See also

02.06.2025 12:43 PM

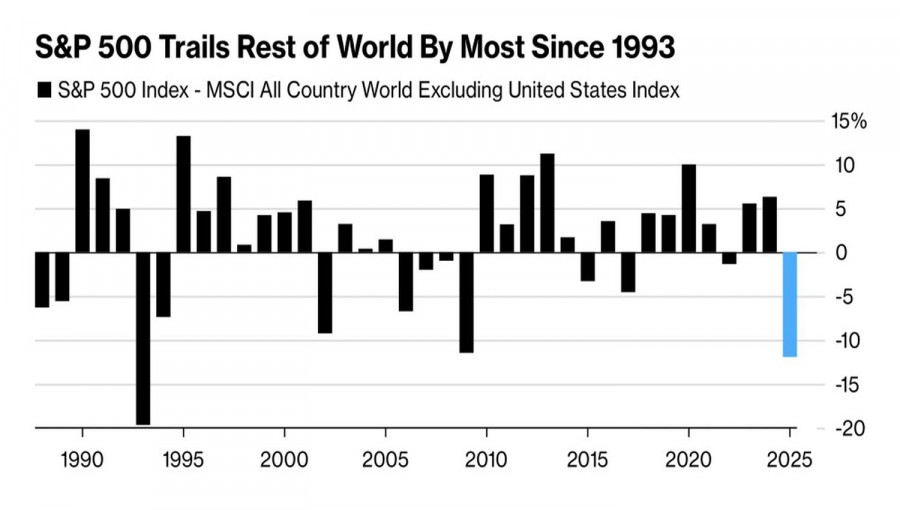

02.06.2025 12:43 PMThe best May since 1990 and the strongest monthly performance in a year and a half helped sugarcoat the bitter pill for the US stock market. Yet, since the start of the year, the S&P 500 has barely grown, ranking 73rd out of 92 global equity indices tracked by Bloomberg. Over the first five months, it posted its worst underperformance versus the MSCI All-Country World Index excluding the US since the 1990s. And the seasonal June patterns offer little cause for optimism: the vacation season kicks off in early summer, and significant market moves are unlikely. Still, every rule has its exception.

S&P 500's divergence from the Global stock index

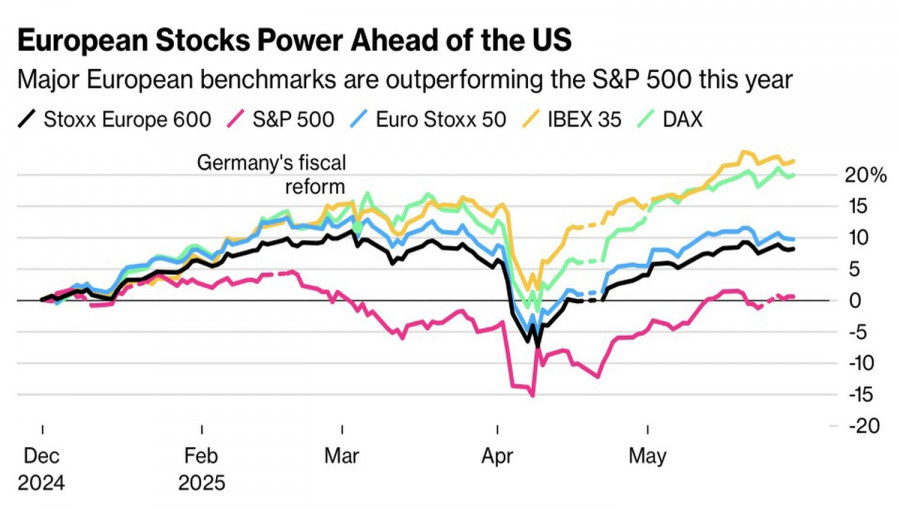

According to UBS research, around $1.4 trillion is expected to flow from the US to Europe over the next five years. The shift began in 2025. Among the top 10 performers year-to-date, eight are European stock indices. The EuroStoxx 600 has outperformed the S&P 500 by a whopping 19 percentage points in dollar terms.

The core reason lies in structural global shifts on both sides of the Atlantic. Donald Trump's policies have been unsettling and largely ineffective:

US vs. European stock index performance

In contrast, Europe has been a pleasant surprise. At the year's start, investors were wary of trade war fallout on the eurozone economy. But thanks to the front-loaded American import demand, Europe kicked off 2025 on a high note. Add to that:

— and you have the perfect storm for a stock market rally.

Is it any wonder capital is flowing from the New World to the Old?

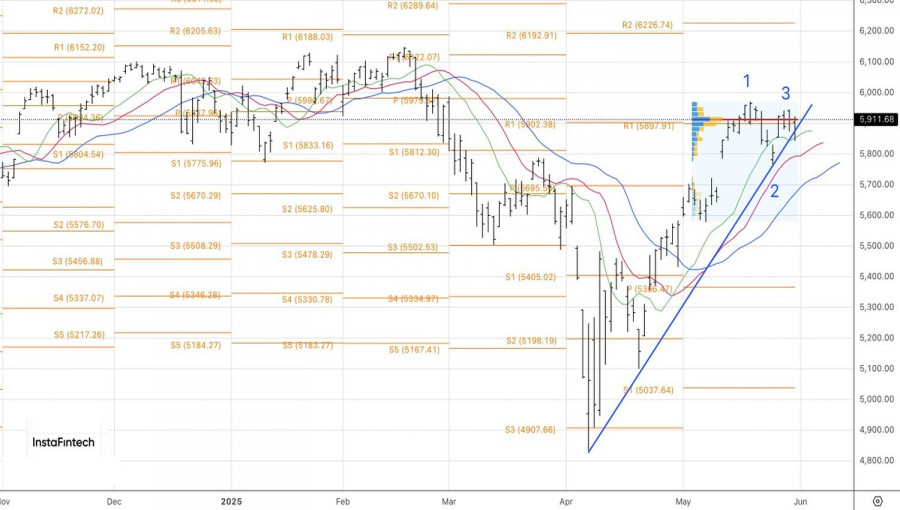

S&P 500 still in game

To be clear, the S&P 500 is unwilling to give up. The US economy remains resilient, and the de-escalation of trade conflicts set the stage for the benchmark index rally of 19% from its April lows. The index now sits just 4% below its all-time high set in February. But the final stretch is always the hardest. Will the index make that push?

Trump is cutting the branch he's sitting on.

President Trump continues to sabotage his own economic base. According to him, China is violating trade agreements with the US. He plans to double tariffs on steel and aluminum imports from 25% to 50% — news that's far from comforting to equity investors.

Technical view: S&P 500 daily chart

On the daily chart, the S&P 500 remains in a tug-of-war over fair value. A break below 5,840 would increase the risk of triggering a bearish 1-2-3 reversal pattern, opening the door for selling. Conversely, a breakout above point 3 near 5,945 could be seen as a buy signal.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.