See also

09.06.2025 12:07 AM

09.06.2025 12:07 AMThe biggest surprise of June has been the divergence between U.S. stock indices and cryptocurrencies. The S&P 500 and Bitcoin are typically considered risk assets, historically moving hand in hand. However, their correlation turned negative in the summer, and it has been increasing. Is it a paradox? In reality, there is logic in BTC/USD's behavior.

During his first presidential term, Donald Trump called U.S. stock indices a measure of his performance. This led to the birth of the term "Trump put." Investors firmly believed that if the S&P 500 started sinking, the president would throw it a lifeline. And that's precisely what happened. The American stock market tanked in early April due to massive tariffs, and the Republican president was forced to announce a 90-day delay.

Subsequently, White House representatives repeatedly pleased the S&P 500 with good news about the progress of trade negotiations. These speeches helped the broad market index climb above 6000 and closer to record highs. Bitcoin, however, has not been able to mirror such a rally in May and June.

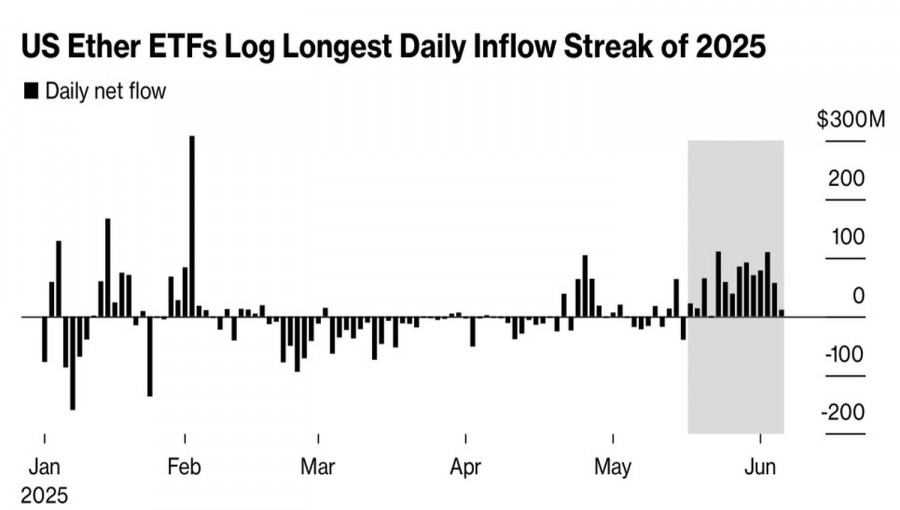

The reasons lie in seeking alternatives and Bitcoin's dependency on Donald Trump's policies. For a long time, Ether, lagging behind the leader of the cryptocurrency sector, finally spread its wings. Over the past two weeks, a group of nine Ether-focused ETFs has attracted $812 million.

Priorities are shifting. Bitcoin, rather than the S&P 500, has become the new measure of Donald Trump's effectiveness as President of the United States. During the election campaign, the Republican promised to make America the world's crypto capital. In 2025, digital assets began to be perceived as the personal business of the President's family. Democrats long resisted the advancement of stablecoin legislation due to conflicts of interest.

Indeed, Trump Media Technology Group announced it is raising $2.5 billion to buy Bitcoin and plans to launch its specialized exchange-traded fund. Strategy was the first company to start acquiring digital assets by issuing shares and bonds, and about thirty other firms have followed suit. By 2030, it is anticipated that the leader in the crypto sector could experience inflows of $330 billion through this channel.

Trump Media Technology Group also plans to join the 60 Bitcoin-focused ETFs. Donald Trump's family is not missing any opportunity to profit from digital assets. Unsurprisingly, the conflict between the President and Elon Musk caused BTC/USD to retreat.

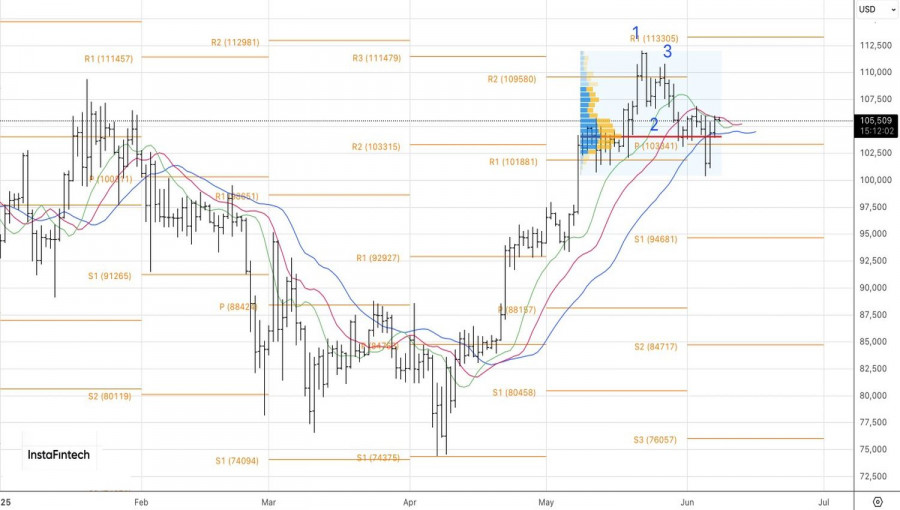

Technically, a 1-2-3 pattern has played out on Bitcoin's daily chart. The decline toward the psychologically important $100,000 mark attracted new buyers. The return above the moving averages and fair value indicates the strength of the bulls. A breakout above the resistance at $106,800 will serve as a signal to buy BTC/USD.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.