See also

20.05.2025 07:04 PM

20.05.2025 07:04 PMToday, the U.S. Dollar Index (DXY), which tracks the dollar's performance against a basket of currencies, is trading near its weekly low, continuing to fight for relevance. The lack of buying interest and a fundamentally bearish backdrop suggest that the path of least resistance for the index remains to the downside.

Traders are anticipating further interest rate cuts by the Federal Reserve in 2025, reinforced by softer-than-expected Consumer Price Index (CPI) and Producer Price Index (PPI) data from the U.S., released last week. Disappointing monthly retail sales figures have also increased the likelihood of sluggish growth in the coming quarters. These factors, along with the unexpected downgrade of the U.S. government's credit rating, continue to put pressure on the dollar.

Meanwhile, the agreement between the U.S. and China to significantly reduce tariffs, along with a 90-day pause to finalize a broader deal, signals a de-escalation of tensions between the world's two largest economies. This eases recession concerns in the U.S. and prevents traders from initiating aggressive bearish positions, helping to limit the dollar's decline despite recent hawkish comments from some FOMC members.

Today, Tuesday, no major economic data releases are expected that could influence the market. Traders will focus on speeches from influential FOMC members, which may impact the U.S. dollar during the North American session.

From a technical perspective, oscillators on the daily chart are in negative territory, indicating that the path of least resistance remains downward. The 100 level is seen as a key support threshold.

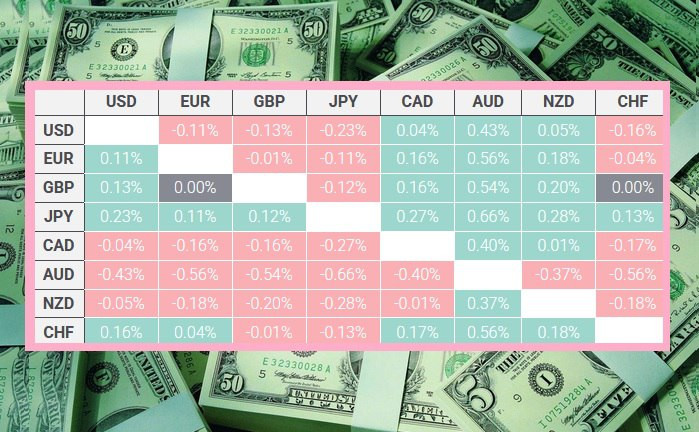

As for current U.S. dollar performance, the table shows that it has strengthened the most against the Australian dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.