See also

09.05.2025 11:10 AM

09.05.2025 11:10 AM"Better go and buy stocks right now! Thanks to the White House's trade policy, the U.S. will attract $10 trillion in investment. This country will be like a rocket going straight up." That's Donald Trump's view. Inspired by the president's calls, investors have driven the S&P 500 index to its highest levels since the end of March. The broad stock index has risen in 11 of the last 13 trading sessions. However, the market is gradually growing tired of the U.S. administration's rhetoric.

The trade deal with the U.K. was presented by the White House as a model for future agreements with other countries. Washington was eager to finalize it ahead of talks with Beijing so that China could see what to aim for. Despite reduced tariffs on imported steel and cars, the 10% universal tariff remains in place. In 2024, the average duty for the U.K. stood at 2.4%.

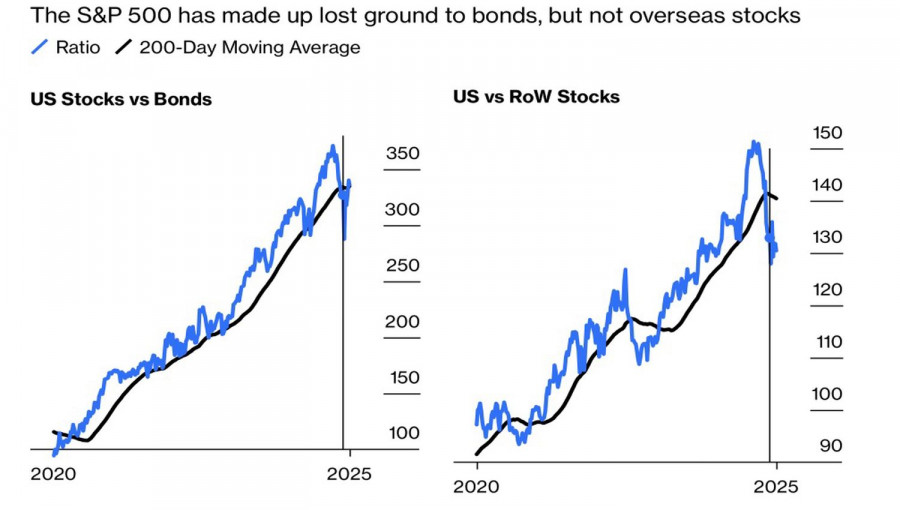

Britain holds a neutral position in foreign trade with the U.S., while surpluses from other countries suggest their tariffs could be even higher than 10%. This spells trouble for American consumers, who will be forced to bear the costs. Prices will rise, and corporate profits will shrink—bad news for U.S. stocks, which are gradually recovering against bonds but still lag behind their international peers.

Dynamics of U.S. Stocks vs. Bonds and Foreign Equities

Trump's optimism—built on tariffs and expectations that Congress will soon extend fiscal stimulus via tax cuts—feeds market greed. The FOMO strategy ("buy or lose") is pushing the S&P 500 upward, but warning signs are growing louder.

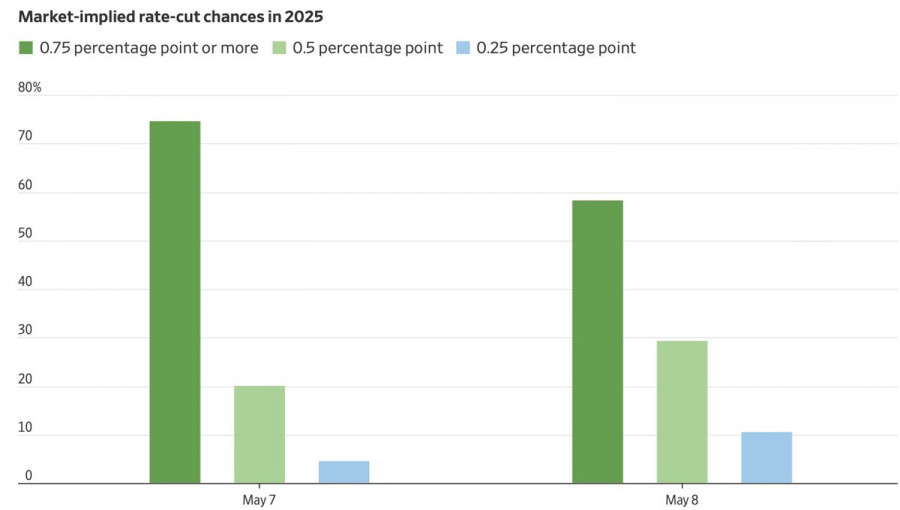

Futures markets have lowered the odds of three rate cuts by the Federal Reserve in 2025 from 75% to 58%. Meanwhile, the probability of two rate cuts has increased from 20% to 30%. Trump once again criticized Jerome Powell, calling him "stupid," but the Fed has made it clear that the president's words carry no weight. If Powell doesn't lower rates, a rally in Treasury yields could hit the S&P 500 hard.

Futures Market Projections for Fed Monetary Expansion

The U.S.–U.K. deal, touted as a landmark agreement, is far from it. Talks with other countries appear to have stalled, and there's no clear break in the clouds with China. The White House continues to present wishful thinking as reality, and it's about time U.S. stocks catch on.

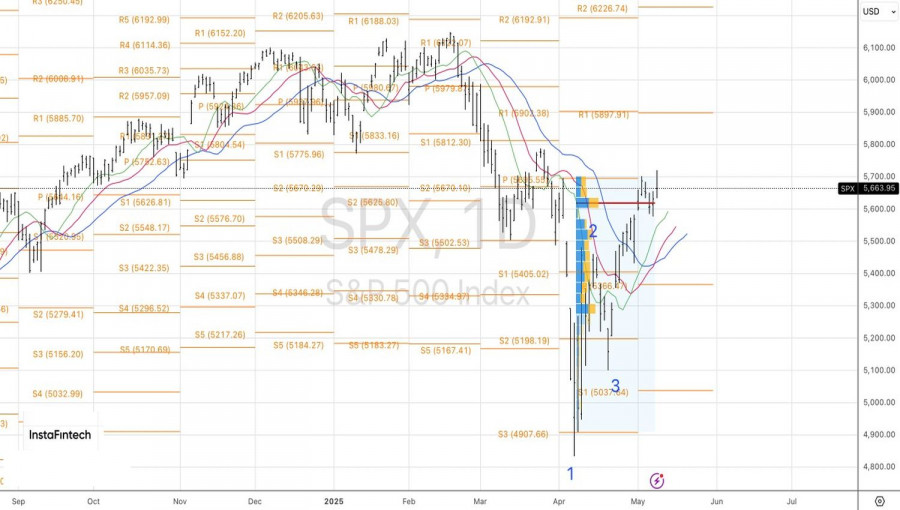

Technically, the daily chart of the S&P 500 has printed a candle with a long upper shadow—indicating that the bulls are running out of steam. As a result, the risks of triggering the bearish Anti-Turtles reversal pattern are rising. To confirm it, breakdowns of support at 5620 and 5580 are needed. These would provide a solid basis for opening short positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.