See also

10.06.2025 08:20 AM

10.06.2025 08:20 AMEuro, Pound, and Other Risk Assets Remain Trapped in Sideways Channels, but the U.S. Dollar Sees Stronger Demand During the U.S. Session After the First Day of China-U.S. Negotiations

The first day of talks between Chinese and U.S. trade representatives sparked hopes that the parties may still find common ground and reach some sort of agreement. The negotiations will continue today, and we'll be closely watching for developments. However, behind the scenes of optimistic statements lies a complex web of contradictions and mutually exclusive demands. The U.S. is likely to push for stricter enforcement of intellectual property rights, access to imports of rare earth materials, and a reduction in the trade deficit. China, in turn, will likely demand the removal of previously imposed tariffs and the loosening of export controls on high-tech products. Beyond economic matters, geopolitical factors play a critical role. Tensions related to Taiwan, the South China Sea, and human rights issues may complicate the negotiation process and hinder compromise.

Today, attention will focus on Italy's industrial production figures and the Sentix investor confidence index for the Eurozone. Weak results could put renewed pressure on the euro. However, behind these macro indicators are deeper trends influencing the European economy. Italian industry, despite occasional periods of growth, continues to face structural issues tied to weak competitiveness and sluggish innovation adoption. Weak industrial output could indicate slowing economic growth not only in Italy but across the Eurozone.

The Sentix investor confidence index is a key barometer of sentiment on financial markets. A sharp drop in this indicator could reflect rising concerns over the outlook for the European economy and potentially trigger capital outflows from the Eurozone.

Today brings important reports from the UK regarding the labor market. If the data on jobless claims and the overall unemployment rate in the UK prove disappointing, it could negatively impact the pound in the early part of the trading session. In addition, the change in average earnings should be carefully analyzed.

If the data meets economists' expectations, applying a Mean Reversion strategy would be best. A Momentum strategy is more appropriate if the data significantly deviates from expectations.

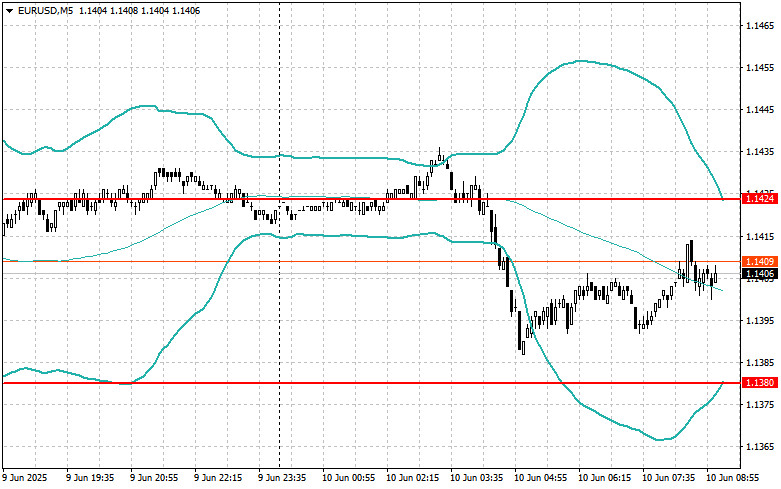

Buying on a breakout above 1.1430 may lead to a rise in the euro toward 1.1459 and 1.1492;

Selling on a breakout below 1.1393 may lead to a decline in the euro toward 1.1361 and 1.1314.

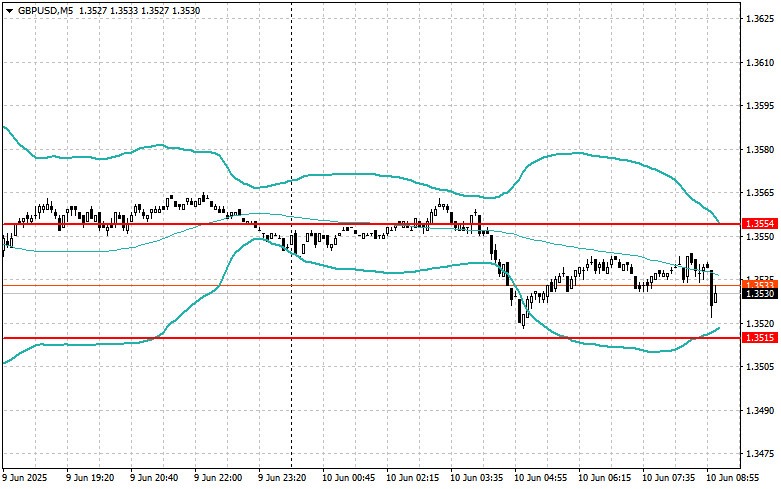

Buying on a breakout above 1.3545 may lead to a rise in the pound toward 1.3580 and 1.3620;

Selling on a breakout below 1.3520 may lead to a decline in the pound toward 1.3500 and 1.3470.

