See also

05.06.2025 09:20 AM

05.06.2025 09:20 AMMarkets have risen for the third consecutive day, interpreting the current situation as widespread trading uncertainty — far from a market crash. This allows for a calmer and more rational outlook. Things are not as bad as they seem. Signs of a cooling U.S. economy are increasing the likelihood of the Federal Reserve resuming a cycle of monetary easing in the near future, while the success of global equities is providing support for the S&P 500 in a challenging environment.

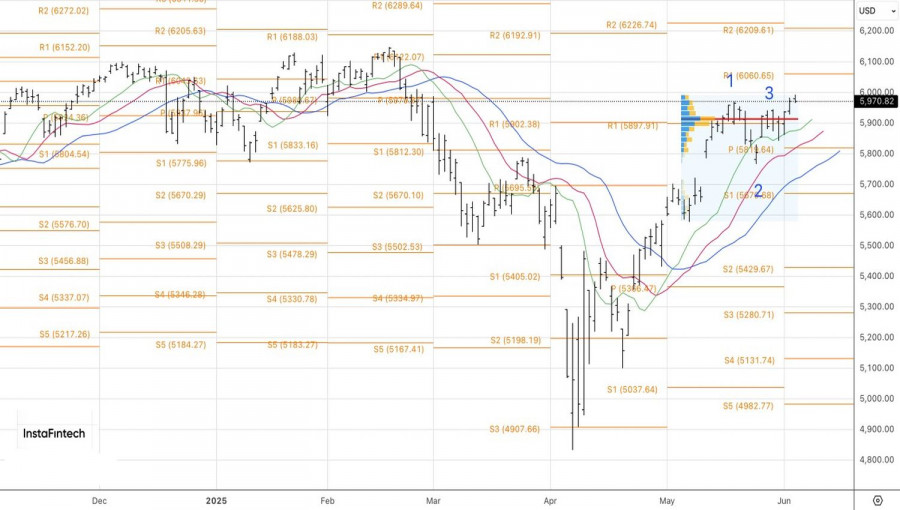

Barclays was among the latest banks to raise its forecast for the broad stock index to 6050 by the end of 2025, up from 5900, citing that the worst tariff drama is behind us. Derivatives predict S&P 500 fluctuations in response to the upcoming U.S. employment report within a range of +/-0.9%, below the historical average of +/-1.3%.

The market has calmed down and plans to return to trading under the "TACO" principle—"Trump Always Causes Outrage"—only in July, when the 90-day grace period from the White House ends. Two possible scenarios are that the president backs down, fearing an S&P 500 collapse, or tariffs sharply increase. In the first case, the broad market index will renew record highs; in the second, it will plunge due to recession fears.

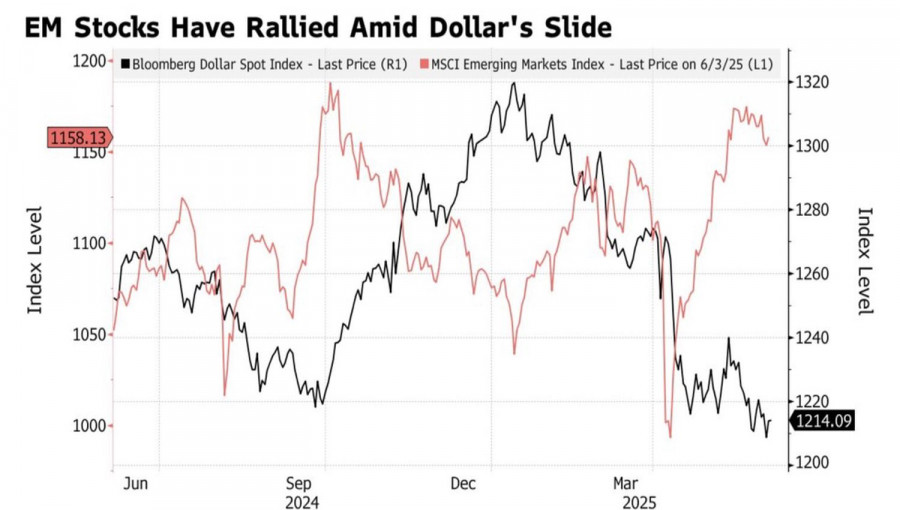

Meanwhile, the global stock market has already surpassed its historical highs achieved in February, which supports the S&P 500, even though other indices are performing better. Capital continues to flow out of the United States. Bank of America recommends focusing on emerging markets, especially Eastern Europe, suggesting investments in the region could deliver double-digit returns amid a weakening U.S. dollar.

A consistently high global risk appetite and belief that the worst of the trade conflicts is over allow the S&P 500 to move upward. The broad stock index is undeterred by the unexpected decline in U.S. service sector activity below the critical 50 mark for the first time in a year or by the worst monthly private sector employment data from ADP in two years.

Negative data has pushed the probability of a Fed rate cut in September to 90%. The futures market is confident that monetary easing will occur by October and December. Investors believe the cooling U.S. economy will force the Fed to throw it a lifeline — excellent news for equities.

Thus, optimism dominates. However, it is dangerous optimism tied to the expectation that Donald Trump will back down from large-scale tariffs. A bubble in the U.S. stock market continues to inflate. The question is not if but when it will burst.

On the daily S&P 500 chart, bulls still hope to restore the uptrend. Long positions opened from 5945 should be maintained. However, a drop below 5900 or a bounce from the pivot level of 6060 would be grounds for a reversal and shift to short positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.