See also

16.05.2025 10:49 AM

16.05.2025 10:49 AMMarkets have fully priced in the outcome of the U.S.–China talks, which resulted in a 90-day trade truce. Weaker-than-expected U.S. economic data offset the early-week optimism.

The recent rally lost momentum amid the release of economic reports throughout the week, which pointed to some softening in inflation and disappointing retail sales figures. These developments heightened concerns over slowing consumer activity. As a result, market participants began considering the likelihood of an earlier start to Federal Reserve rate cuts this year. We are effectively seeing the onset of a new phase of uncertainty: on one hand, the Fed, via Chair Jerome Powell, has signaled no rush to resume rate cuts; on the other, inflation continues to decline gradually, reaching an annual rate of 2.3%. Note that the Fed's target inflation rate is 2%.

What to Expect Amid the End of the Rally and Unclear Prospects for the Fed's Next Moves and Trade Negotiations

It is clear that the U.S. currently lacks the real economic capacity to rebuild its entire domestic industrial base rapidly. Current efforts are based on luring companies from Europe and other countries back to the U.S., and on blatant pressure tactics toward its trade partners. This suggests that Donald Trump will continue to apply geopolitical leverage, which will further deepen uncertainty and increase the risk of triggering a global crisis.

Under these conditions, we should expect the absence of sustainable trends, high volatility, and a general sense of nervousness in the markets.

What Can Be Expected on the Market Today?

I believe the U.S. dollar may continue its gradual decline amid speculation that the Trump administration favors a weaker dollar to remain competitive globally. This perspective is understandable, as American companies encounter significant challenges in international markets due to high domestic labor costs. In this environment, with inflation potentially falling towards 2%, the dollar is likely to remain under pressure. Meanwhile, equity markets may continue their upward trend, driven by expectations of an earlier resumption of Fed rate cuts.

Gold remains under pressure amid reduced U.S.–China trade tensions. The start of peace talks between Russia and Ukraine also weighs on the yellow metal. The price has fallen below the support level 3210.00, which may pave the way for further decline toward 3152.90. The 61.75 mark may serve as a sell level.

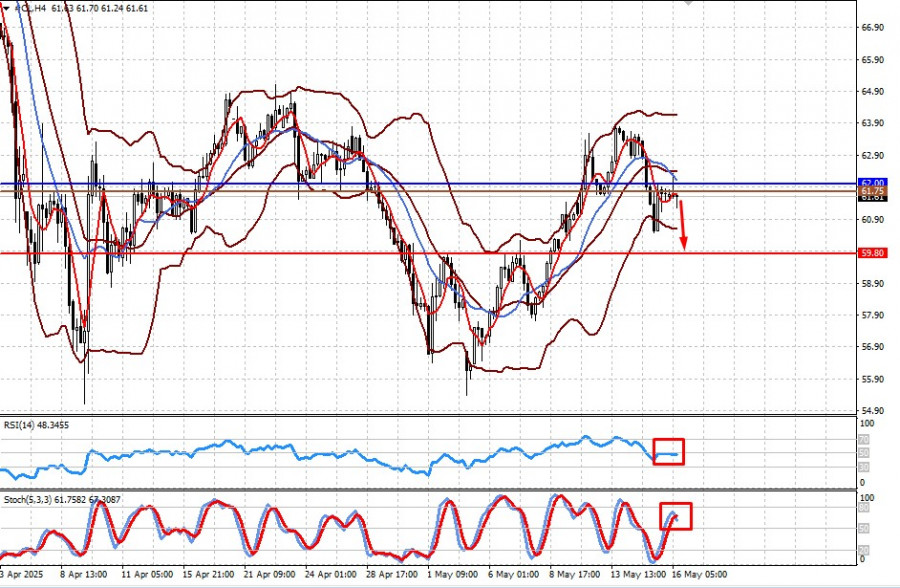

WTI crude is trading below the 62.00 level. OPEC+'s stance on increasing output and the weakening demand for crude oil exerts downward pressure on prices. The price may rebound to 62.00, from which I believe it should be sold with a target of 59.80. The 3201.48 level may serve as a sell entry point.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.