See also

22.05.2025 09:49 AM

22.05.2025 09:49 AMThe chaos and instability caused by Donald Trump, both in the U.S. and around the world, have become a regular occurrence. However, they still contribute to significant market volatility, and this situation shows no signs of improvement.

The U.S. stock market fell sharply on Wednesday amid a surge in Treasury yields and concerns over changes in fiscal policy proposed by the U.S. president. These developments significantly affected investor sentiment and halted the growth of domestic equity indices.

Long-term bond yields spiked after a weak auction of $16 billion in 20-year Treasury bonds, with the yield on 30-year Treasuries rising to around 5% — the highest since 2023. The benchmark 10-year government bond yield reached a local April high. All of this unfolded in the context of a proposed tax and spending bill that could further widen the federal budget deficit.

Naturally, these developments and movements in the bond and equity markets had a negative impact on the dollar, which, according to its index, fell below the 100-point mark and continued to decline almost vertically during the morning session. Japanese Finance Minister Kato stated that he had not yet discussed exchange rates with U.S. Treasury Secretary Bessent during the G7 meeting in Canada. Meanwhile, reports have emerged that the U.S. is pressuring South Korea to introduce measures to strengthen the won. These reports indicate that the U.S. is interested in weakening its national currency to stimulate the international trade of American companies.

The only beneficiaries of this market turmoil were gold and cryptocurrencies, which have risen noticeably amid heightened volatility and general uncertainty over the outlook.

The internal disarray within the Trump administration and the desire to preserve everything without making any sacrifices will only worsen the situation in America and the markets. Under such conditions, the Federal Reserve is unlikely to decide on a rate cut in the near future but will continue to feed the markets with hope, which may partially contain a potential collapse.

The U.S. stock market will likely continue to decline due to the ambiguous situation surrounding the new tax law. The dollar may also keep falling in the Forex market under the pressure of domestic turmoil. This generally negative picture may pause gold price growth and reduce local demand for cryptocurrencies.

Gold prices are trading in a short-term downtrend and may locally rise to its resistance line at 3358.50. Failure to break above this level could serve as a basis for a price reversal and a renewed decline toward 3200.00. A potential level for selling the pair could be 3349.51 or a simple market sell.

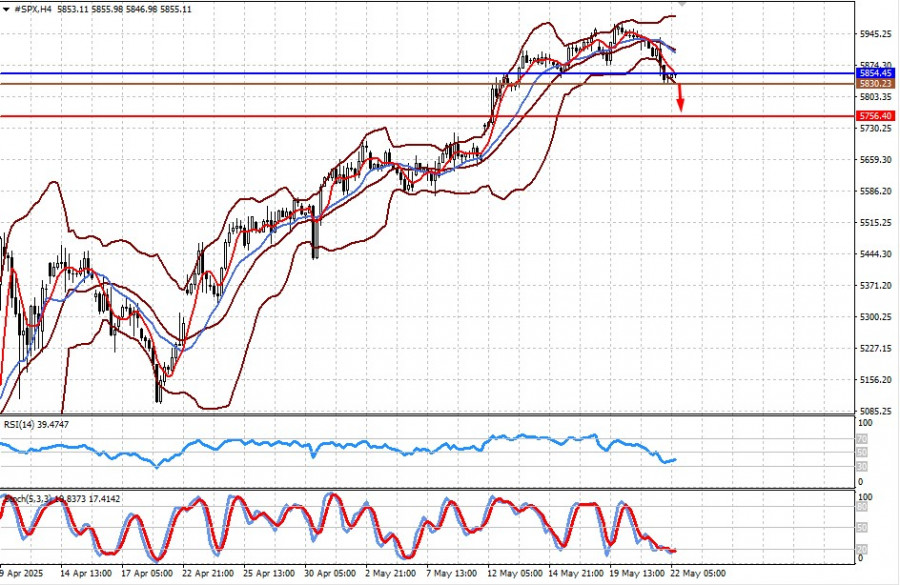

The CFD contract on the S&P 500 futures remains under pressure and is trading near 5854.45. Continued negative market sentiment may lead to a renewed decline toward 5756.40. A potential level for selling the pair could be 5830.23.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.