Buying on a breakout above 144.90 may lead to a rise in the dollar toward 145.30 and 145.65;

Selling on a breakout below 144.50 may lead to a decline in the dollar toward 144.05 and 143.66.

I will look to sell after a failed breakout above 1.1424 followed by a return below that level;

I will look to buy after a failed breakout below 1.1380 followed by a return above that level.

I will look to sell after a failed breakout above 1.3554 followed by a return below that level;

I will look to buy after a failed breakout below 1.3515 followed by a return above that level.

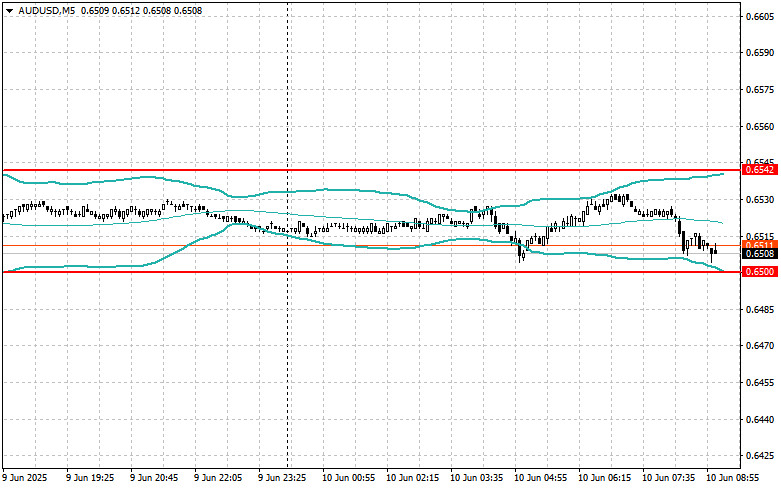

I will look to sell after a failed breakout above 0.6542 followed by a return below that level;

I will look to buy after a failed breakout below 0.6500 followed by a return above that level.

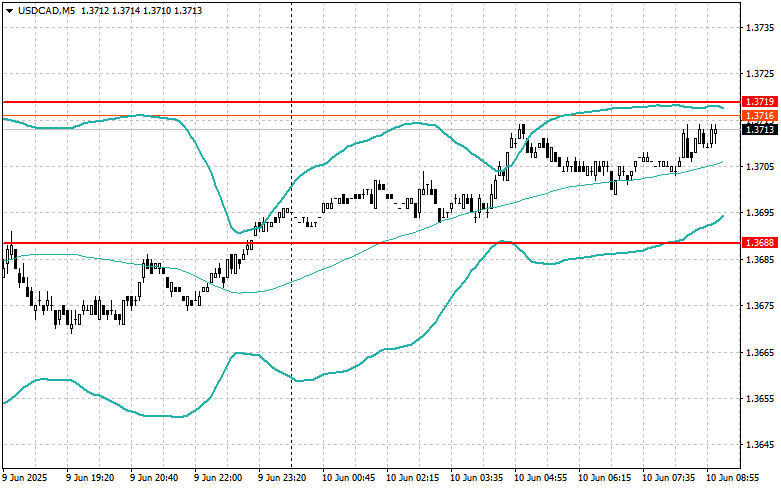

I will look to sell after a failed breakout above 1.3719 followed by a return below that level;

I will look to buy after a failed breakout below 1.3688 followed by a return above that level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 154.66 coincided with the MACD indicator just beginning to move up from the zero mark, which allowed buying the dollar in line with the trend. However

The test of the price at 1.3145 coincided with the MACD indicator just beginning to move down from the zero mark, confirming the right entry point for selling the pound

The test of the price at 1.1633 coincided with the MACD indicator rising significantly above the zero mark, which limited the pair's upward potential. For this reason

The euro, pound, and other risky assets continued to rise against the U.S. dollar. Confusion among the U.S. Federal Reserve, with significantly differing statements from policymakers, has put pressure

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.