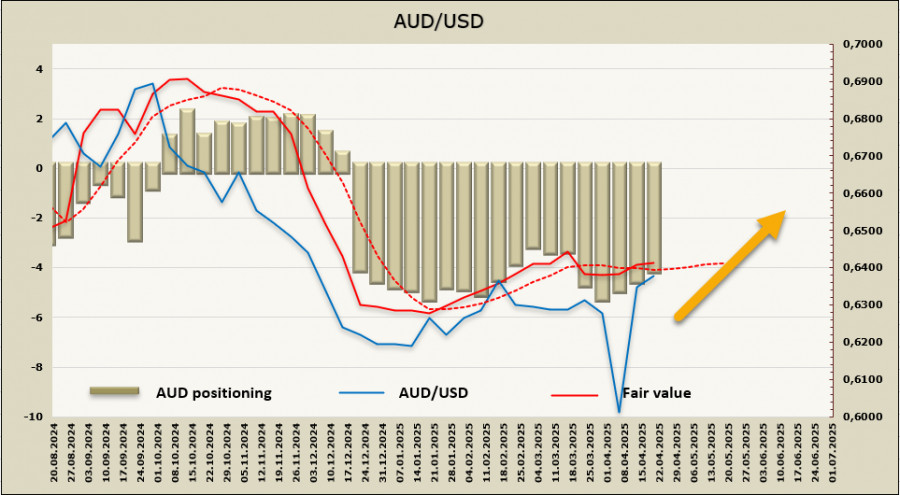

The net short position on the AUD has slightly decreased and stands at -3.73 billion for the reporting week. Positioning remains bearish, but after some initial hesitation, the fair value estimate has risen above the long-term average. This suggests that the current bullish trend may not yet be over.

As expected, the bullish impulse in AUD/USD—traditionally triggered by turmoil from the Trump administration—was short-lived. After a sharp rally, the pair consolidates near the resistance zone at 0.6410/30. At the same time, dollar weakness prevents the pair from retreating, so the chances for continued growth appear more favorable. A breakout above the local high of 0.6442 and firming above it could lead to further gains toward the next target at 0.6440/50. We consider this scenario more likely. Support lies at the technical level of 0.6317; a drop below this level is unlikely.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.