See also

19.06.2025 12:42 AM

19.06.2025 12:42 AMMarkets remain cautious as several high-impact events loom that could significantly alter the risk balance—namely, the FOMC meeting on Wednesday evening and a potential U.S. intervention in the war between Israel and Iran.

The Bank of Canada's meeting minutes, published on Tuesday, reveal that the central bank considered cutting rates but ultimately chose not to, citing high uncertainty regarding tariffs and their economic consequences. During discussions, it was noted that Canada's economy shows "greater resilience than expected," though expectations for the second quarter are "much weaker." Combined with signs of persistent core inflation, this prevented the BoC from proceeding with a rate cut.

The FOMC meeting is in focus even though markets are nearly certain the Federal Reserve will hold rates steady. Attention will center on new economic projections and the updated dot plot. One potential development is that the committee could remove one of the forecasted rate cuts for this year, supported by a robust labor market—bolstered further by tighter immigration policies, which may lead to renewed wage growth.

Disinflation trends remain uncertain, especially with the risk of a sharp spike in oil prices if the Middle East conflict escalates. Rising tariffs, combined with that, could intensify inflationary pressures.

If the Fed adjusts its rate-cut outlook toward a slower pace, this could support the U.S. dollar and potentially trigger an upward move in USD/CAD.

Last week was uneventful for the loonie—macroeconomic data had little impact on price action. Until the inflation report, due on June 24, volatility is expected to stay subdued unless geopolitical risks escalate.

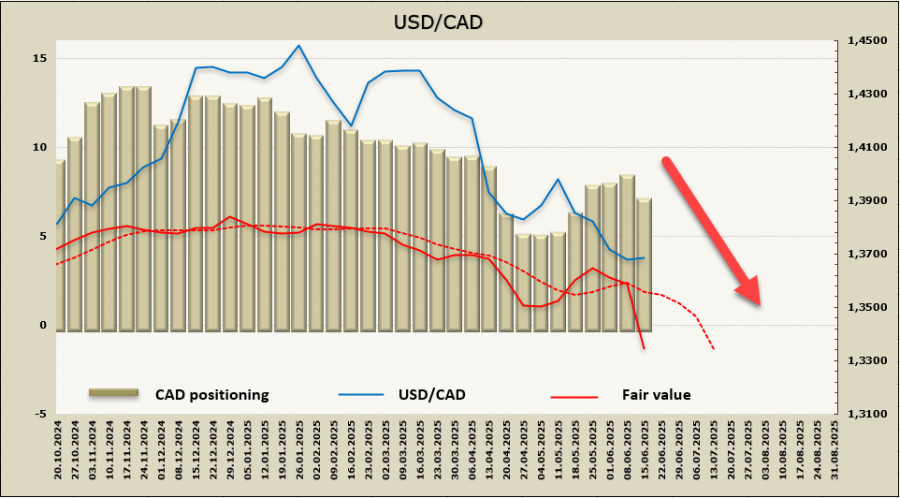

Net short positioning on CAD narrowed significantly during the reporting week by $1.09 billion to –$6.81 billion. However, the imbalance still isn't in CAD's favor. That said, the fair value estimate has dropped well below the long-term average, supporting expectations of further downside in USD/CAD.

USD/CAD continues to decline, setting a new low not seen since October 2024. At present, there are no technical signs of a bullish reversal. The next target is support at 1.3410–1.3430. The dollar looks somewhat oversold on the daily chart, increasing the risk of a corrective upward retracement. In this case, the 1.3810–1.3830 zone will act as resistance, and a breakout above that level appears unlikely.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.