See also

22.05.2025 12:26 PM

22.05.2025 12:26 PMThe RBA cut the interest rate by 25 basis points to 3.85% on Wednesday, in line with market expectations. At the concluding press conference, the RBA Governor acknowledged that a 50-point cut had also been discussed.

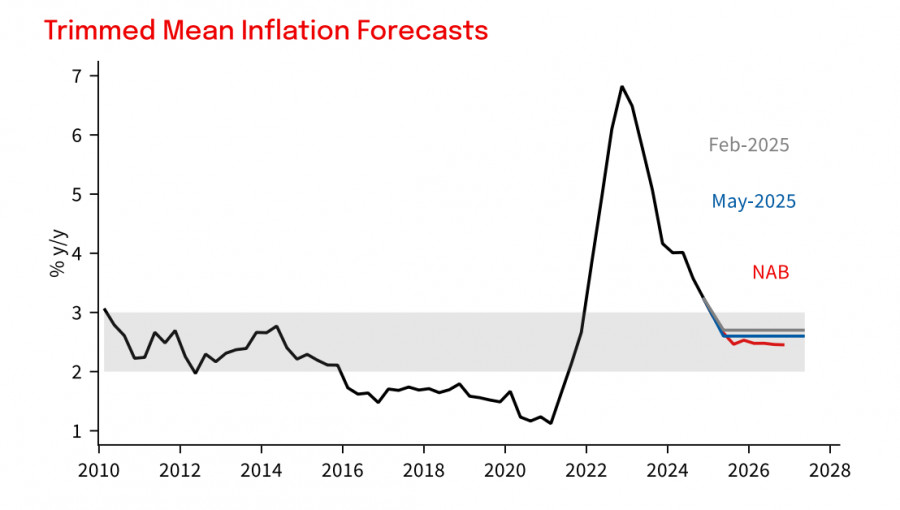

The RBA signaled a dovish shift back in April. Inflation risks are now considered balanced, and the quarterly forecasts were slightly revised in a dovish direction: core inflation expectations were lowered (with NAB forecasting even lower inflation than the RBA), the unemployment rate forecast was revised upward, and the 2025 GDP forecast was downgraded from 2.4% to 2.1%, based on weaker-than-expected consumer activity.

The RBA made it clear that rate cuts will continue, describing current monetary policy as "somewhat less restrictive." Less restrictive, but still tight—suggesting that a further move toward neutral policy is needed. NAB forecasts three additional rate cuts in July, August, and November, bringing the cash rate to 3.1% by year-end. The RBA, however, sees the rate at 3.2% by mid-2026—slightly higher than NAB's outlook.

Overall, the outcome of the meeting provided no support for the Australian dollar. There are no apparent drivers for its strengthening. Slowing inflation and lower GDP projections imply a lower policy rate and reduced yield appeal. Adding to that is the uncertainty surrounding tariffs on China, the consequences of which, the RBA suspects, could partly spill over to Australia—making the outlook even less positive. Recent PMI data also points to a slowdown: growth in new orders is at a 2025 low, and overall business confidence is declining.

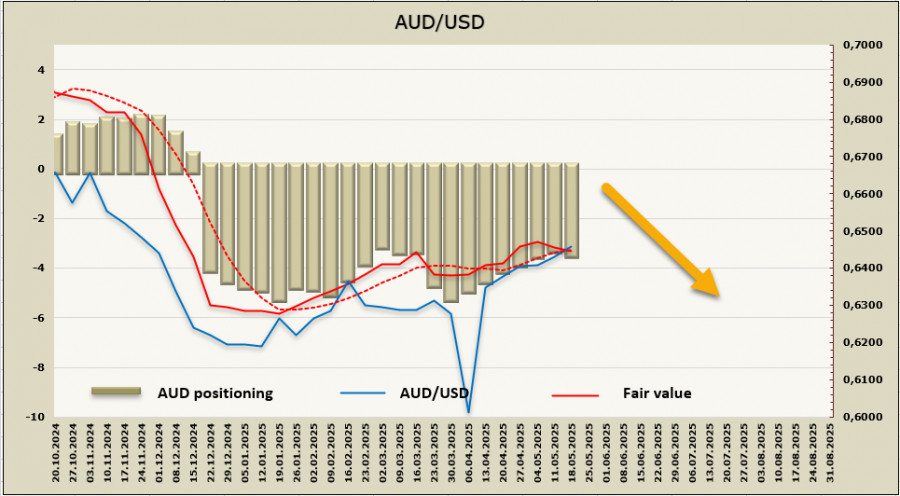

The net short position on AUD increased slightly over the reporting week to -3.19 billion, while the fair value has fallen below its long-term average.

AUD/USD Technical Outlook

The AUD/USD pair is stuck in the middle of its consolidation range, and the recent bullish impulse appears to have been fully priced in. The probability of a decline has increased—we expect a move toward the 0.6345/55 level. If signs of weakness intensify, the next target may be the technical support level at 0.6290.

There are fewer and fewer reasons to expect a recovery, and only the weakness of the U.S. dollar is preventing the Aussie from resuming its downward trend.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.