See also

13.05.2025 12:23 AM

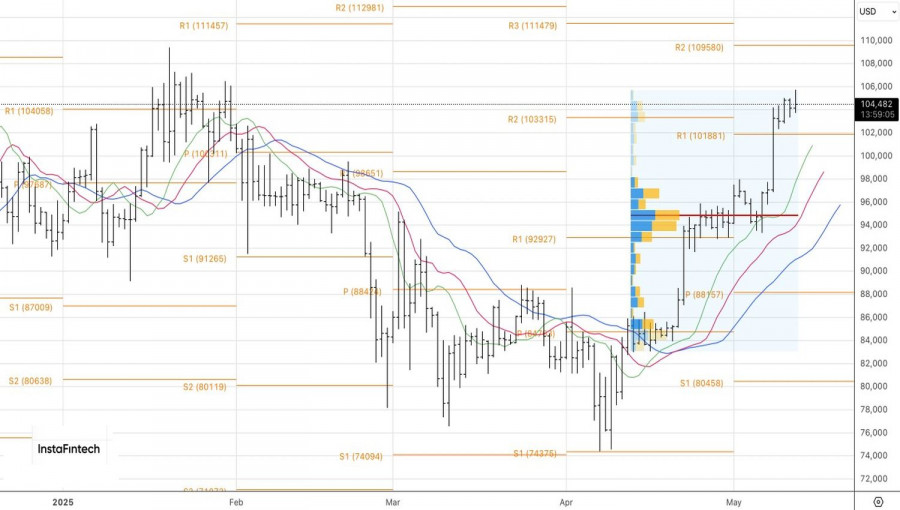

13.05.2025 12:23 AMBitcoin has broken above the 100,000 mark, entered a consolidation phase, and confirmed the familiar pattern. Previously, after breaking through psychologically significant levels, the cryptocurrency experiences a period of stagnation before deciding on its next direction. This time, the digital asset has every reason to act cautiously.

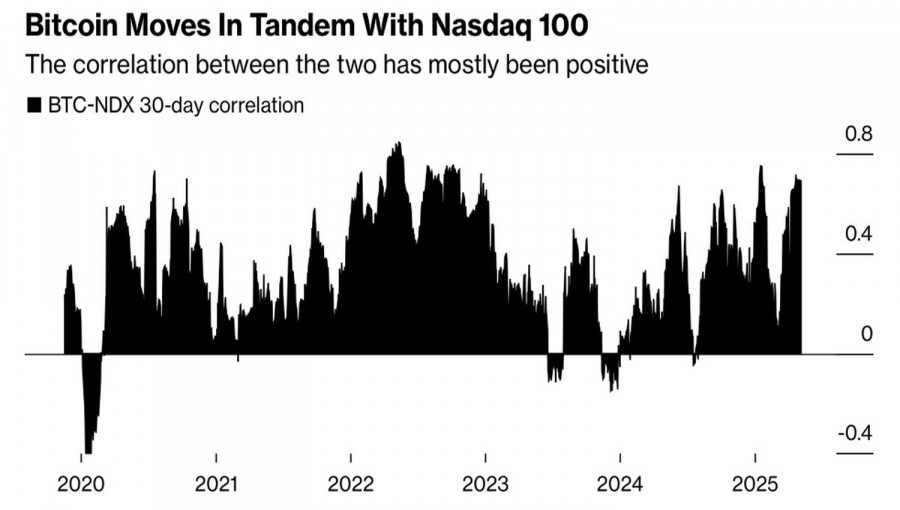

The primary driver behind BTC/USD's nearly 40% rally from its April lows has been the global appetite for risk, fueled by a decrease in trade uncertainty. Bitcoin continues to track the performance of U.S. stock indices closely, and its correlation with the NASDAQ 100 is steadily increasing.

The outperformance of BTC/USD compared to U.S. equity indices is due to asset managers viewing cryptocurrency and gold as essential tools for portfolio diversification. Since the beginning of the year, capital inflows into the four largest gold-focused ETFs have totaled $14 billion, while Bitcoin-related inflows reached $8 billion.

This is mainly due to fears of stagflation or recession and concerns over the stability of the U.S. financial system. Should the U.S. economy significantly cool down, the Federal Reserve will be forced to lower interest rates, which, combined with financial system vulnerabilities, would place severe pressure on the U.S. dollar. Bitcoin is viewed by investors as an alternative to fiat currencies, making a falling USD Index a reason to buy BTC/USD.

Meanwhile, leading crypto exchange Coinbase reported $2 billion in Q1 revenue—up 24% year-over-year, though down 10% from Q4. The forecast was $2.105 billion. Net profit fell by 94%. The company also revealed it had abandoned its previously used crypto accumulation strategy. Poor financial results might force a change in that stance. A new major buyer could help fuel another BTC/USD rally.

For now, traders primarily focus on the negotiations between the U.S. and China. White House officials have hinted that some deal has already been reached, with details expected in a few hours, and the financial market's reaction. The intrigue is boosting risk appetite, but it must be acknowledged that the previous rally in U.S. equities was driven by emotion. Perhaps it's time to "sell the news"?

Using Bitcoin as a mandatory tool for portfolio diversification suggests that any BTC/USD pullback, if it happens at all, could be less intense than for the NASDAQ or S&P 500. The cryptocurrency may remain on solid footing as long as risk appetite remains high.

Technically, BTC/USD is consolidating on the daily chart. If a candlestick with a long upper wick forms, the risk of a pullback increases. Such a dip would offer a chance to add to long positions opened at 83,170 and 94,600 on a bounce from support at 101,880 and 98,700.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.