See also

02.06.2025 12:36 PM

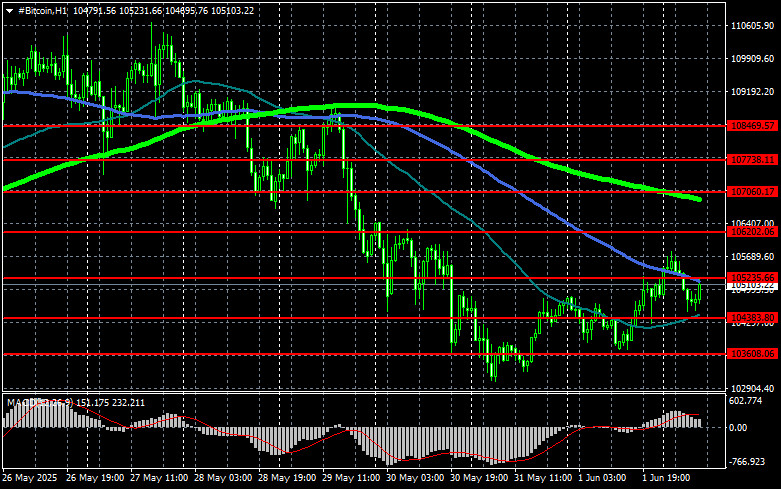

02.06.2025 12:36 PMBitcoin appears to have found a bottom near $104,000 and is currently trading around $104,500 in early June.

It is evident that the cryptocurrency is positioned at a psychological and technical inflection point, one that could determine the success or failure of the next bullish trend.

In the short term, technical indicators like the RSI and MACD suggest that the strong bullish momentum may be gradually weakening. However, the long-term outlook remains optimistic, with growing conviction among analysts and market participants that we could be in the early stages of a new supercycle.

Key support for Bitcoin remains around $103,000, with a more substantial base forming near $97,600. If BTC can hold above the $103,000–$105,000 range, there is potential for a fresh rally toward $115,000. Conversely, a breakdown below $103,000 could lead to a deeper correction, targeting the $93,000–$97,000 range.

Even in this bearish case, it should not be seen as the end of the broader uptrend, but rather as an indication that the market may require more time to consolidate before resuming upward momentum.

Trading recommendations:

Buyers of BTC are currently aiming to reclaim $105,200, a level that would pave the way for $106,200, followed closely by $107,000. The ultimate upside target is $107,700, a breakout above which would strengthen the bullish market structure. In the event of a decline, buyers are expected to re-enter around $104,300. A drop below this area could quickly push BTC toward $103,600, with a deeper target at $102,800.

As for ETH, clear consolidation above $2,513 would open the way toward $2,546, with the final upside target at $2,576, a level that would confirm the formation of a bullish trend.

Should ETH decline, support is seen around $2,473. A move below this area could drag ETH down to $2,441, with a final downside target near $2,412.

What we see on trading charts:

The crossing or testing of these moving averages often signals trend reversals or momentum shifts in the market.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.