See also

13.06.2025 12:53 PM

13.06.2025 12:53 PMThe AUD/JPY pair has been under selling pressure for the third consecutive day, reaching an almost two-week low around 92.30 during Friday's Asian session. After a sharp drop, spot prices rebounded above the psychological level of 93.00, but the daily decline still exceeded 0.80%.

Amid rising tensions in the Middle East — including Israel's preemptive strike on Iran — and the expansion of tariff barriers in the U.S., investors are becoming more cautious and favoring safe-haven assets.

This shift has strengthened the Japanese yen, traditionally viewed as a safe-haven currency, while simultaneously reducing demand for riskier currencies such as the Australian dollar. As a result, there is growing demand for the JPY and weakening of the AUD, which continues to pressure the AUD/JPY pair lower.

An additional factor weighing on the AUD/JPY pair is the expectation that the Bank of Japan will continue its path toward normalizing monetary policy, thereby supporting the strength of the yen.

The above-mentioned fundamental backdrop suggests that the path of least resistance for spot prices remains to the downside, reinforcing the case for a continued pullback from Wednesday's four-week high. However, oscillators on the daily chart have not yet turned negative, indicating that selling pressure has not fully intensified — suggesting sellers should remain cautious.

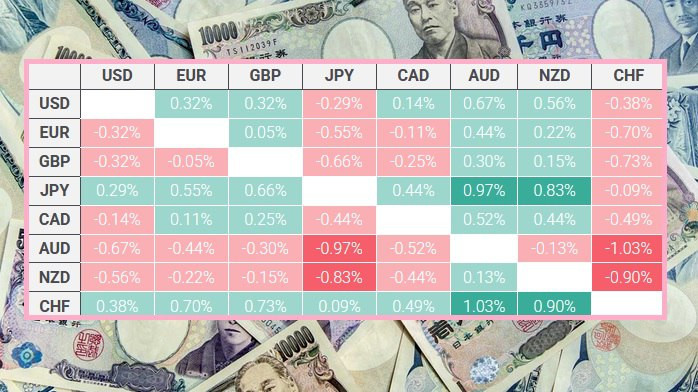

The accompanying table shows the percentage change in the Japanese yen against major currencies today. Notably, the yen has posted strong gains particularly against the Australian dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.